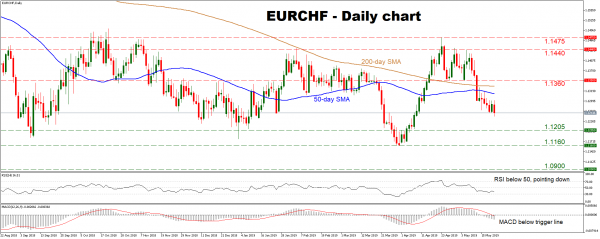

EURCHF retreated in recent weeks, falling below both its 50- and 200-day simple moving averages (SMAs). The near-term outlook has thus turned to cautiously negative, though the bigger picture still seems neutral – with a decisive break either above 1.1475 or below 1.1160 needed to change that.

Short-term momentum oscillators concur, with the RSI already below 50 and pointing lower, and the MACD being in negative territory and below its red trigger line.

Further declines could meet immediate support near the 1.1205 zone, defined by the inside swing high on April 1, with a downside break opening the door for the 22-month low of 1.1160.

On the flipside, a rebound may stall near the neighborhood of 1.1310 – 1.1330, where the 50- and 200-day SMAs are located, respectively. Close to that region is also the support-turned-resistance level of 1.1360, marked by the swing lows in late April and early May.

In short, some further losses shouldn’t be ruled out in the immediate term, but as long as the price remains between 1.1475 and 1.1160, the broader outlook is neutral.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals