Sterling weakens broadly today and remains the worst performing one for the week. BoE rate decision provided little inspiration while growth forecasts are notably lowered in the Inflation Report. Euro is the second weakest one on expectation of ECB easing in September. On the other hand, Yen is currently the strongest one into US session, in particular again Sterling and Euro. Dollar is the second strongest, as supported by yesterday’s hawkish FOMC rate cut.

Technically, EUR/JPY breaks 120.05 support and resumes recent fall from 127.50 towards 118.62 low. GBP/JPY even breaks 131.51 (2019 low) and resume long term decline from 156.69 (2018 high). USD/JPY looks a bit vulnerable now as it’s eyeing 108.49 minor support. Break would turn bias to the downside for 107.21 support. Yen crosses could generally be the focus for the rest of the session.

In Europe, currently, FTSE is down -0.42%. DAX is up 0.22%. CAC is up 0.44%. German 10-year yield is down -0.001 at -0.439. Earlier in Asia, Nikkei rose 0.09%. Hong Kong HSI dropped -0.76%. China Shanghai SSE dropped -0.81%. Singapore Strait Times dropped -0.27%. Japan 10-year JGB yield rose 0.0228 to -0.131.

BoE stands pat on unanimous votes, revises down growth forecasts notably

BoE left Bank Rate unchanged at 0.75% as widely expected. Asset purchase target was also kept at GBP 435B. Both decisions were made by unanimous vote. BoE noted in the statement that “global trade tensions have intensified and global activity has remained soft.” That led to “substantial decline” in forecast interest rates in advanced economies and “material loosening in financial conditions”, including the UK. Also, an “increased perceived likelihood” of no-deal Brexit further lowered UK interest rate and led to Sterling’s “marked depreciation.

BoE also maintained that “assuming a smooth Brexit and some recovery in global growth, a significant margin of excess demand is likely to build in the medium term.” And “were that to occur, the Committee judges that increases in interest rates, at a gradual pace and to a limited extent, would be appropriate to return inflation sustainably to the 2% target.”

In the latest BoE quarterly inflation report, GDP growth was revised quite notably low for 2019 and 2020. Four-quarter GDP growth to Q3 2019 was revised down from 1.2% to 1.0%. That for Q3 2020 was revised down from 1.7% to 1.4. Though, that for Q3 2021 was revised up from 2.1% to 2.4%. CPI inflation for Q3 2019 was revised down from 1.8% to 1.7%. That for Q3 2020 was revised up from 1.7% to 1.9%. And that for Q3 2021 was revised up from 2.1% to 2.2%.

Bank rate projection was unchanged for Q3 2019, at 0.7%. For Q3 2020 and 2021, Bank Rate forecasts were both revised to 0.5%, down from 0.8% and 0.9% respectively. The path for Bank Rate was implied by forward market interest rates.

UK PMI manufacturing unchanged at 48.0, manufacturing sector suffocating under choke-hold

UK PMI Manufacturing was unchanged at 48.0 in July, above expectation of 47.7. That’s also the lowest reading since February 2013. Markit noted that output, new orders and employment fell again. Though, businesses forecast output to be higher in one year’s time.

Rob Dobson, Director at IHS Markit: “July saw the UK manufacturing sector suffocating under the choke-hold of slower global economic growth, political uncertainty and the unwinding of earlier Brexit stockpiling activity…. The weak, highly competitive environment makes a sustained revival highly unlikely in the coming months… On a more positive note, there may still be brighter times over the horizon. Over two-fifths of companies expect to see higher output a year from now, assuming political uncertainties and global trade tensions ease as expected.”

Eurozone PMI manufacturing finalized at 46.5, monetary policy could do little to address headwinds

Eurozone PMI Manufacturing is finalized at 46.5 in July, revised up from 46.4, down from June’s final of 47.6. Markit said output and orders were both down markedly as confidence hit lowest since December 2012. Also, there was sharpest recorded reduction in employment for over six years.

Looking at the member states, Germany PMI manufacturing hit 84-month low at 43.2. Austria hit 57-month low of 47.0. Italy and Spain recovered slightly to 48.5 and 48.2 respectively. Ireland hit 75-month low of 48.7. France hit 7 month low of 49.7.

Chris Williamson, Chief Business Economist at IHS Markit said: “The Eurozone PMI dashboard is a sea of red, with all lights warning on the deteriorating health of the region’s manufacturers…“The downturn is being led by Germany, reflective of a further worsening conditions in the auto sector and falling global demand for business equipment. However, output is also falling in Italy, France, Spain, Ireland and Austria and is close to stalling in the Netherlands. Greece notably bucked the deteriorating trend.

“Rising geopolitical concerns, including trade wars and Brexit, and worries about slower economic growth both domestically and internationally were all widely reported as having subdued current demand and hit confidence in the outlook. The concern is that, while policymakers have become increasingly alarmed at the deteriorating conditions, there may be little that monetary policy can do to address these headwinds.”

Japan PMI manufacturing finalized at 49.4, downturn has now become deeply rooted

Japan PMI Manufacturing was finalized at 49.4 in July, revised down from 49.6, just fractionally above June’s 49.3. Joe Hayes, Economist at IHS Markit, said: “Latest manufacturing PMI data did little to suggest that the worst has passed for the global goods-producing sector. Japanese manufacturers cut output for the seventh consecutive month amid soft demand from domestic and overseas clients…

“Forward-looking survey indicators suggest that manufacturers in Japan are set for another difficult quarter, as firms scaled down stocks and input purchasing to keep a lid on costs…. Furthermore, more signs that the manufacturing downturn has now become deeply rooted was apparent in prices data, as output charges were reduced at the fastest pace in nearly three years amid increasing efforts to stimulate sluggish demand.”

Australian PMI rebounds to 51.3, but performance gap widens

Australia AiG Performance of Manufacturing Index rose to 51.3 in July, up from 49.4, back in expansion. AiG noted that “performance gap between the expanding and contracting manufacturing sectors has grown in recent months.” July’s improvement was driven by building materials, wood, furniture & other’ manufacturers, the large food & beverages sector and the chemicals sector. However, heavy industrial sectors (metals, machinery & equipment) continue to report weak conditions. Local demand remains weak but overseas demand remains strong. Also from Australia, import price index rose 0.9% qoq in Q2, below expectation of 1.8% qoq.

China Caixin PMI manufacturing rose to 49.9, government’s policies taking effect

China Caixin PMI Manufacturing rose to 49.9 in July, up from 49.4 and beat expectation of 49.6. Markit noted that production stabilized amid slight uptick in new work. However, employment fell at the quickest pace for give months. Also, factory gate prices declined for the first time since January.

Zhengsheng Zhong, Director of Macroeconomic Analysis at CEBM Group said: “China’s manufacturing economy showed signs of recovery in July. Business confidence rebounded, reflecting the strong resilience in the economy. Policies such as tax and fee reductions designed to underpin the economy had an effect. The situation may strengthen policymakers’ insistence to regulate the property market and the finance industry.”

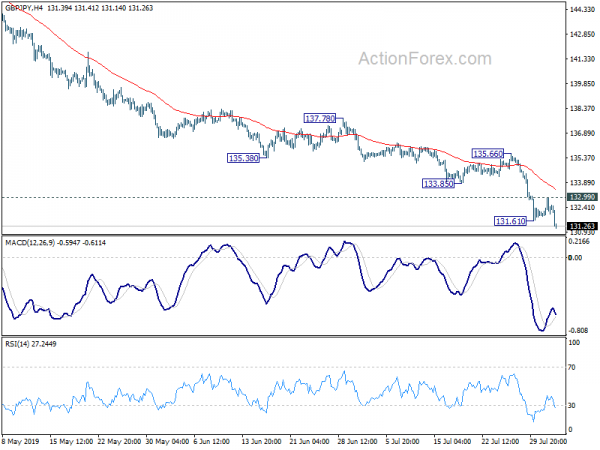

Daily Pivots: (S1) 131.74; (P) 132.37; (R1) 132.89; More…

GBP/JPY’s decline resumed after brief consolidation the break of 131.51 low indicates resumption of larger down decline from 156.69. Intraday bias is back on the downside. Further fall should be seen to 122.36 low next. On the upside, above 132.99 minor resistance will turn intraday bias neutral first. But recovery should be limited by 135.66 resistance to bring fall resumption.

In the bigger picture, medium term fall from 156.59 (2018 high) is still in progress. Break of 131.51 will target 122.36 (2016 low). Structure of such decline is corrective looking so far, arguing that it’s just the second leg of consolidation from 122.36. Thus, we’d expect strong support from 122.36 to contain downside to bring reversal.

| GMT | Ccy | Events | Actual | Consensus | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:30 | AUD | AiG Performance of Manufacturing Index Jul | 51.3 | 49.4 | ||

| 00:30 | JPY | PMI Manufacturing Jul F | 49.4 | 49.6 | 49.6 | |

| 01:30 | AUD | Import price index Q/Q Q2 | 0.90% | 1.80% | -0.50% | |

| 01:45 | CNY | Caixin PMI Manufacturing Jul | 49.9 | 49.6 | 49.4 | |

| 07:45 | EUR | Italy Manufacturing PMI Jul | 48.5 | 48 | 48.4 | |

| 07:50 | EUR | France Manufacturing PMI Jul F | 49.7 | 50 | 50 | |

| 07:55 | EUR | Germany Manufacturing PMI Jul F | 43.2 | 43.1 | 43.1 | |

| 08:00 | EUR | Eurozone Manufacturing PMI Jul F | 46.5 | 46.4 | 46.4 | |

| 08:30 | GBP | PMI Manufacturing s.a. Jul | 48 | 47.7 | 48 | |

| 11:00 | GBP | BoE Bank Rate | 0.75% | 0.75% | 0.75% | |

| 11:00 | GBP | BOE Asset Purchase Target | 435B | 435B | 435B | |

| 11:00 | GBP | MPC Official Bank Rate Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | MPC Asset Purchase Facility Votes | 0–0–9 | 0–0–9 | 0–0–9 | |

| 11:00 | GBP | BoE Inflation Report | ||||

| 11:30 | USD | Challenger Job Cuts Y/Y Jul | 43.20% | 12.80% | ||

| 12:30 | USD | Initial Jobless Claims (JUL 27) | 215K | 212K | 206K | 207K |

| 13:30 | CAD | Manufacturing PMI Jul | 49.2 | |||

| 14:00 | USD | ISM Manufacturing Jul | 52 | 51.7 | ||

| 14:00 | USD | ISM Prices Paid Jul | 49 | 47.9 | ||

| 14:00 | USD | ISM Employment Jul | 54.5 | |||

| 14:00 | USD | Construction Spending M/M Jun | 0.40% | -0.80% | ||

| 14:30 | USD | Natural Gas Storage | 36B |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals