The forex markets is rather mixed today, partly thanks to fading momentum in global stock rebound. Australian Dollar is so far the strongest one for today. Dollar follows as second strongest, paring some of yesterday’s losses. Yen is the third strongest. But no apparent momentum is seen in all three. On the hand, Swiss Franc is the weakest for today so far, followed by Sterling and then Canadian Dollar.

Over the week, Dollar remains the worst performing one as Fed officials generally want patience before raising interest rate again. Richmond Fed Thomas Barkin also expressed some concern over the economy. Comments from Fed chair Jerome Powell, James Bullard and Charles Evans later today will likely echo similar cautiousness.

Technically, Dollar is generally weak except versus GBP/USD. However, downside momentum is not too convincing. AUD/USD and USD/CAD have both displayed loss of momentum. EUR/USD and USD/CHF also quickly pared back much of yesterday’s move. A focus today will be on whether Dollar would suffer renewed selling, or stage a stronger recovery.

In other markets, FTSE is dropping -0.19%, DAX is down -0.15% and CAC is down -0.52%. German 10 year yield is down -0.0179 at 0.204. Earlier in Asia, Nikkei closed down -1.29%. Singapore rose 0.81%. Hong Kong HSI rose 0.22% but China Shanghai SSE dropped -0.36%. Japan 10-year JGB yield dropped -0.0061 to 0.025 but stays positive.

US initial jobless claims dropped -17k to 216k

US initial jobless claims dropped -17k to 216k in the week ending January 5, below expectation of 226k. Four-week moving average of initial claims rose 2.5k to 221.75k. Continuing claims dropped -28k to 1.722M in the week ending December 29. Four-week moving average of continuing claims rose 15.25k to 1.721M.

Released from Canada, new housing price index rose 0.0% mom in November, matched expectations. Building permits rose 2.6% mom, beat expectation of -0.5% mom.

Released earlier today, UK BRC retail sales monitor dropped -0.7% yoy in December versus expectation of -0.3% yoy. China CPI slowed to 1.9% yoy in December, down from 2.2% yoy and missed expectation of 2.1% yoy. PPI slowed to 0.9% yoy, down from 2.7% yoy and missed expectation of 1.6% yoy. Japan leading index dropped 0.3 to 99.3 in November.

Fed Barkin: Economic numbers strong, but business sentiment weakened considerably

In a prepared speech, Richmond Fed President Thomas Barkin said ” as we enter 2019, I hear a lot of concern” regarding growth. Such concerns were driven by “trade, international economies or politics.” And some were “market driven, as volatility has increased and the yield curve has narrowed.”

Also, he noted that “some companies are still feeling hungover from the Great Recession” and that’s a real issue. That is, “as the economy’s numbers look strong but business sentiment has weakened considerably.”

Barking concluded that “the United States faces a slower growth trend that isn’t in any of our interests. Changing the slope is doable via initiatives to expand the workforce and boost productivity growth.” Read more forex news…

UK Leadsom: Brexit plan B will be ready within days if the deal is voted down

In UK, Andrea Leadsom, the Leader of the House of Commons, said the government will set out its plan B should Prime Minister Theresa May’s Brexit deal is voted down next week. She told the Parliament that “the prime minister has shown her willingness to always return to this House at the first possible opportunity if there is anything to report in terms of our Brexit deal and we will continue to do so.”

Meanwhile, May’s spokesman said she is still working on more assurances from the EU on the Brexit deal, in particular the Irish backstop. May still hope to convince MPs to vote for the agreement on January 15.

Opposition Labour leader Jeremy Corbyn said the party would vote against the deal. And after that it’s voted down, “an election must be the priority. It is not only the most practical option, it is also the most democratic option.” Though, he’s open that “if a general election cannot be secured, then we will keep all options on the table, including the option of campaigning for a public vote.”

Note: our best forex robot for automated trading has low risk and stable profit. You can try to test results of our forex robot free.

MOFCOM: China-US trade talks enhanced mutual understanding and laid foundation for resolving mutual concerns

In a relatively brief statement, the Chinese Ministry of Commerce said the trade talks with the US this week were extensive and laid down the foundation for resolving trade friction between the countries.

The MOFCOM statement said “The two sides actively implemented the important consensus of the two heads of state and conducted extensive, in-depth and meticulous exchanges on trade issues and structural issues of common concern, which enhanced mutual understanding and laid the foundation for resolving mutual concerns. Both parties agreed to continue to maintain close contact.”

USD/CHF Mid-Day Outlook

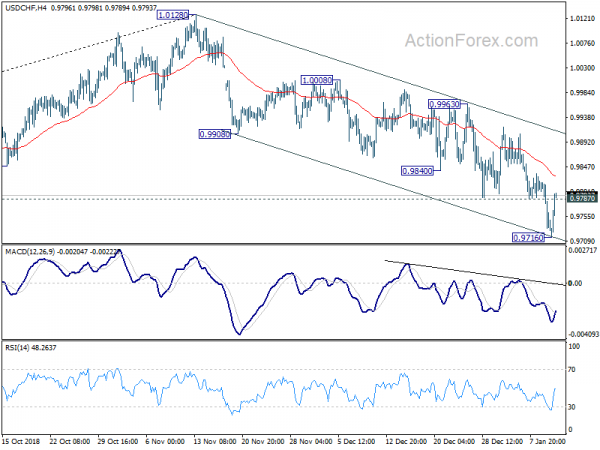

Daily Pivots: (S1) 0.9710; (P) 0.9766; (R1) 0.9799; More….

USD/CHF recovers after dropping support from near term channel. Intraday bias is turned neutral for some consolidations. But upside of recovery should be limited well below 0.9963 resistance to bring another decline. Current fall from 1.0128 should be correcting whole rise from 0.9186. Below 0.9716 will target 0.9541 (61.8% retracement of 0.9186 to 1.0128 at 0.9546).

In the bigger picture, current development suggests that rise from 0.9186 has possibly completed with three waves up to 1.0128 already. Decline from 1.0128 could either be correcting this move, or reversing the trend. As long as 0.9541 support holds, we’d slightly favor the former scenario, and expect another rise through 1.0128 at a later stage. However, sustained break of 0.9541 will confirm trend reversal and bring deeper fall back to 0.9186 low.

Note: The best forex auto trader robot 2021-2022 according to our clients is ForexV Portfolio v.11. It is fully automated trading system with stable profit and low risk. Go to our forex robot store and buy EA with discount.

Economic Indicators Update

-62B-20B

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:01 | GBP | BRC Retail Sales Monitor Y/Y Dec | -0.70% | -0.30% | -0.50% | |

| 01:30 | CNY | CPI Y/Y Dec | 1.90% | 2.10% | 2.20% | |

| 01:30 | CNY | PPI Y/Y Dec | 0.90% | 1.60% | 2.70% | |

| 05:00 | JPY | Leading Index CI Nov P | 99.30% | 99.50% | 99.60% | |

| 12:30 | EUR | ECB Monetary Policy Meeting Accounts | ||||

| 13:30 | USD | Initial Jobless Claims (JAN 5) | 216K | 226K | 231K | 233K |

| 13:30 | CAD | New Housing Price Index M/M Nov | 0.00% | 0.00% | 0.00% | |

| 13:30 | CAD | Building Permits M/M Nov | 2.60% | -0.50% | -0.20% | -0.40% |

| 15:30 | USD | Natural Gas Storage |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals