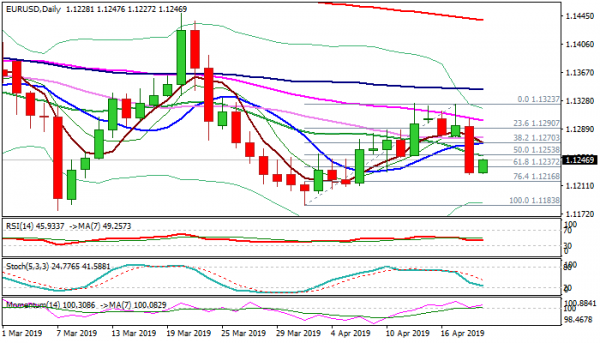

The Euro bounces from new two-week low at 1.1226, posted after Thursday’s 0.6% fall (the biggest one-day loss since 22 Mar). Bears accelerated after weaker than expected Eu members PMI data on Thursday and were boosted by rally of the dollar after upbeat US data. Bearish signal on Thursday’s close below 1.1237 (Fibo 61.8% of 1.1183/1.1323 upleg) keeps risk of further weakness, as daily MA’s are in negative configuration and stochastic heads south. On the other side, momentum regained traction after reversing just above its 7-SMA / centerline and boosts recovery. Broken 20SMA offers immediate resistance at 1.1252, which should ideally cap upticks and guard pivotal 10SMA barrier at 1.1270 (also broken Fibo 38.2% 1.1183/1.1323), violation of which would sideline bears and shift focus towards key barriers at 1.1300 (55SMA) and lower platform at 1.1323.

Res: 1.1252; 1.1270; 1.1300; 1.1323

Sup: 1.1226; 1.1216; 1.1200; 1.1183

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals