Global stock markets are boosted by optimism over US-China trade negotiation. And commodity currencies ride on positive sentiment to strengthen broadly today. On the other hand, Yen is clearly under broad based pressure as risk aversion receded. It’s followed by Dollar and then Swiss Franc. Euro shows little reaction to unexpected fall in unemployment rate. Meanwhile, Sterling is mixed as the Brexit debate resumes in Parliament.

BoC rate decision will be a major focus in US session. The central bank will very likely keep policy rate unchanged at 1.75%. But this is far from being certain after recent rebound in oil prices. Still, the current rebound is seen as mainly driven by the Saudi-led production cut and US-China trade talk. And the boosts to oil prices should be short-lived. BoC might also downgrade its GDP growth forecast modestly in today’s new projections.

FOMC December meeting minutes will be another focus. But detail were already provided during the post meeting press conference, as well as the projections. We’d not expecting anything substantial from the minutes.

In other markets, DOW futures point to another day of triple digit gain at open. At the time of writing, FTSE is up 1.06%, DAX Is up 1.35% and CAC is up 1.39%. German 10-year yield is down -0.0021 at 0.228. Earlier in Asia, Nikkei rose 1.10%. Hong Kong HSI rose 2.27%. China Shanghai SSE added 0.71% and Singapore Strati Times rose 1.12%. Japan 10-year JGB yield rose 0.0339 to 0.032. *if you want to trade professionally use our forex robot*

US-China trade talks concluded after a “good few days”

US and China delegations ended the prolonged three-day trade negotiation meeting in Beijing with some positive signs. Ted McKinney, U.S. Under Secretary of Agriculture for Trade and Foreign Agricultural Affairs, said there were a “good few days” in China, and the meeting “went just fine”. He added that “It’s been a good one for us.”

Chinese Foreign Ministry spokesman Lu Kang said “extending the consultations shows that the two sides were indeed very serious in conducting the consultations.”

Bostic: Fed should be patient and wait for greater clarity on economic outlook

Atlanta Fed President Raphael Bostic said Fed should be patient on the next interest rate move until there is greater clarity on the economic outlook. He noted that business executives are “starting to examine their own business strategies and initiatives in anticipation of slowing economic conditions either through deleveraging or holding off on expansionary plans”. And, the financial markets showed that there was “heightened uncertainty and concern” among investors.

Bostic said “The appropriate response is to be patient in adjusting the stance of policy and to wait for greater clarity about the direction of the economy and the risks to the outlook”. And, “All the available evidence at the moment points to caution regarding firms’ approach to expansion. As long as that caution exists I suspect it will act as a natural governor” on growth.

NOTE: You can not find the right trading strategy? if you have no time to study all the tools of the trade and you have not funds for errors and losses – trade with the help of our Keltner channel forex robot developed by our professionals. Also you can testing in Metatrader our forex scalping robot free download .

Pro-EU group pushing for binary Brexit referendum

Pro-EU campaigners updated so called “Roadmap to a People’s Vote” to push for a referendum on Brexit if, and likely so, Prime Minister Theresa May’s deal is voted down in the Commons next week. The report note that “Nobody has come forward with a proposal that could secure a majority in the present circumstances. The blunt reality is that such a proposal does not exist”. And, “the only credible way forwards for (lawmakers) will be to hand the decision back to the people.” While a referendum would inevitably require extending Article 50 and delaying the March 29 Brexit date, the group said 27 other EU member states are unlikely to stand in its way.

The group preferred a “binary choice”: for the referendum”: either the Government’s deal vs staying in the EU; or an alternative, deliverable form of Brexit vs staying in. But they do not entirely rule out a referendum with three options.

Separately, Prime Minister Theresa May told the parliament that “I’ve been in contact with European leaders … about MPs’ concerns. These discussions have shown that further clarification over the backstop is possible and those talks will continue over the next few days,”

Eurozone unemployment rate dropped to 7.9%, lowest since Oct 2008

Eurozone unemployment rate dropped to 7.9% in November, lower than expectation of 8.1%. That’s notable improvement from 8.7% back in November 2017. It’s also the lowest figure since October 2008.

Among the Member States, the lowest unemployment rates in November 2018 were recorded in Czechia (1.9%), Germany (3.3%) and the Netherlands (3.5%). The highest unemployment rates were observed in Greece (18.6% in September 2018) and Spain (14.7%).

Also released in European session, German trade surplus widened to EUR 19.0B in November. Swiss CPI slowed to 0.7% yoy in December versus expectation of 1.0% yoy.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our odin forex robot free download

GBP/USD Mid-Day Outlook

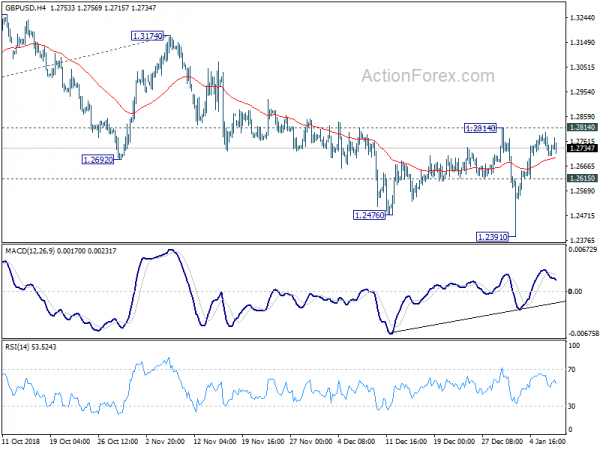

Daily Pivots: (S1) 1.2682; (P) 1.2740; (R1) 1.2773; More….

Intraday bias in GBP/USD stays neutral at this point. Also, near term outlook remains bearish with 1.2814 resistance intact. On the downside, below 1.2615 minor support will turn bias to the downside for retesting 1.2391 first. Break will extend the down trend from 1.4376 and target 61.8% projection of 1.4376 to 1.2661 from 1.3174 at 1.2114 next. However, firm break of 1.2814 resistance will be an early sign of trend reversal and bring stronger rebound back to 1.3174 resistance next.

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA. The structure and momentum of the fall from 1.4376 argues that it’s resuming long term down trend from 2.1161 (2007 high). And this will now remain the preferred case as long as 1.3174 structural resistance holds. GBP/USD should target a test on 1.1946 first. Decisive break there will confirm our bearish view.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Service Index Dec | 52.1 | |||

| 00:00 | JPY | Labor Cash Earnings Y/Y Nov | 2.00% | 1.30% | 1.50% | |

| 00:30 | AUD | Building Approvals M/M Nov | -9.10% | -0.30% | -1.50% | |

| 07:00 | EUR | German Trade Balance (EUR) Nov | 19.0B | 17.6B | 17.3B | |

| 07:30 | CHF | CPI M/M Dec | -0.30% | -0.10% | -0.30% | |

| 07:30 | CHF | CPI Y/Y Dec | 0.70% | 1.00% | 0.90% | |

| 10:00 | EUR | Eurozone Unemployment Rate Nov | 7.90% | 8.10% | 8.10% | 8.00% |

| 13:15 | CAD | Housing Starts Dec | 213K | 210K | 216K | |

| 15:00 | CAD | BoC Rate Decision | ||||

| 15:30 | USD | Crude Oil Inventories | ||||

| 19:00 | USD | FOMC Meeting Minutes |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals