Euro tumbles broadly after ECB delivered and all-the-way dovish meeting. There will be no rate hike until at least 2020. New TLTRO-III is announced. ECB expects sizeable moderation in growth. GDP growth forecast was revised down substantially. Yet, risks surrounding outlook are still tilted to the downside. Selloff in Euro is dragging down other European majors, as well as German 10-year yield, which is back below 0.1 handle.

Staying in the currency markets, commodity currencies are surprisingly the strongest ones today, despite dovish outlook on RBA, RBNZ and even BoC. Pull back in global treasury yield could be a factor helping them. Even US 10-year yield is now back below 2.7 handle and is moving downward. Overall, Yen and Dollar are mixed.

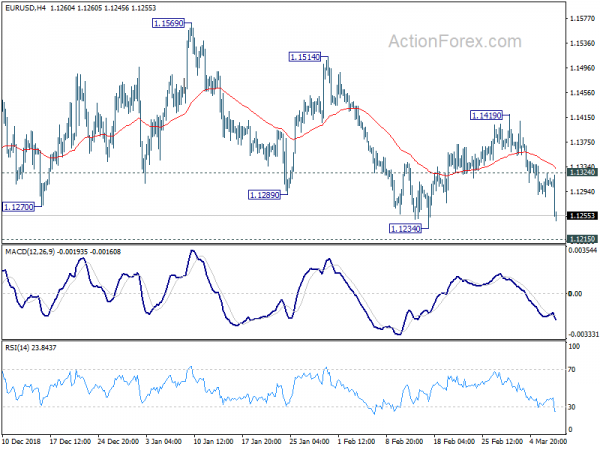

Technically, EUR/USD is heading back to 1.1215 low and break will confirm resumption of larger down trend from 1.2555. USD/CHF will likely test 1.0098/0128 resistance zone too. GBP/USD is back pressing 1.3109 but it’s stubbornly holding on to this support so far.

In Europe, FTSE is down -0.28%. DAX is down -0.16%. CAC is down -0.10%. German 10-year yield is down -0.033 at 0.095, back below even 0.1 handle. Earlier in Asia, Nikkei dropped -0.65%. Hong Kong HSI dropped -0.89%. China Shanghai SSE rose 0.14%. Singapore Strait Times rose 0.21%. Japan 10-year JGB yield dropped -0.0062 to -0.001.

All-the-way dovish ECB to keep interest rates unchanged longer

Euro drops broadly after an all-the-way dovish ECB meeting and takes European majors lower. ECB keeps interest range unchanged at 0.00% as widely expected. The central bank now expects to keep interest rates at present levels “at least through the end of 2019”, prolonged from “summer of 2019”. Also, TLTRO-III is announced, quarterly from September 2019 through March 2021. It’s aiming at preserving favorable bank lending conditions, and smooth transition of monetary policy.

In ECB’s post meeting press conference, President Mario Draghi said there are signs that “some of the idiosyncratic domestic factors dampening growth are starting to fade”. However, the weakening in data points to a “sizeable moderation in the pace of the economic expansion that will extend into the current year”. Underlying inflations “continues to be muted”. And weaker economic momentum is “slowing the adjustment of inflation” towards target.

Draghi added that Incoming have continued to be weak, in particular in manufacturing, “reflecting the slowdown in external demand compounded by some country and sector-specific factors”. And the impact is “turning out to be somewhat longer-lasting”. Thus, near-term growth outlook will be weaker than previously anticipated

In the new staff projections, GDP growth was “revised down substantially in 2019 and slightly in 2020”. GDP is projected to grow by 1.1% in 2019, 1.6% in 2020 and 1.5% in 2021. They compare to December’s projection of 1.7% in 2019, 1.7% in 2020 and 1.5% in 2021. Risks surrounding outlook are “still tilted to the downside”, due to “geopolitical factors, the threat of protectionism and vulnerabilities in emerging markets.”

HICP inflation is projected to be at 1.2% in 2019, 1.5% in 2020 and 1.6% in 2021. They compare to December’s projection of 1.6% in 2019, 1.7% in 2020 and 1.8% in 2021.

More on ECB: ECB Announces new TLTROs, Markedly Downgrades Growth and Inflation Forecasts

Eurozone Q4 GDP growth finalized at 0.2% qoq, employment grew 0.3% qoq

Eurozone Q4 GDP growth was finalized at 0.2% qoq, unrevised. Annually, GDP grew 1.1% yoy. Over the whole 2018, GDP grew 1.8%. During Q4, household final consumption expenditure rose by 0.2%. Gross fixed capital formation increased by 0.6%. Exports increased by 0.9%. Imports increased by 0.5%. Eurozone Employment growth in Q4 was finalized at 0.3% qoq, 1.3% yoy.

Also released in European session, Swiss unemployment rate was unchanged at 2.4% in February. Foreign currency reserves dropped to CHF 739B in February.

US initial jobless dropped -3k to 223k

US initial jobless claims dropped -3k to 223k in the week ending March 12, slightly below expectation of 225k. The four-week moving average of initial claims dropped -3k to 226.25k. Continuing claims dropped 50k to 1.755M in the week ending February 23. Four-week moving average of continuing claims rose 4.75k to 1.767M. Also release, US non-farm productivity was finalized at 1.9% in Q4, unit labor cost at 2.0%. Canada building permits dropped -5.5% mom in January.

BoE Tenreyo: Effect of Brexit uncertainty on demand increasingly evident

BoE MPC member Silvanna Tenreyo said the “effect of that Brexit uncertainty on demand has become increasingly evident in recent months”. The effect is most apparent in business as “investment has been falling in the UK at a time when it has been growing in our international peers; business confidence surveys have slumped; hiring intentions have fallen back.”.

There were also signs of impact on households as “housing market is weakening; consumer confidence has deteriorated. This all happened at a time when household real incomes are rising and all else equal, one might normally have expected spending to be rising too.”

On monetary policy in case of disorderly Brexit in a speech. She echoed the view that seems to be the consensus in the MPC now. That is, “a situation where the negative demand effects outweigh those other effects is more likely, which would necessitate a loosening in policy.”

But she also noted reiterated that “the monetary policy response to such a scenario will depend on the balance of these effects on supply, demand and the exchange rate”. And, it is “to envisage other plausible scenarios requiring the opposite response.”

UK Hammond: The governor will not vote for no-deal Brexit

Chancellor of the Exchequer Philip Hammond told BBC radio that “The government is very clear where the will of parliament is on this. Parliament will vote not to leave the European Union without a deal,” and he had “a high degree of confidence about that.”

At the same time, he also warned that voting against Prime Minister Theresa May’s deal, the UK “will then be in unknown territory where a consensus will have to be forged across the House of Commons and that will inevitably mean compromises being made.”

The UK parliament is scheduled to have another Brexit deal meaningful vote on March 12. If it’s rejected, there will be a vote on no-deal Brexit on March 13. Then if both are rejected, there will be a vote on Article 50 extension.

Australia recorded second largest trade surplus in Jan, but retail sales missed

Australia trade surplus widened to AUD 4.55B in January, up from AUD 3.77B and beat expectation of AUD 2.90B. That’s also the second largest surplus on record. Exports rose 5% to AUD 1.90B while imports rose 3% to AUD 1.12B.

However, retail sales was disappointing. Sales grew merely 0.1% mom in January, rebounding from -0.4% decline in prior month, but missed expectation of 0.3% mom.

Also from Australia, AiG Performance of Construction index rose 0.7 to 43.8 in February, indicating a slower rate of contraction.

China: Some regions will face relatively big budgetary pressure this year

China plans to cut around CNY 2T in taxes and fees for companies in 2019 as growth could slow to the lowest pace in three decades at 6.0-6.5%. Yet, its Finance Minister Liu Kun warned that “considering the downward pressure on the economy and the upcoming policy of larger tax and fee cuts, some regions will still face relatively big budgetary pressure this year.”

Budget deficit is targeted to be at 2.8% of GDP, up from 2.6% in 2018. Liu said “the arrangement on the budget deficit ratio has fully considered factors including fiscal revenue and local government special bonds and leaves more policy room for future macro adjustments.” To offset the reduction in tax and fee revenue, Liu noted the government will collect more profits from some state-owned financial institutions and companies. The government is also trying to secure funding via other channels “which allows us not to raise the deficit ratio too high.”

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1285; (P) 1.1307; (R1) 1.1327; More…..

EUR/USD drops to as low as 1.1245 so far and intraday bias remain on the downside for 1.1215 low. Decisive break there will resume larger down trend from 1.2555. On the upside, above 1.1345 minor resistance will turn bias to the upside for 1.1324 resistance to extend the consolidation from 1.1215.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 21:30 | AUD | AiG Performance of Construction Index Feb | 43.8 | 43.1 | ||

| 00:30 | AUD | Trade Balance (AUD) Jan | 4.55B | 2.90B | 3.68B | 3.77B |

| 00:30 | AUD | Retail Sales M/M Jan | 0.10% | 0.30% | -0.40% | |

| 05:00 | JPY | Leading Index CI Jan P | 95.9 | 96 | 97.5 | |

| 06:45 | CHF | Unemployment Rate Feb | 2.40% | 2.40% | 2.40% | |

| 08:00 | CHF | Foreign Currency Reserves (CHF) Feb | 739B | 741B | ||

| 10:00 | EUR | Eurozone Employment Q/Q Q4 F | 0.30% | 0.30% | 0.30% | |

| 10:00 | EUR | Eurozone Employment Y/Y Q4 F | 1.10% | 1.20% | 1.20% | |

| 10:00 | EUR | Eurozone GDP Q/Q Q4 F | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | Challenger Job Cuts Y/Y Feb | 117.20% | 18.70% | ||

| 12:45 | EUR | ECB Rate Decision | 0.00% | 0.00% | 0.00% | |

| 13:30 | EUR | ECB Press Conference | ||||

| 13:30 | CAD | Building Permits M/M Jan | -5.50% | -1.50% | 6.00% | 6.40% |

| 13:30 | USD | Initial Jobless Claims (MAR 02) | 223K | 225K | 225K | 226K |

| 13:30 | USD | Nonfarm Productivity Q4 F | 1.90% | 1.60% | 2.30% | |

| 13:30 | USD | Unit Labor Costs Q4 F | 2.00% | 1.70% | 0.90% | |

| 15:30 | USD | Natural Gas Storage | -141B | -166B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals