Trump-Xi trade talks could spark ‘explosion’ higher for stocks like Apple – or lead to a bear market

Wall Street is convinced a ‘deal’ of sorts will be announced after President Donald Trump meets with Chinese President Xi Jinping Saturday night to discuss the trade war that is creating issues for both nations’ economies. But the potential outcome...

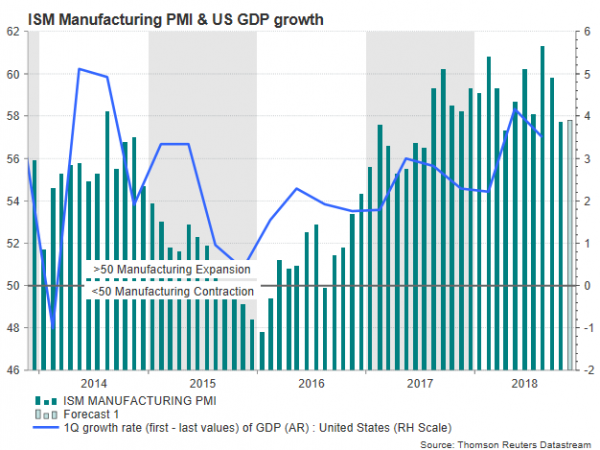

ISM Manufacturing PMI to Tick Up in November

The ISM manufacturing index, a closely watched indicator for US factory activity and thus a growth barometer will come into the light on Monday at 1500 GMT. The figure is expected to show that manufacturers regained some lost ground in November, retaining the streak of overall robust growth...

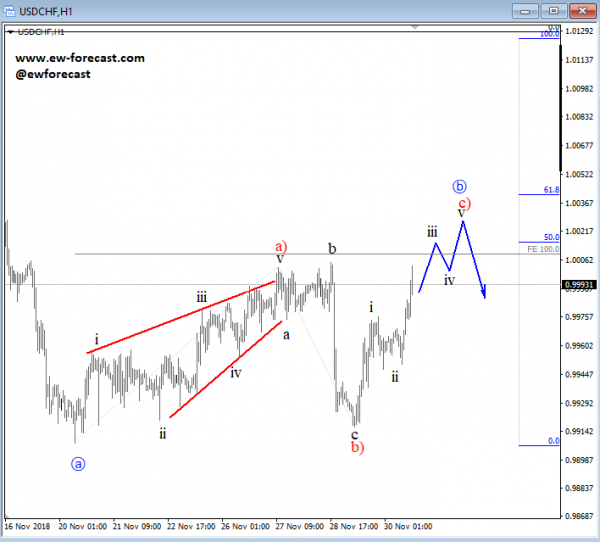

Elliott Wave Analysis: Correction on USDCHF Points Lower

USDCHF is trading in a corrective wave b, which is unfolding a three-wave a)-b)-c) move with wave c in play. Wave c is a motive wave, which means it must unfold five legs, before we may label it as completed....

Week Ahead – Spotlight on US Jobs Report after ‘Powell Put’; RBA and BoC Meet

The coming week will be significant both in terms of data releases as well as for central bank meetings. November nonfarm payrolls out of the US will likely be the most anticipated report but it’s going to be a big...

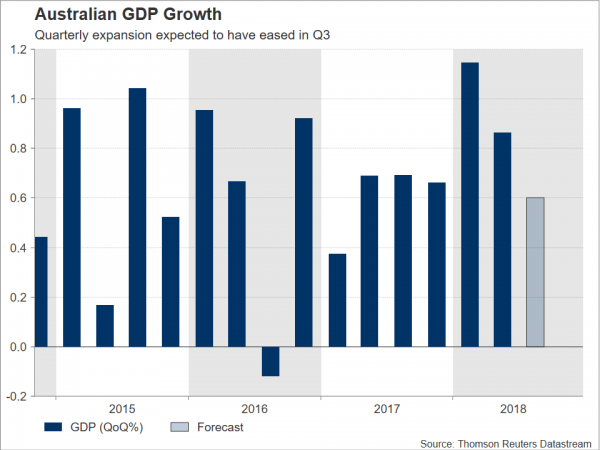

Australia & New Zealand Weekly: Q3 GDP Preview, Housing Slowing Amidst Overall Robust Conditions

Week beginning 3 December 2018 Australia: Q3 GDP preview, housing slowing amidst overall robust conditions. RBA: policy decision and Deputy Governor Debelle speaking. Australia: Q3 partials and GDP, dwelling approvals and prices, retail, trade balance. NZ: terms of trade, building...

Weekly Focus – Growth Weakness ahead of Trade Talks

Market Movers ahead The meeting between Donald Trump and Xi Jinping this weekend could be a turning point in the trade war and there is a good chance of a deal despite more sabre rattling this week. Markets have reacted...

WTI OIL Outlook: Extended Consolidation Awaits for a Catalyst to Establish in Fresh Direction

WTI oil stands at the back foot on Friday but holding above psychological $50 support, which was cracked on Thursday’s dip to $49.40. Failure to eventually close below $50 trigger, kept the price in extended consolidation during this week. Long-legged...

Your first trade for Friday, November 30

The “Fast Money” traders shared their first moves for the market open. Tim Seymour was a buyer of Haliburton. Karen Finerman was a buyer of the Emerging Markets ETF. Dan Nathan was a buyer of Box. Guy Adami was a...

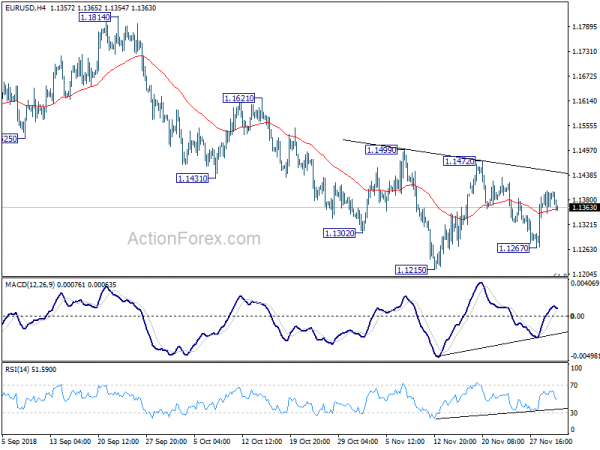

Euro Lower after Inflation Data, Dollar Pare Losses ahead of Trump-Xi Meeting

The forex markets are generally staying in familiar range as traders turn cautious ahead of G20 summit and, of course, the highly anticipated Trump-Xi summit. There are rumors flying around on whether there will be a deal of no deal....

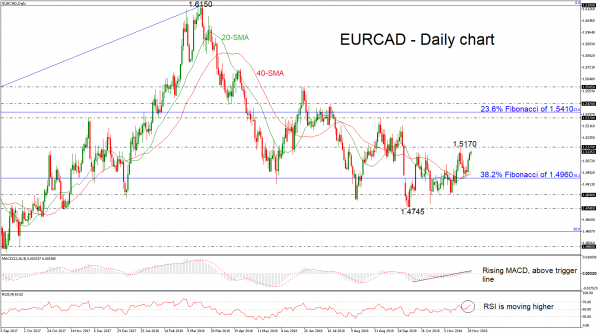

EURCAD Shows Strength But Outlook Still Negative

EURCAD is looking more positive over the last couple of days as prices have climbed back above the 20- and 40-simple moving averages (SMAs) in the daily timeframe. The rebound on the 38.2% Fibonacci retracement level of the upleg from...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals