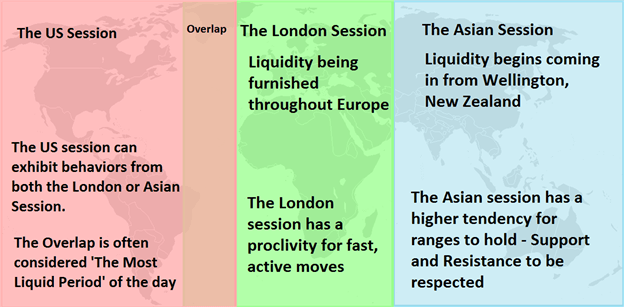

There are three major forex trading sessions which comprise the 24-hour market: the London session, the US session and the Asian session. Each major geographic market center can exhibit vastly unique traits and tendencies that can allow traders to effectively execute strategies at any time.

Although the forex market is the most liquid of all asset classes, there are periods whereby volatility is constant, and others subdued. Understanding these different forex session times can improve the reliability of a forex trading strategy.

In this article, we will explore each of these forex market sessions including their key characteristics – forex time zones and how they affect trading.

What are the main forex trading sessions?

Customarily, the forex market is divided into three market sessions:

The forex market is seen as highly functional/dynamic during these trading sessions as major banks, institutions and retail traders are operational. Noting the specific times of each trading session will assist forex traders in developing their trading strategies around this data.

Asian trading session

Tokyo is the first forex session to open, and many large participants use the trade momentum In Asia to develop their strategies and utilise as a gauge for future market dynamics. Approximately 6% of the world’s FX transactions are enacted in the Asian trading session.

European trading session

London is the largest and most important forex trading session in the world, with roughly a 34% market share of the daily forex volume. Most of the world’s largest banks keep their dealing desks in London because of the market share. The large number of participants in the London forex market and the high value of the transactions makes the London session more volatile than the other two forex sessions.

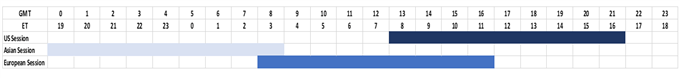

The onslaught of liquidity coming in from London can greatly increase the ‘average hourly move’ of major currency pairs such as EUR/USD. The chart below illustrates this statistic based on the time of day – notice the increase that takes place as the European trading session begins at 03:00 ET (08:00 GMT).

Source: DailyFX Traits of Successful Traders research (2010-2012)

US trading session

The second largest trading market, New York handles approximately 16% of the world’s forex transactions. Many of the transactions in New York occurs during the US/Europe overlap, with transactions slowing as liquidity dries up and European traders exit the forex market.

Notice the green dot on the previous chart around 08:00 ET (13:00 GMT) when US comes online and when the market has the Europe/US overlap, the average movement increases even further until London falls offline (denoted by the red dot) near 12:00 ET (17:00 GMT).

When is the best time to trade?

DailyFX data has shown over the last 10 years, European currency pairs have shown greater success when traded during the 19:00 -11:00 GMT period. As mentioned previously, the liquidity during this time is relatively low as the US session has little/no affect. This lower liquidity allows for range bound trading strategies with greater use of indicators such as RSI.

Day traders who like ranges, meaning buying at support and selling at resistance should consider trading the European currencies during the late US session into the Asian session (19:00–07:00GMT).

Day traders who like breakouts and trends should consider trading when Europe comes online to when the Europe moves offline (08:00–17:00GMT). Secondarily, trading Asian currencies (AUDor NZD) during the Asian session may provide some breakouts too as that is the active business day for those home currencies.

If you try to trade breakouts of European currencies during the Asian session, you will likely find it frustrating as those markets tend not to move as much since that is ‘off hours’ for those currencies.

For more insights on forex trading sessions, read“When is the best time of day to trade forex?”

Supporting pages and guides to enhance your forex trading experience

- If you are just starting out on your trading journey it is essential to understand the basics of forex trading in our free New to Forex trading guide.

- We also offer a range of trading guides to supplement your forex knowledge and strategy development.

- Our research team analyzed over 30 million live trades to uncover the traits of successful traders. Incorporate these traits to give yourself an edge in the markets.

- Traders often look to retail client sentiment when trading popular FX markets. DailyFX provides such data, based on IG client sentiment.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals