Key points covered in this podcast

- What is the opening range?

- Why the opening range bias is a useful trading tool to have at your disposal

- How opening ranges work on multiple timeframes

The opening range breakout strategy is a logical and repeatable strategy that involves traders building firm market direction biases after price breaks above or below the market defined opening price range of a session.

In a special installment of our DailyFX podcast Trading Global Markets Decoded, our senior strategist Tyler Yell walks through the concept of opening ranges here, covering how they are effective for building a bias, how they play out, and what traders should watch out for when trading them.

Follow our podcasts on a platform that suits you

iTunes: https://itunes.apple.com/us/podcast/trading-global-markets-decoded/id1440995971

Stitcher: https://www.stitcher.com/podcast/trading-global-markets-decoded-with-dailyfx

Soundcloud: https://soundcloud.com/user-943631370

Google Play: https://play.google.com/music/listen?u=0#/ps/Iuoq7v7xqjefyqthmypwp3x5aoi

Typically with opening range breakout strategy, traders are looking to ride a clear move as soon as possible; bulls will build long positions and bears will build short positions as early in the session as they can.

Then after a period of time the opening range is set, that breakout will determine the path of least resistance for the rest of the day, where a trend, if it is to take place, may eventually move. Tyler uses the example of the ’10 O’Clock Bulls’ in the 1990s, where bullish breakouts were common. ‘The US equity market opens at 9:30 and then if you get a breakout you tend to have the bearish dump their positions and then everyone load into the topside.

‘That’s how they got the name 10 O’Clock Bulls; 30 minutes after the open, the opening range would be established and typically broken higher, and you’d see this aggressive move higher,’ he explains.

The Opening Range Concept

With the opening range concept, you typically have a very clear frame of price over the first 30 minutes of a session. Once you have the high and the low of the session, if you have an upper breakout, you’re typically not going to see that low broken for the rest of the day, Tyler explains. Conversely, if you have a downside break, you’re typically not going to see that high broken for the rest of the day. ‘That allows traders to build in not only a bias but a very clear stop point.’

This is very different to fundamental analysis, where you’re thinking of different factors that will affect the value and the market view of a certain asset. ‘With opening range breakouts, you’re looking at it more from a trading standpoint – where is the trend, how can I manage risk, how can I preserve capital at all costs?’ Tyler says.

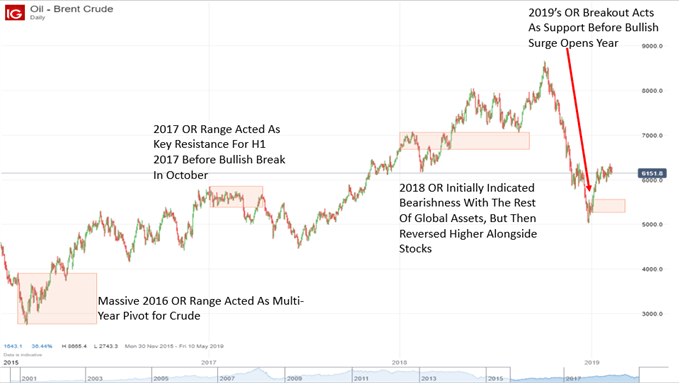

The chart below gives an example of how four opening ranges played out in consecutive years.

An advantage of opening range breakout strategy is that it gives you not only a clear bias, but it presents clear messages: that traders don’t want to miss out on the first big directional move of the year, and they don’t want to be lagging the benchmarks they follow.

But in addition to that, Tyler says, traders can’t afford to be holding a loss, and if they’re on the wrong side of an opening range breakout they’re usually pretty quick to get out of that trade, and then reverse, or find themselves a new opportunity to trade.

From a trading standpoint, that’s a very valuable thing. ‘You can build this view that if it breaks below that opening range and I’m bullish, then I get out of the trade, maybe I stop and reverse, and if I’m bearish, and it breaks higher, then I get out of that trade, possibly stop and reverse or go to another market altogether,’ Tyler says.

Understanding Macro Opening Ranges

It’s important to understand Macro opening ranges;that opening ranges work on multiple timeframes. You can go session opening ranges, daily opening ranges, weekly, monthly, quarterly and biannual. ‘As a trader, pick a market you’re focused on, or a handful of markets, and opening ranges will help you manage risk and understand how trends are playing out,’ Tyler advises.

Opening range breakouts are a tool that you should definitely put in your pocket, especially from a trading standpoint, where you not only need a clear bias but you need an objective way to measure risk or measure when your view is no longer likely to play out. ‘To me, opening ranges give you a great way to approach that,’ Tyler says.

Be Sure to Check out our Series on Becoming a Better Trader

DailyFX analyst Paul Robinson recently recorded a series on how you can prepare your trading for 2019, as well as building up a respected library of webinars and how-to videos on DailyFX that deal with the core tenets of successful trading that you can access here.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our forex ea download

Signal2forex reviews

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals