Markets turned a bit mixed as month end approaches. European stocks are generally higher while DOW up over 100pts at open. Meanwhile, treasury yields are steady tough, with German 10-year yield slightly lower, but US 10-year yield is recovering. In the currency markets, Canadian Dollar is notably stronger after solid GDP report. But Yen seems to be even stronger. On the hand, Swiss Franc and Euro are the weaker ones but there is no follow through selling. Dollar is mixed after PCE inflation show no surprise.

Technically, 1.1026 in EUR/USD will be a major focus for the near term. Decisive break will resume larger down trend from 1.2555. The anticipated selloff in Sterling hasn’t happened so far. It looks like GBP/USD, EUR/GBP and GBP/JPY will engage in sideway trading further. USD/JPY dips ahead of 106.73 minor resistance, maintaining near term bearishness.

In other markets, currently, DOW is up 0.53%. In Europe, FTSE is up 0.67%. DAX is up 1.19%. CAC is up 0.86%. German 10-year yield is down -0.0091 at -0.703. Earlier in Asia, Nikkei rose 1.19%. Hong Kong HSI rose 0.08%. China Shanghai SSE dropped -0.16%. Singapore Strait Times rose 0.80%. Japan 10-year JGB yield rose 0.0066 to -0.277.

US personal income rose 0.1%, spending rose 0.6%

In July, US personal income rose 0.1%, below expectation of 0.3%. Spending grew 0.6%, above expectation of 0.5%. The increase in personal income in July primarily reflected increases in compensation of employees and government social benefits to persons that were partially offset by a decrease in personal interest income. Headline PCE inflation rose to 1.4% yoy, matched expectations. Core PCE inflation was unchanged at 1.6% yoy, matched expectations.

Canada GDP grew 0.2% in June, 0.9% in Q2

Canada GDP grew 0.2% mom in June, above expectation of 0.1% mom. That’s also the fourth consecutive month of expansion. Growth in 17 of 20 industrial sectors more than compensated for a decline in manufacturing. Goods-producing industries declined 0.2% as a result of lower manufacturing, largely offsetting the growth in May. Services-producing industries were up 0.3%.

For Q2, GDP grew 0.9% qoq, after just 0.1% growth in each of the previous two quarters. This growth was led by a 3.2% rise in export volumes, while final domestic demand edged down (-0.2%). Expressed at an annualized rate, real GDP advanced 3.7% in Q2.

Eurozone CPI unchanged at 1.0% yoy, unemployment rate unchanged at 7.5%

Eurozone CPI was unchanged at 1.0% yoy in August, matched expectations. Core CPI was also unchanged at 0.9% yoy, missed expectation of 1.0% yoy. Looking at the components, food, alcohol & tobacco is expected to have the highest annual rate in August (2.1%, compared with 1.9% in July), followed by services (1.3%, compared with 1.2% in July), non-energy industrial goods (0.4%, stable compared with July) and energy (-0.6%, compared with 0.5% in July).

Eurozone unemployment rate was unchanged at 7.5% in July, matched expectations. It’s also the lowest rate recorded since July 2008. EU 28 unemployment was unchanged at 6.3%, also the lowest since 2000. Among the Member States, the lowest unemployment rates in July 2019 were recorded in Czechia (2.1%) and Germany (3.0%). The highest unemployment rates were observed in Greece (17.2% in May 2019) and Spain (13.9%).

From Germany, retail sales dropped -2.2% mom in July, below expectation of -1.4% mom. From UK, mortgage approvals rose to 67k in July. M4 money supply rose 0.7% mom in July versus expectation of 0.2% mom.

Swiss KOF unchanged at 97, More favorable signals from foreign demand

Swiss KOF Economic Barometer was unchanged at 97.0 in August, above expectation of 95.2. KOF noted that “somewhat more favourable signals than before are coming from indicators of foreign demand and domestically from consumer prospects and manufacturing. The remaining indicator bundles (accommodation and food service activities, financial, insurance and other services as well as construction), however, tend to point to stagnation or slight deterioration in economic sentiment.”

Japan industrial production rose 1.3%, but retail sales dropped -2.0%

A batch of mixed economic data was released from Japan today. Industrial production rose 1.3% mom in July, well above expectation of 0.3% mom. Growth was supported by increased production of cars and chemicals, which offset decline in oil products. The somewhat solid rebound in production offered a hopeful sign that manufacturers are weathering global slowdown and escalation of US-China trade war so far.

On the other hand, retail sales dropped -2.0% yoy in July, much worse than expectation of -0.6% yoy. The contraction raised concerns that momentum of domestic demand was much weaker than originally expected. In particular, consumption could be further strained by the planned sale tax hike later in the year.

Also released, unemployment rate dropped to 2.2% in July, beat expectation of 2.3%. Housing starts dropped -4.1% yoy, versus expectation of -5.4% yoy. Tokyo CPI slowed to 0.7% yoy in August, down from 0.9% yoy, missed expectation of 0.8% yoy.

Australia building approvals dropped -9.7%, activity taking another leg down

Released from Australia, building approvals dropped -9.7% mom in July, much worse than expectation of 0.0% mom. The decline tool approvals to lowest level in more than six years, and down -28% on a year ago. Also, total approvals are now tracking materially below ‘underlying demand’ for the first time since 2013. The data highlighted risk that building activity is taking another leg down. Also released, private sector credit rose 0.2% mom in July, matched expectations.

Separately, RBA said in its corporate plan that “movements in asset values and leverage may be more important for economic developments than in the past given the already high levels of debt on household balance sheets.” And, “especially in the context of weak growth in household income, high debt levels could complicate future monetary policy decisions by making the economy less resilient to shocks,” it added.

USD/CAD Mid-Day Outlook

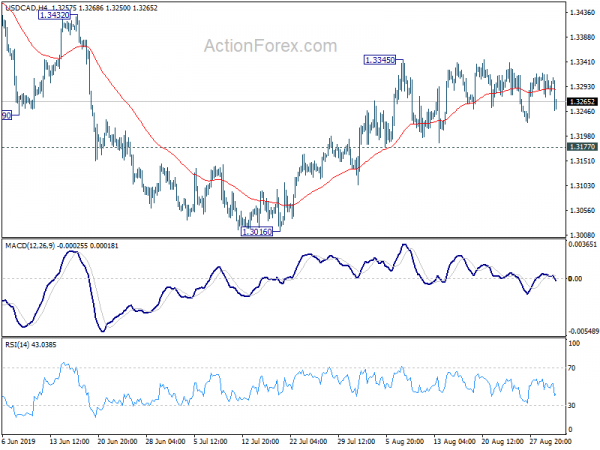

Daily Pivots: (S1) 1.3270; (P) 1.3294; (R1) 1.3316; More…

USD/CAD dips notably in early US session but stays in range of 1.3177/3345. Intraday bias remains neutral for more consolidations. As long as 1.3177 minor support holds, further rally is expected. On the upside, break of 1.3345 will resume the rebound from 1.3016 to 1.3564/3664 resistance zone. Nevertheless, break of 1.3177 will turn bias back to the downside for 1.3016 instead.

In the bigger picture, focus stays on 1.3068 cluster support (38.2% retracement of 1.2061 to 1.3664 at 1.3052). Strong rebound from there will retain medium term bullish. But sustained break of 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685, is needed to confirm resumption of up trend from 1.2061 (2017 low). Otherwise, medium term outlook will stay neutral first. Decisive break of 1.3052/68 will confirm completion of up trend from 1.2061 (2017 low). Further fall should be seen to 61.8% retracement at 1.2673 next.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:45 | NZD | Building Permits M/M Jul | -1.30% | -3.90% | -4.00% | |

| 23:01 | GBP | GfK Consumer Confidence Aug | -14 | -11 | -11 | |

| 23:30 | JPY | Tokyo CPI Core Y/Y Aug | 0.70% | 0.80% | 0.90% | |

| 23:30 | JPY | Jobless Rate Jul | 2.20% | 2.30% | 2.30% | |

| 23:50 | JPY | Retail Trade Y/Y Jul | -2.00% | -0.60% | 0.50% | |

| 23:50 | JPY | Industrial Production M/M Jul P | 1.30% | 0.30% | -3.30% | |

| 01:30 | AUD | Building Approvals M/M Jul | -9.70% | 0.00% | -1.20% | -0.80% |

| 01:30 | AUD | Private Sector Credit M/M Jul | 0.20% | 0.20% | 0.10% | |

| 05:00 | JPY | Housing Starts Y/Y Jul | -4.10% | -5.40% | 0.30% | |

| 06:00 | EUR | German Retail Sales M/M Jul | -2.20% | -1.40% | 3.50% | |

| 07:00 | CHF | KOF Leading Indicator Aug | 97 | 95.2 | 97.1 | 97 |

| 08:30 | GBP | Mortgage Approvals Jul | 67K | 66K | 66K | |

| 08:30 | GBP | Money Supply M4 M/M Jul | 0.70% | 0.20% | 0.10% | 0.00% |

| 09:00 | EUR | Eurozone Unemployment Rate Jul | 7.50% | 7.50% | 7.50% | |

| 09:00 | EUR | Eurozone CPI Estimate Y/Y Aug | 1.00% | 1.00% | 1.00% | |

| 09:00 | EUR | Eurozone CPI Core Y/Y Aug A | 0.90% | 1.00% | 0.90% | |

| 12:30 | CAD | GDP M/M Jun | 0.20% | 0.10% | 0.20% | |

| 12:30 | CAD | Industrial Product Price M/M Jul | -0.30% | 0.40% | -1.40% | |

| 12:30 | CAD | Raw Materials Price Index M/M Jul | 1.20% | 1.50% | -5.90% | -6.10% |

| 12:30 | USD | Personal Income Jul | 0.10% | 0.30% | 0.40% | 0.50% |

| 12:30 | USD | Personal Spending Jul | 0.60% | 0.50% | 0.30% | |

| 12:30 | USD | PCE Deflator M/M Jul | 0.20% | 0.20% | 0.10% | |

| 12:30 | USD | PCE Deflator Y/Y Jul | 1.40% | 1.40% | 1.40% | 1.30% |

| 12:30 | USD | PCE Core M/M Jul | 0.20% | 0.20% | 0.20% | |

| 12:30 | USD | PCE Core Y/Y Jul | 1.60% | 1.60% | 1.60% | |

| 13:45 | USD | Chicago PMI Aug | 47.9 | 44.4 | ||

| 14:00 | USD | U. of Mich. Sentiment Aug F | 92.3 | 92.1 |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals