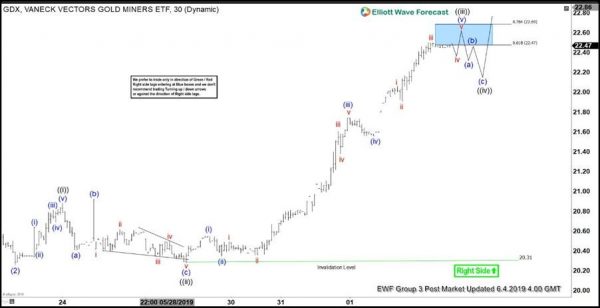

Elliott Wave View: Impulsive Rally In $GDX

Elliott wave view in Gold Miners ETF ($GDX) suggests the pullback to $20.26 ended wave (2). Wave (3) is currently in progress and the internal subdivides as an impulse Elliott Wave structure. Up from $20.26, Wave ((i)) ended at $20.88,...

ECB to Add More Dovish Notes: Focus on Forward Guidance Extension and Pricing of TLTRO-III

We expect the ECB to deliver a more dovish message in June. We expect to see changes in the forward guidance. ECB would also announce the technical details of TLTRO-III. The economic projections would probably similar to the previous ones,...

Stocks making the biggest moves after hours: Box, Coupa and more

Traders and financial professionals work at the opening bell on the floor of the New York Stock Exchange (NYSE), June 3, 2019 in New York City. Drew Angerer | Getty Images News | Getty Images Check out the companies making...

Aussie Improves to 3-Week High, Retail Sales Next

AUD/USD has moved higher in the Monday session. In North American trade, AUD/USD is trading at 0.6957, up 0.30% on the day. Earlier in the day, the pair touched 0.6966, its highest level since mid-May. On the release front, Australian...

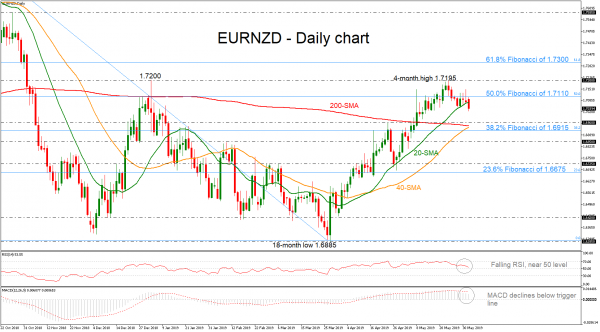

EURNZD Remains Under Pressure Celow 20-day SMA

EURNZD is declining below the 20-day simple moving average (SMA) today, confirming the recent bearish structure in the near term. The RSI is moving towards the 50 level, while the MACD is holding below the trigger line but is still...

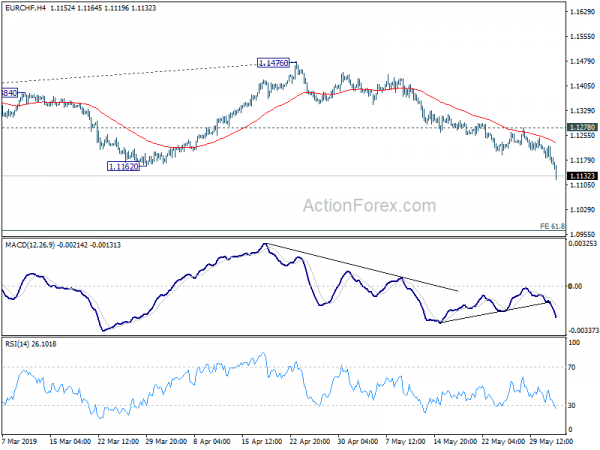

Dollar Softens ahead of Important Economic Data, EUR/CHF Hits 2-Yr Low

Dollar weakens broadly today as markets are turning their focuses to manufacturing from the US. Final reading of Markit PMI shouldn’t deviate much from the first print 50.6. Meanwhile, ISM manufacturing could probably how confidence turned after last round of...

US 30 Index Opens with Gap Down; Flirts with 4-Month Low

The US 30 index futures opened with negative gap today below the 38.2% Fibonacci retracement level of the upward movement from the 16-month low of 21,596 to the 6-month high of 26,712 near 24,754. The index is on the back...

Arab-Latin lessons on diversification

Diversification from oil could remain a pipe dream This is not just because of geography but also because they are in some respects so similar. Their economies are, above all, just too reliant on exports of primary goods – not...

DAX Has Dismal Week As U.S. Threatens Tariffs Against Mexico

The DAX has started the week with slight losses. Currently, the index is at 11,707, down 0.17% on the day. In economic news, German manufacturing PMI ticked lower to 44.3, down from 44.4. The eurozone indicator dropped from 47.9 to...

Dollar Mixed as China’s White Paper Signals No Quick End to Trade War

Dollar opened the week mildly lower but appears to have found some footing in early European session. Trump is fighting trade wars on two fronts, at least. On the one hand, China has cleared stated its position for not backing...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals