For the 24 hours to 23:00 GMT, the EUR rose 0.51% against the USD and closed at 1.1333.

In the US data indicated that the US NFIB small business optimism index dropped to a two-year low level of 101.2 in January, compared to a reading of 104.4 in the prior month. Market participants had envisaged the index to fall to a level of 103.0. Meanwhile, the nation’s JOLTs job openings unexpectedly rose to a record high level of 7335.0K in December, defying market expectations for a drop to a level of 6846.0K. The JOLTs job openings had registered a revised level of 7166.0K in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1340, with the EUR trading 0.06% higher against the USD from yesterday’s close.

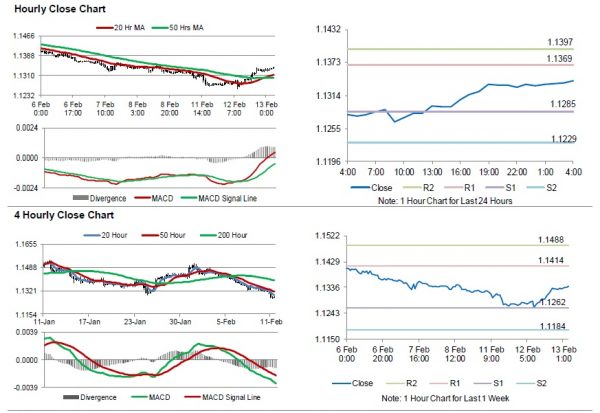

The pair is expected to find support at 1.1285, and a fall through could take it to the next support level of 1.1229. The pair is expected to find its first resistance at 1.1369, and a rise through could take it to the next resistance level of 1.1397.

Moving ahead, traders would keep an eye on the Euro-zone’s industrial production for December, set to release in a few hours. Later in the day, the US consumer price index and average hourly earnings, both for January, along with the MBA mortgage applications, will pique significant amount of investors’ attention. Additionally, the US monthly budget statement for December, would keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.

For traders: our Portfolio of forex robots for automated trading has low risk and stable profit. You can try to test results of our download forex ea

Signal2forex review

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals