The Reserve Bank of New Zealand is expected to keep its benchmark interest rate at +1.75% this evening (08:00 pm ET).

Many expect Governor Orr to join the RBA with a more “dovish” statement this go around, and in contrast to the November release. The statement should reflect the increased global risks over the past three-months.

Currently, the market is pricing close to a +40% chance of an RBNZ rate cut by May, and with that in mind, investors should expect the accompanying policy statement to trigger a rates market reaction.

Kiwi inflation is just below target, but unemployment has risen recently.

Rate differentials support U.S dollar:

Many of the commonwealth central banks (BoC, BoE, RBA) have assumed the Fed’s cautious outlook on monetary policy, which suggests that a gap in yields – U.S vs. the rest – will remain for the foreseeable future.

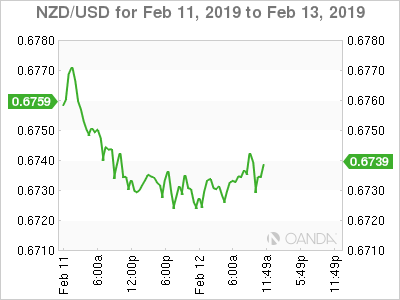

Higher U.S yields does support owning dollar dominated assets. The New Zealand dollar is down by -0.2% at NZ$0.672, having dropped to a three-week low of NZ$0.6719 during today’s European session.

Reserve Bank of Australia (RBA)

The RBA has adopted a “neutral” policy bias, stating that the Australian economy “could be weaker than it thinks and that the risks to the economic outlook are more balanced.”

Nevertheless, Governor Lowe remains upbeat on the Aussie job market, but has given the RBA the latitude to cut interest rates should growth fall short of expectations and the unemployment rate start to rise.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals