For the 24 hours to 23:00 GMT, the USD rose 0.10% against the JPY and closed at 109.40.

In the Asian session, at GMT0400, the pair is trading at 109.37, with the USD trading marginally lower against the JPY from yesterday’s close.

Overnight data showed that Japan’s retail trade climbed 1.3% on an annual basis in December, higher than market consensus for a rise of 1.0%. In the prior month, retail trade had advanced 1.4%.

On the other hand, the nation’s large retailer’s sales dropped 1.0% on a monthly basis in December, less than market expectations for a fall of 1.1%. In the previous month, large retailer’s sales had recorded a decline of 2.2%. Moreover, the consumer confidence index fell to a level of 41.9 in January, more than market expectations for a drop to a level of 42.4. The index had recorded a level of 42.7 in the previous month.

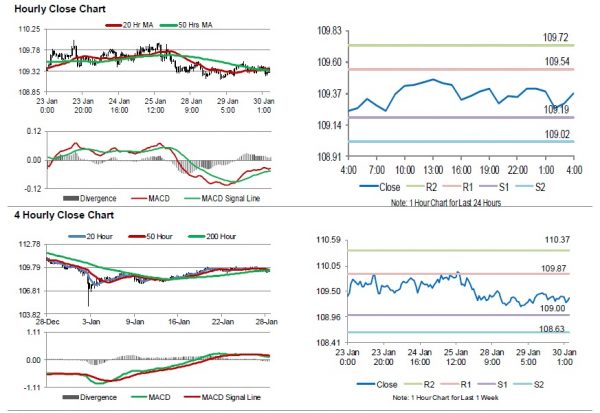

The pair is expected to find support at 109.19, and a fall through could take it to the next support level of 109.02. The pair is expected to find its first resistance at 109.54, and a rise through could take it to the next resistance level of 109.72.

Moving ahead, traders would closely monitor Japan’s industrial production and housing starts, both for December, slated to release overnight.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals