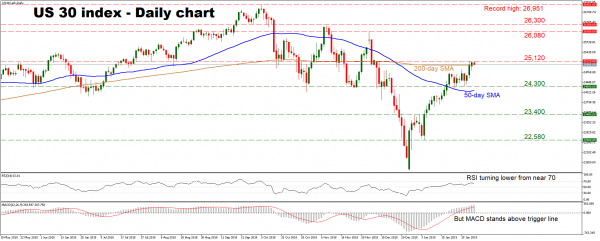

US 30 Index Clears 200-Day SMA, Seems Positive in Immediate Term

The US 30 index has continued to recover in recent sessions, managing to close above its 200-day simple moving average (SMA) on January 31. Combined with the fact that recent price action consists of higher highs and higher lows, the...

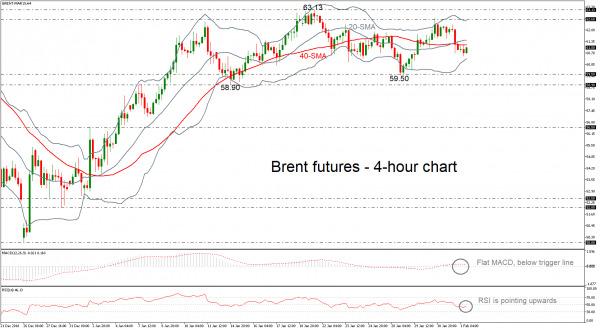

Brent Crude Oil Futures Trade Sideways in Near Term; Hold in Tight Bollinger Band

Brent crude oil futures have been moving sideways within the Bollinger bands over the last three weeks, failing to create a significant movement. The RSI indicator suggests that the market might improve in the coming sessions as it is pointing...

USDZAR Remains Negative, May Post “Death Cross” Soon

USDZAR has continued to print lower highs and lower lows on the daily chart, keeping the medium-term picture decisively negative. Enhancing this view, price action is taking place firmly below both the 50- and 200-day simple moving averages (SMAs). Notice...

GBP/USD Faces Corrective Weakness On Price Rejection

GBPUSD faces correction weakness on price rejection following its flat close on Thursday. Support is seen at 1.3000 level. Further down, support comes in at the 1.2950 level where a break will turn focus to the 1.2900 level. Further down,...

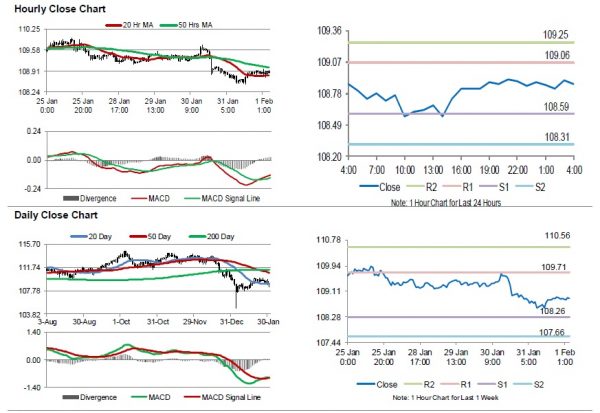

USD/JPY Outlook: Tight Ranges Ahead US NFP, Little Impact From Renewed Risk Aversion

The pair holds within tight consolidation and awaiting US jobs data for fresh signals after pullback from 110 resistance zone showed initial signs of stall. Thursday’s strong downside rejection left daily hammer, suggesting that easing might be over. Rising bullish...

EUR/USD Might Surge To R2 At 1.1500

During Thursday’s trading session, the currency exchange rate depreciated to 1.1440, passing through the support levels of the 55-hour simple moving average and the 50.00% Fibo. On Friday, the rate was located above the 50.00% Fibonacci retracement level at the...

GBP/USD Aims To Break PP At 1.3084

During Friday’s morning hours, the British Pound passed through the support levels of the 55-hour and the 200-hour simple moving averages to trade at the 1.3047 mark. In regards to the near-term future, most likely, the rate will be resisted...

USD/JPY Could Trade At 108.40

During Thursday’s trading session, the rate depreciated to 108.40, as it was expected. On Friday morning, the US Dollar appreciated against the Japanese Yen to the 108.93 mark. Most likely, the US Dollar will depreciate against the Japanese Yen to...

Dollar Regains Ground after US-China Trade Talks, Turns to Non-Farm Payrolls

It seems that the impacts of poor economic data and Fed’s dovish turn on the markets are “roughly balanced” for now. Stocks in the US and Asia turned mixed and stayed mixed since yesterday. Poor Chinese manufacturing data gives the...

Japan’s Unemployment Rate Unexpectedly Fell To A 26-Year Low Level In December

For the 24 hours to 23:00 GMT, the USD declined 0.17% against the JPY and closed at 108.85. In the Asian session, at GMT0400, the pair is trading at 108.87, with the USD trading a tad higher against the JPY...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals