For the 24 hours to 23:00 GMT, the GBP declined 0.53% against the USD and closed at 1.3080, after UK lawmakers dismissed calls to extend the Brexit negotiations, indicating that the UK has exactly two months before leaving the European Union, whether or not a deal has been secured. Meanwhile, the MP’s passed an amendment that the UK Prime Minister Theresa May should initiate a substitute agreement over the Irish backstop with a view to avoid a no-deal Brexit.

In the Asian session, at GMT0400, the pair is trading at 1.3087, with the GBP trading 0.05% higher against the USD from yesterday’s close.

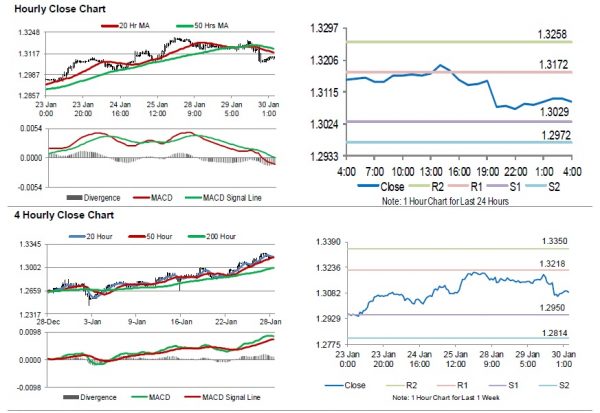

The pair is expected to find support at 1.3029, and a fall through could take it to the next support level of 1.2972. The pair is expected to find its first resistance at 1.3172, and a rise through could take it to the next resistance level of 1.3258.

Going ahead, traders would await UK’s net consumer credit and mortgage approvals, both for December, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals