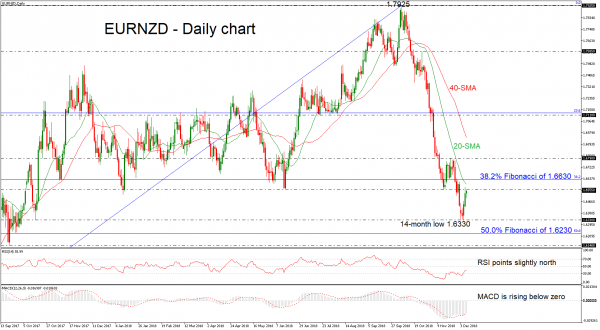

EURNZD created a strong negative rally over the last two months, after the pullback on the three-year high of 1.7925. Looking at the very short-term, the price has been moving higher since yesterday finding support on the 14-month low of 1.6330. However, the technical indicators are hovering in the bearish zone. The RSI is sloping marginally up below the neutral threshold of 50, while the MACD is weakening its negative momentum above the trigger line.

Further upside pressure may meet again the significant resistance of 1.6555, before touching the 38.2% Fibonacci retracement level of the upward movement from 1.4535 to 1.7925, around 1.6630. Even higher, the pair could edge sharply higher, hitting the 1.6790 resistance, identified by the peaks on November 22.

On the flip side, a bounce off the 1.6550 barrier could slip prices towards the 14-month low. Lower still, the bears may aim for the 50.0% Fibonacci of 1.6230, after which prices could plunge until the September 2017 bottom of 1.6140.

Concluding, the overall picture seems to be negative as it holds below the 20- and 40-simple moving averages (SMAs) and the lower low of 1.6330 confirmed that.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals