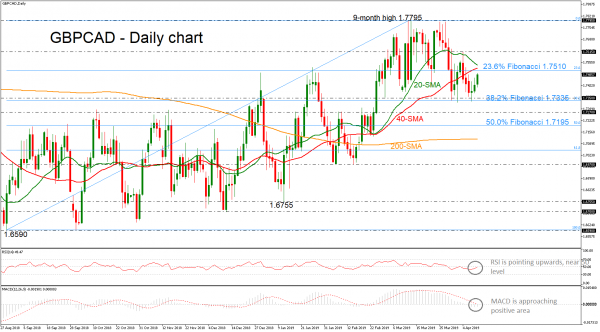

GBPCAD is rising after it found strong support at the 38.2% Fibonacci retracement level of the upward movement from 1.6590 to 1.7795, around 1.7335. The technical indicators are trying to strengthen their momentum, mirroring the market’s behavior over the last days as the RSI is approaching the 50 level, while the MACD is still holding in the bearish area but is edging higher.

Additional increases may drive the price towards the 20- and 40-day simple moving averages (SMAs) currently around the 23.6% Fibonacci of 1.7510, and then could challenge the nine-month high of 1.7615. Above the latter, the nine-month peak of 1.7795, registered on March 12 comes into view.

In case the pair changes its short-term direction to the downside, the bears would probably challenge the 1.7350 support and the 38.2% Fibonacci of 1.7335, which has been a congested area over the last month. A break lower, could last until the 1.7270 barrier.

In the more medium-term picture, the slightly bullish correction shifted to a stronger positive tendency, however, it failed several times over the last sessions to post a higher high.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals