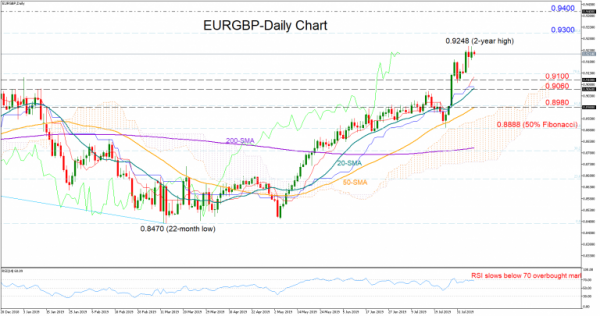

EURGBP flied even higher this week to top its 2-month old rally at 0.9248, the highest mark reached in almost two years.

The spotlight is now on the 0.9300 round-level, where any violation may drive the price towards the 0.9400 mark.

However, with the RSI losing steam below its 70 overbought mark, the bullish pressures may rather weaken, turning the short-term picture into a neutral one. Its also worth noting that the pair is trending in overbought waters in the weekly chart according to the RSI, suggesting a softer session ahead.

Should the price slip below the red Tenkan-sen line and the 0.9100 mark, the 20- and the 50-day simple moving averages (SMA) at 0.9060 and 0.8980 respectively could defend against a more aggressive bearish wave. A failure to hold above the latter, would open the door for the 50% Fibonacci of 0.8888 of the downleg from 0.9305 to 0.8470.

In the medium-term picture, EURGBP is in the green zone and is expected to stay in the positive neighborhood as long as it keeps trading above its upward-sloping 50- and 200-day SMAs.

In brief, EURGBP is expected to soften positive momentum in the short-term, while holding bullish in the medium-term.

Recommend professional Forex robots

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals