Dollar rises broadly in early US session with help from rebound in treasury yields. 10-year yield is now trying to regain 2.4 handle. Poor Q4 GDP is ignored while traders could be hopeful on some progress in US-China trade talks in Beijing. The development drags down the Japanese to one of the weakest.

Nevertheless, Sterling is the worst performing one on Brexit impasse. There will be another debate in the parliament tomorrow. But there is no sign of finally approving the deal to push the Brexit date from April 12 to May 22. Euro is also among the weakest after poor Eurozone sentiments indicators and Germany CPI miss.

Technically, with today’s decline, EUR/USD is heading to 1.1176 key support and break will resume medium term down trend. USD/JPY’s rebound now turn focus to 110.95 minor resistance and bring will bring stronger rise back to 112.13 resistance. EUR/JPY breached 123.82 temporary low but there is no follow through selling yet. Though, more downside is mildly in favor in EUR/JPY.

In Europe, FTSE is currently up 0.90%. DAX is up 0.48%. CAC is up 0.34%. German 10-year yield is up 0.0131 at -0.065. Earlier in Asia, Nikkei dropped -1.61%. Hong Kong HSI rose 0.16%. China Shanghai SSE dropped -0.92%, lost 3000 handle. Singapore Strait Times rose 0.16%. Japan 10-year JGB yield dropped -0.0263 to -0.092, heading towards -0.1 handle.

US initial claims dropped to 211k, Q4 GDP revised down to 2.2% only

US initial jobless claims dropped -5k to 211k in the week ending March 23, below expectation of 220k. Four-week moving average of initial claims dropped 3.25k to 217.25k. Continuing claims rose 13k to 1.756M in the week ending March 16. Four-week moving average dropped -4.25k to 1.751M.

Q4 GDP growth was finalized at 2.2% annualized, revised down from 2.6% and missed expectation of 2.4%. That’s sharply slower from Q3’s 3.4%. Real GDP grew only 2.9% in 2018, up from 2.2% in 2017 but was below 3.0% handle.

Pending home sales dropped -1.0% mom in February versus expectation of 0.0% mom.

US Mnuchin look forward to productive meetings in China

US Treasury Secretary Steven Mnuchin said he’s looking forward to “productive meetings” as he arrived in Beijing with Trade Representative Robert Lighthizer for another round of trade negotiations. Mnuchin told reporter that “ambassador Lighthizer and myself are pleased to be back here in Beijing, and we look forward to productive meetings.”

Citing unnamed officials, Reuters reported that China’s proposals went further than in the past, which created hope for an eventual trade deal. The discussions on forced technology transfer covered areas that were not touched before, in terms of both scope and specifics.

Meanwhile, the texts of agreements moved forward in all areas even though they’re not where the US want to be. The areas are believed to include forced technology transfer and cyber theft, intellectual property rights, services, currency, agriculture and non-tariff barriers to trade.

Another official noted that some of the tariffs imposed since last year will stay even after a deal is made. And this will be an important issue to resolve, as an important part of the final deal. But for now, there is no clear timeline for completing the deal yet. And negotiations could drag on till June.

China pledges to quicken full market access on banking and finance

Chinese Premier Li Keqiang told business executives at the Boao forum that there is no trust deficit with the US and hoped that the trade talks could achieve results. Li also pledged that China must protect intellectual property or there is no hope for transformation in the country. He also sounded upbeat on the economy and said “changes” in March exceeded expectations.

Besides, Li said China is “quickening the full opening of market access for foreign investors in banking, securities and insurance sectors.” Scope of foreign banks, bank and non-bank card payments will be “expanded sharply”. Restrictions on securities and insurance brokers will also be removed. Li emphasized the measures will be “implemented this year in a relatively forceful way”. In addition, China is drafting rules to relax the restrictions on foreign acquisitions of Chinese listed corporations.

EU Schinas: Apr 12 is the end date if no Brexit deal ratified this week

European Commission spokesman Margaritis Schinas warned again that “If the Withdrawal Agreement is not ratified by the end of this week, Article 50 will be extended to April 12 and it is now for the UK government to inform about how it sees the next steps.” On the indicative votes, Schinas added, “we counted eight ‘noes’ last night, now we need a ‘yes’ on the way forward.”

Prime Minister Theresa May is still meeting Conservative colleagues and Northern Ireland’s Democratic Unionist Party to seek support on her Brexit deal. Meanwhile, May is believed to be still seeking to have another meaningful vote tomorrow. Her spokesman said “Tomorrow’s motion will need to be compliant with both the Speaker’s ruling and the EU council’s decision on conditionality relating to exit on 22 May. Discussions are ongoing and we will look to table the motion as soon as possible today, in order to avoid asking for another extension and the requirement to undertake European parliament elections.”

Hard-line Brexiteer Jacob Rees-Mogg extended his support to May and urged DUP to “come over to the deal”. But DUP insisted they won’t even abstain but just reject it. Another Brexiteer Boris Johnson told Evening Standard newspaper that “May’s deal si dead”.

British Chambers of Commerce Director General Adam Marshall criticized that the uncertainty of the “Brexit black hole” is generating “a growing list of business casualties and a litany of rising costs”. He also urged MPs to do all to avoid no-deal Brexit. He said “messy and disorderly exit would not just be deeply irresponsible – it would be a flagrant dereliction of duty.”

Eurozone economic sentiment dropped to 105.5, dragged by markedly lower industrial confidence

Eurozone Economic Sentiment Indicator (ESI) dropped to 105.5 in March, down from 106.2 and missed expectation of 105.9. EU28 ESI dropped -0.4 to 105.0. The deterioration of Eurozone ESI was resulted from “markedly lower confidence in industry”. Industrial Confidence dropped to -1.7, down from -0.4 and missed expectation of -0.5. Services Confidence dropped to 11.3, down from 12.1 and missed expectation of 12.0. Consumer Confidence was finalized at -7.2, up from -7.4. Amongst the largest Eurozone economies, ESI rose markedly in Spain (+2.3), while it decreased sharply in Germany (−1.8) and the Netherlands (−1.3), and remained broadly unchanged in France (+0.2) and Italy (−0.2).

Eurozone Business Climate Indicator dropped to 0.53, down from 0.69 and missed expectation of 0.69. All the five components of the indicator worsened: while managers’ views of the past production, their production expectations, and their assessments of both overall and export order books declined significantly, their appraisal of the stocks of finished products worsened only slightly.

Also released, Eurozone M3 money supply grew 4.3% yoy in February, above expectation of 3.9% yoy. German CPI slowed to 1.3% yoy in March, down from 1.5% yoy and missed expectation of 1.5% yoy.

New Zealand ANZ business confidence dropped, RBNZ cut sooner rather than later

New Zealand ANZ Business Confidence dropped to -38 in March, down from -30.9. Activity Outlook also dropped to 6.3, down from 10.5. ANZ noted that GDP growth has moderated but is still respectable. However, leading indicators are suggesting that the economy is “running out of steam quite rapidly”.

In particular, export intentions dropped to levels lower than during the Asian Financial Crisis of 1998-9 and the Global Financial Crisis of 2008-9. Sharply lower export intentions despite a well-behaved exchange rate suggest global factors are a part of slowdown in momentum.

Overall, ANZ expects next move in RBNZ to be a cut, “with a growing risk that it is sooner rather than later.”

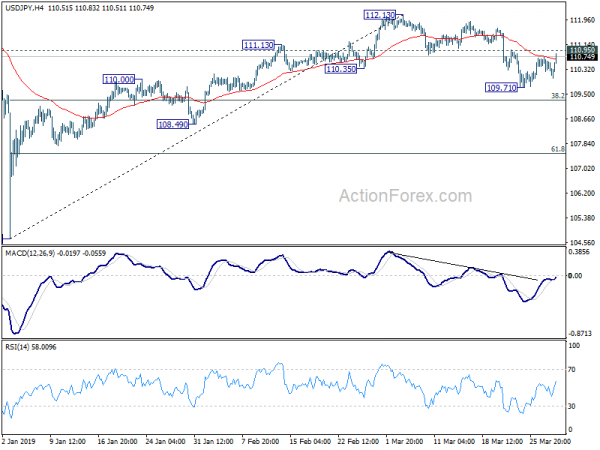

USD/JPY Mid-Day Outlook

Daily Pivots: (S1) 110.26; (P) 110.48; (R1) 110.74; More…

USD/JPY’s recovery from 109.71 resumes after brief retreat. But upside is limited below 110.95 minor resistance. Intraday bias remains neutral first. On the upside, break of 110.95 minor resistance will argue that the pull back from 112.13 has completed at 109.17. In this case, intraday bias will be turned back to the upside for retesting 112.13. On the downside, break of 109.71 will resume the decline from 112.13 to 38.2% retracement of 104.69 to 112.13 at 109.28. Break of 109.28 will target 61.8% retracement at 107.53 next.

In the bigger picture, while the rebound from 104.69 was strong, USD/JPY failed to sustain above 55 week EMA (now at 110.91), and was kept well below 114.54 resistance. Medium term outlook is turned mixed and we’ll wait for the structure of the fall from 112.13 to unveil to make an assessment later. For now, more range trading is expected between 104.69 and 112.13 first.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 00:00 | NZD | ANZ Business Confidence Mar | -38 | -30.9 | ||

| 09:00 | EUR | Eurozone M3 Money Supply Y/Y Feb | 4.30% | 3.90% | 3.80% | |

| 10:00 | EUR | Eurozone Business Climate Indicator Mar | 0.53 | 0.69 | 0.69 | |

| 10:00 | EUR | Eurozone Economic Confidence Mar | 105.5 | 105.9 | 106.1 | 106.2 |

| 10:00 | EUR | Eurozone Industrial Confidence Mar | -1.7 | -0.5 | -0.4 | |

| 10:00 | EUR | Eurozone Services Confidence Mar | 11.3 | 12 | 12.1 | |

| 10:00 | EUR | Eurozone Consumer Confidence Mar F | -7.2 | -7.2 | -7.2 | -7.4 |

| 12:30 | USD | GDP Annualized Q4 F | 2.20% | 2.40% | 2.60% | |

| 12:30 | USD | GDP Price Index Q4 F | 1.90% | 1.80% | 1.80% | |

| 12:30 | USD | Initial Jobless Claims (MAR 23) | 211K | 220K | 221K | 216K |

| 13:00 | EUR | German CPI M/M Mar P | 0.40% | 0.60% | 0.40% | |

| 13:00 | EUR | German CPI Y/Y Mar P | 1.30% | 1.50% | 1.50% | |

| 14:00 | USD | Pending Home Sales M/M Feb | -1.00% | 0.00% | 4.60% | 4.30% |

| 14:30 | USD | Natural Gas Storage | -47B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals