RBA Minutes Indicates Data- Dependence in Future Policy. Further Rate Cuts Likely Given Limited Decline in Unemployment Rate

RBA’s minutes for the August meeting indicated that future monetary policy action would be data-dependent. While acknowledging some improvements in the economic developments after the two consecutive rate cuts, spare capacity in the labor market remained significant. The country’s unemployment...

The Seeds Of Fiscal Stimulus

The next round of stimulus Long-time readers will know, that I have argued that global central banks are reaching the limits monetary policy stimulus. Looking around the developed world, only the United States has achieved anything like a post-GFC normalisation...

White House official denies administration is looking at a payroll tax cut

President Donald Trump during a cabinet meeting at the White House July 16, 2019 in Washington, DC. Chip Somodevilla | Getty Images Top White House officials have started to float a payroll tax cut as a potential means to stem...

Stocks rebounding, but new highs may be elusive in trade war

Stocks are bouncing higher but could be trapped in a range until there’s a resolution of the trade wars and an end to the uncertain shadow it is casting over business confidence and the economy. The S&P 500, up 1.2%...

Canadian CPI and Retail Sales Data Unlikely to Halt BoC Rate Cut Bets as Yields Invert

Canada is not synonymous with the trade war and economic slowdown and yet markets are giving warning signs that the country is headed for a recession. Recent economic indicators have been largely encouraging, pointing to accelerated growth. This week’s upcoming...

GER30 Index Closes above the 50-SMA and Downtrend Line

The GER30 index put in a rally, pushing upwards off the 11,266 low of August 15. The price surpassed 11,580, which is the 23.6% Fibo of the down leg from 12,600 to 11,266 and near the resistance of 11,607 from...

USD/JPY Outlook: Bulls Struggle at Key Fibo Barrier

The pair stands at the front foot for the third straight day and tests again pivotal Fibo barrier at 106.68 (38.2% of 109.31/105.05 bear-leg, which repeatedly limited recovery attempts in past two weeks. Formation of 5/10DMA’s bull-cross and north-heading stochastic/RSI,...

Risk Appetite Coming Back on Huawei Reprieve and Stimulus Talks

Global markets stage a strong rebound today with help from talk of global stimulus. China has already indicated that it will reform rate system to lower lending cost. There were also talks that Germany is considering stimulus measures. Markets response...

Trading the News | James Stanley | Podcast

How to go about trading the news and more: Key points covered in this podcast: – Looking for breakouts when trading the news – Can economic factors co-exist with technical analysis? – When going against public sentiment works out In...

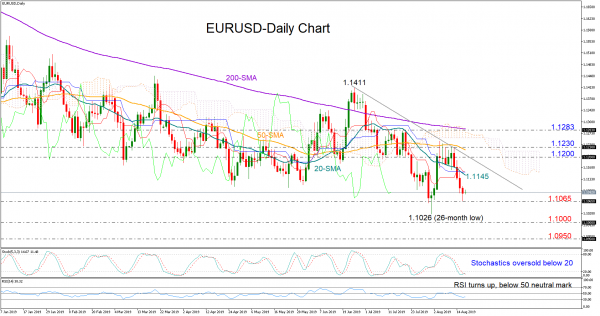

EURUSD Looks For A Rebound But Upside Could Be Limited

EURUSD surrendered most of its monthly gains and dropped below 1.1100 after finding a wall around the 50-day simple moving average (SMA) and the 1.1230-1.1250 area. Technically, the price could pause negative momentum in the very short-term as the Stochastics signal oversold conditions. The...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals