Wealthfront bets on ‘self-driving money,’ following Netflix’s playbook — not Wall Street’s

The terms “wealth management” and “viral sensation” are rarely used in the same sentence. Andy Rachleff, co-founder of the robo-advisor Wealthfront, is betting his retirement years he can change that. After a career spent investing in Silicon Valley start-ups, Rachleff...

Risk Aversion to Come Back in Q2 as Stocks and Yields Recouple

Intensifying recession fear was the main theme in the markets in March, alongside never-ending Brexit and trade tensions. With downside risks to growth starting to materialize, major global central banks started their dovish turns. Most notably, Fed now forecasts no...

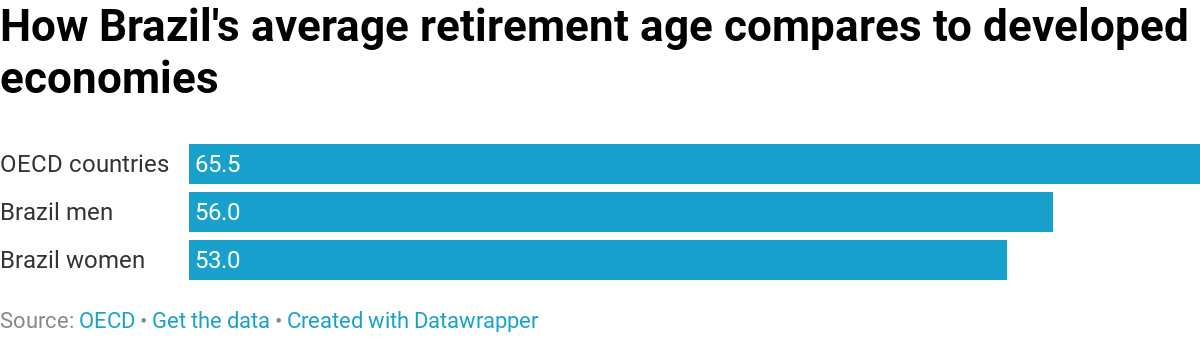

The future of Brazilian stocks hinges on two words: Pension reform

Brazilian stocks are off to a solid start in 2019, but whether they can continue to climb depends on one major policy shift: reforming Brazil’s overcrowded public pension system. Brazil’s benchmark stock index — the Bovespa — reached an all-time...

Weekly Economic and Financial Commentary: What Lies Beyond the Soft First Quarter?

U.S. Review Resiliency in the Face of Uncertainty The U.S. economy continues to show a great deal of resiliency in the face of slowing global economic growth and a whole host of geopolitical uncertainty. Falling long-term interest rates have raised...

The Weekly Bottom Line: When the Downside Risks Loom Large

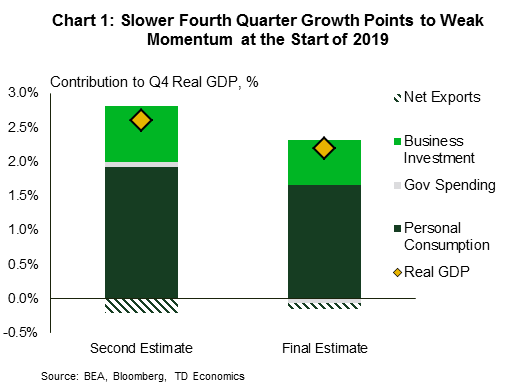

U.S. Highlights The U.S. economy expanded at a slower pace than previously reported in the fourth quarter (2.2% vs. 2.6%). This left annual average growth at just below the 3% mark, though Q4/Q4 they were just able to hit that...

April Optimism Could be Key Turning Point for Global Growth

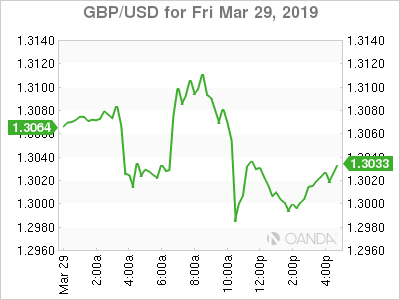

The US dollar climbed higher as markets balanced out global growth concerns along with optimism a trade deal was nearing between the two largest economies in the world. US economic data painted a mixed picture with the earlier data in...

Down but not out, Romania is just a riskier bet

The cards have been stacked against Romania in a turbulent year Analysts have downgraded Romania in Euromoney’s country risk survey according to preliminary results for Q1 2019 to be officially released next week. The country has come through a turbulent...

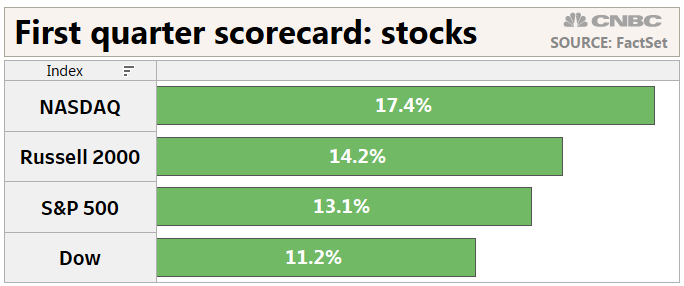

Key data could end or defend recession fears as stocks notch best quarter in a decade

Stocks head into the second quarter propelled by the best quarter in nearly a decade as the long tepid IPO market starts to simmer again. But the markets also face a reality check in the week ahead with some key...

Here are the winners and losers from the stock market’s first quarter of 2019

The first quarter has been a banner period for Wall Street. The S&P 500 rose 13.1 percent this quarter and notched its best start to a year since 1998. The broad index also posted its biggest one-quarter gain since 2009....

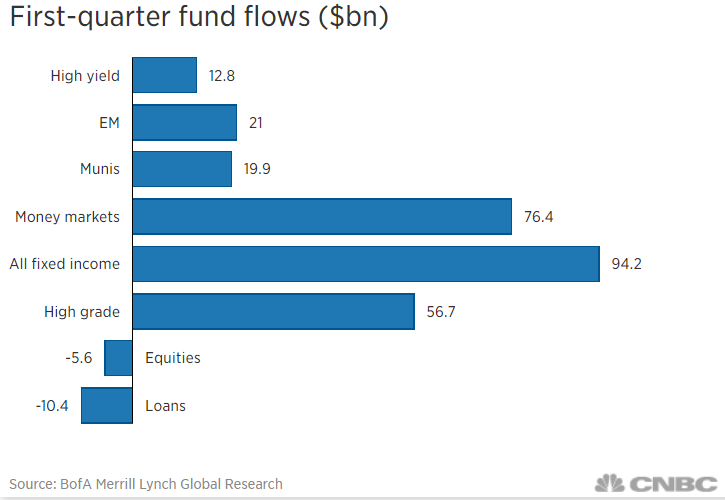

Investors shun stock funds amid the market’s best start to a year since 1998

This quarter is one for the Wall Street history books — stocks are on track to post their best quarter since 2009 and best start to a year in more than two decades. However, investors shrugged it off. While the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals