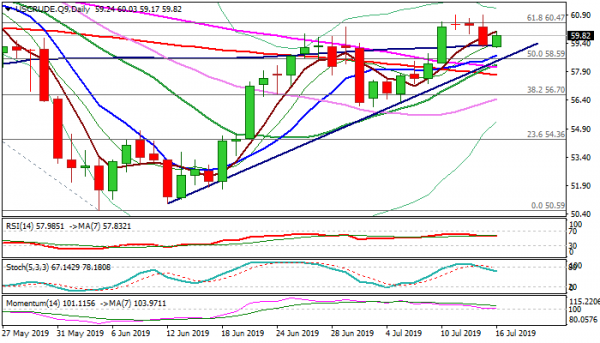

WTI oil price managed to regain traction and edge higher on Tuesday after Monday’s fall was contained by 100DMA ($59.31).

Larger uptrend from $50.59 low showed initial signs of stall at important Fibo barrier at $60.47 (61.8% of $66.58/$50.59), where double-Doji has formed before Monday’s easing.

Bulls came under pressure after hurricane in the gulf of Mexico caused less than expected damage that resulted in restarting production on a number of oil platforms in the gulf.

Fears of fresh pressure on oil price on rising US shale production that is on track to reach record highs in August could put the price lower, with initial negative signal expected on violation of 100DMA and further evidence of deeper pullback expected on break below trendline support ($58.65) and 200DMA ($57.74).

Extended consolidation can be expected while the price stays between 100DMA and Fibo barrier ($60.47), while strong bullish signal could be expected on firm break above $60.47 pivot.

Daily techs are in mixed setup and lack clearer direction signal for now, as markets are awaiting release of weekly US crude inventories report (API due later today and EIA on Wednesday).

Res: 60.00; 60.47; 60.88; 61.38

Sup: 59.31; 58.65; 58.15; 57.74

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals