Key Highlights

- The Euro declined to a new monthly low at 1.1110 and later recovered against the US Dollar.

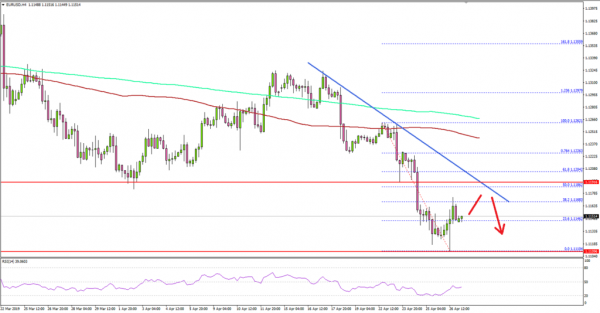

- A crucial bearish trend line is in place with resistance at 1.1190 on the 4-hours chart of EUR/USD.

- The US GDP in Q1 2019 (Prelim) increased 3.2%, more than the 2.0% forecast.

- The Euro Zone Business Climate Index in April 2019 could decline from 0.53 to 0.50.

EURUSD Technical Analysis

The Euro remained in a bearish zone below the 1.1250 support against the US Dollar. The EUR/USD pair declined below 1.1150 and traded to a new monthly low at 1.1110 before starting an upside correction.

Looking at the 4-hours chart, the pair rebounded above the 1.1120 level and the 23.6% Fib retracement level of the last decline from the 1.1262 high to 1.1110 low. The pair even surpassed the 1.1150 level, but there are many hurdles on the upside.

The previous key supports near 1.1180 and 1.1200 are likely to act as strong resistances. Moreover, there is a crucial bearish trend line in place with resistance at 1.1190 on the same chart.

Besides, the 50% Fib retracement level of the last decline from the 1.1262 high to 1.1110 low is near the 1.1186 level. Therefore, the pair is likely to face a significant resistance near the 1.1180-1.1200 area.

On the downside, an initial support is near the 1.1120 level, below which the price could test the 1.1100 and 1.1080 support levels.

Fundamentally, the US Gross Domestic Product Annualized reading for Q1 2019 (Prelim) was released by the US Bureau of Economic Analysis. The market was looking for growth rate of 2.0% in Q1 2019, less than the last 2.2%.

The actual result better than the forecast, as the US GDP grew at an annual rate of 3.2% in Q1 2019, according to the “advance” estimate released by the Bureau of Economic Analysis.

The report added that:

The acceleration in real GDP growth in the first quarter reflected an upturn in state and local government spending, accelerations in private inventory investment and in exports, and a smaller decrease in residential investment.

Overall, the US Dollar buyers remain in action and major pairs like EUR/USD, GBP/USD and AUD/USD are likely to struggle in the near term.

Economic Releases to Watch Today

- Euro Zone Business Climate Index April 2019 – Forecast 0.50, versus 0.53 previous

- Euro Zone Economic Sentiment Indicator April 2019 – Forecast 105.0, versus 105.5 previous.

- US Personal Income for March 2019 (MoM) – Forecast +0.4%, versus +0.2% previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals