Following the Fed, the RBA comes next in line to decide on monetary policy. The first meeting of 2019 at 0330 GMT on Tuesday is expected to extend the historic period of inaction to 29 months, though with the Fed, the world’s most influential central bank, shifting outlook to neutral, speculation is swirling that Australia’s central may appear more dovish this time. The event will be followed by a speech from the RBA governor, Philip Lowe, on Wednesday (0130 GMT) and updated economic forecasts mentioned in the Bank’s quarterly policy statement on Friday (0030 GMT).

After making markets believe that interest rates will rise at least two times in 2019, the Fed chief Jerome Powell made a U-turn at last Wednesday’s FOMC policy meeting, saying instead that the central bank will not raise borrowing costs until the data clarify that the economy is heading in the right direction. It is not that Fed policymakers doubt the healthy shape of the US economy but that headwinds such as the boiling US-Sino trade war, Brexit, and signs of economic weakness in China and the Eurozone, could potentially squeeze the global economy, dragging US economic activities downward as well.

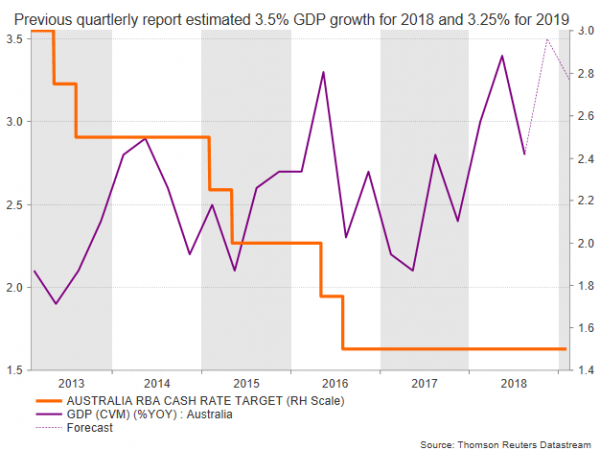

With rate cut speculation now increasing in the US and elsewhere, and fears over a global economic slowdown heating, it would not be wise for the Reserve Bank of Australia to abandon its easy-policy approach at this point. Recall that the Bank refrained from easing its record stimulus during 2018 in the face of highly indebted households, subdued wages, and rising uncertainties surrounding the Chinese economy at a time when its overseas peers were moving ahead with their tightening plans. Even if the labour market showed improvement last year, with the unemployment rate dropping to seven-year lows, the advance in wages was insufficient to boost household spending and hence inflation towards the midpoint of the RBA’s 2-3% target band. Since this is still the case, and in consideration of a slowing housing market and a discouraged business sector, policymakers are anticipated to keep interest rates at the all-time low of 1.5% once again.

Powell’s dovish turn however, will likely affect sentiment within the RBA and it would be interesting to see whether the RBA has become worried enough to adjust the content of the rate statement. Specifically, a removal of the well-contained “next move up” phrase would confirm that policymakers have put rate hike plans to rest in the current time and are relying on data to shape the direction of interest rates. Such an action could also foresee Philip Lowe delivering a cautious speech on Wednesday and growth forecasts easing on Friday in fears the economy may appear relatively more sensitive to a contraction in global growth because of the importance of capital inflows and commodity exports. Consequently, the rate cut scenario may come back to the surface as well. Yet, some board members attempted to discard such expectations last week, with Ian Harper, one of the nine policy setters, putting faith that the next move in interest rates is likely to be higher.

In FX markets, even if some degree of dovishness has been already priced in, AUDUSD would still bear the negative consequences if the RBA softens its language. The pair could find immediate support within the 0.72-0.7150 area where the 50-period moving average is currently trending. Breaking that range, the next stop could be near the 0.7070 resistance-turned support level., while lower the way could open towards the 0.70 round level.

Alternatively, should the RBA envision higher interest rates in the future, painting a more rosy outlook for the Australian economy than analysts expect, the price could crawl up to 0.73. Another leg higher could hit resistance at 0.7345, while steeper increases may also retest the December high of 0.7392.

It is also worth noting that beyond the RBA rate decision, data on retail sales and trade balance will be separately handed at 0030 GMT on Tuesday.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals