Euro weakens broadly today, in relatively quiet markets, as traders are probably adjusting their positions ahead of tomorrow’s ECB rate decision. A new package of stimulus is widely expected. Yet, opinions on the exact composition of the package is divided. Meanwhile, steady market sentiments is keeping Yen and Swiss Franc soft. On the other hand, Dollar, Australian and Canadian are the stronger ones. US President Donald Trump continues his attack on Fed. But markets are really rather used to the erratic tweets, and shrug them off.

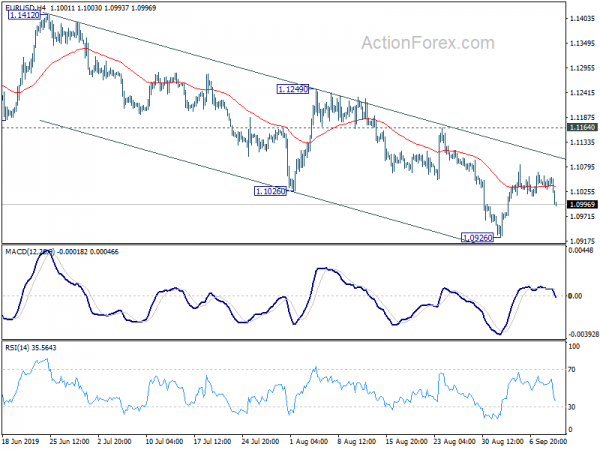

Technically, EUR/USD’s dip today now puts focus back to 1.0926 low. Break will resume medium term down trend. EUR/AUD is also on track to retest 1.5894 support. For now, as long as 117.73 minor support in EUR/JPY holds, further rebound is still in favor. But break will turn focus back to 115.86 low. While Euro turns weak, EUR/GBP is still holding on to 0.8891 key cluster support. We’d still favor strong support from there to bring rebound.

In other markets, US opens nearly flat. FTSE is up 0.95%. DAX is up 0.74%. CAC is up 0.27%. German 10-year yield is down -0.0017 at -0.549, but stays well above -0.6 handle. Earlier in Asia, Nikkei rose 0.96%. Hong Kong HSI rose 1.78%. China Shanghai SSE dropped -0.41%. Singapore Strait Times rose 1.55%. Japan 10-year JGB yield rose 0.0184 to -0.206.

Trump: We’re missing once in a lifetime opportunity before of Fed’s boneheads

In a pair of tweets, US President Donald Trump urged Fed to cut interest rates down to zero or less. And the US government could then start to refinance its debt. He complained again that it’s only “naivete” of Fed chair Jerome Powell” for not allowing the US to pay lowest interest rate.

He said “The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. We have the great currency, power, and balance sheet. The USA should always be paying the the lowest rate. No Inflation! It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of “Boneheads.”

China exempts 15 categories of US imports from tariffs

Today, China announced to exempt a range of US imports from the 25% tariffs imposed last year. The exemptions cover 16 categories of products, ranging from fish food to pesticides, and will be effective from Sept. 17 to Sept. 16 2020. Negotiations between the teams are continuing, in preparation for top level meeting to be held in Washington next month.

Additionally, China also announced yesterday to abolish the investment quota restriction for Qualified Foreign Institutional Investors (QFII) and Renminbi Qualified Foreign Institutional Investors (RQFII) to boost financial reforms and opening-up.

Scotland’s supreme court rules Johnson’s parliament suspension as unlawful

Scotland’s highest court of appealed ruled that UK Prime Minister Boris Johnson’s decision to suspend the parliament until October 13 was unlawful. Scottish National Party lawmaker Joanna Cherry, who led the challenge immediately called for parliament “to be recalled immediately”.

Johnson’s spokesman, on the other hand, said he has absolute respect for the independence of the judiciary. However, they’re still going to appeal the Scottish court’s ruling.

Kiel Institute revises down German growth forecast as economy enters technical recession

Kiel Institute revised down 2019 Germany growth forecast to 0.4%, down from 0.6%. It noted that the economy is “facing one of the weakest years since the financial crisis” and “such weak figures were last seen in 2013”. GDP is expected to contract by -0.3% in Q3, following -0.1% in Q2. Though, growth is expected to pick up to 1.0% in 2020, and then 1.4% in 2021.

Referring to two consecutive quarters of contraction, “Germany thus formally meets the definition of a ‘technical recession’, but this is not yet associated with a macroeconomic underutilization of capacities. Only in such a case could we speak of a recession in the sense of a cyclical phenomenon,” said Stefan Kooths, Head of the Forecasting Centre at the Kiel Institute for the World Economy.

Kiel said the economic outlook has been adversely affected above all by the political uncertainty caused by trade conflicts and the Brexit crisis, with investment and exports coming under particular pressure. Kiel Institute President Gabriel Felbermayr criticized that “the real problem with Donald Trump’s trade disputes is not the tariffs themselves, but the great uncertainty about what is to come. Uncertainty is poison for investment decisions.”

NAB expects RBA to cut to 0.5% by February, more stimulus might be needed afterwards

Australia’s NAB revised their RBA interest expectations today, now factoring in an additional rate cut in February, in addition to one in November, to take cash rate to 0.50%. NAB also said RBA “could cut as soon as October if there was further weakness in the labour market revealed next week.”

NAB noted that ‘the forecast of lower interest rates reflects increased downside risks to the domestic economy and greater uncertainty about the world economy.” Domestically, growth continued to undershoot RBA’s forecast and unemployment is likely to edge higher. Private demand has fallen for the first time since the global financial crisis. business survey also points to continued weakness in private demand. Internationally, global trade and manufacturing fell on US-China trade war escalation. Business confidence has slumped with firms deferring investment.

NAB also urged for additional fiscal stimulus through new infrastructure investment, cash hand-outs and/or the pull-forward of tax cuts. It also warned that more stimulus could be needed by mid-2020 even with interest rate at 0.50%, “unless the Government steps in”.

EUR/USD Mid-Day Outlook

Daily Pivots: (S1) 1.1029; (P) 1.1045; (R1) 1.1058; More…

EUR/USD drops notably today after failing to sustain above 4 hour 55 EMA. But it’s staying above 1.0926 and intraday bias remains neutral first. In case, correction from 1.0926 extends, upside should be limited below 1.1164 resistance to bring down trend resumption. On the downside, break of 1.0926 will resume lager down trend from 1.2555 for 1.0813 fibonacci level next.

In the bigger picture, down trend from 1.2555 (2018 high) is in progress. Prior rejection of 55 week EMA also maintained bearishness. Further fall should be seen to 78.6% retracement of 1.0339 to 1.2555 at 1.0813. Decisive break there will target 1.0339 (2017 low). On the upside, break of 1.1412 resistance is needed to indicate medium term bottoming. Otherwise, outlook will stay bearish in case of rebound.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 23:50 | JPY | BSI Large Manufacturing Q/Q Q3 | -0.2 | -7.1 | -10.4 | |

| 23:50 | JPY | BSI Large All Industry Q/Q Q3 | 1.1 | -1 | -3.7 | |

| 00:30 | AUD | Westpac Consumer Confidence Sep | -1.70% | 3.60% | ||

| 12:30 | USD | PPI Final Demand M/M Aug | 0.10% | 0.10% | 0.20% | |

| 12:30 | USD | PPI Final Demand Y/Y Aug | 1.80% | 1.70% | 1.70% | |

| 12:30 | USD | PPI Core M/M Aug | 0.30% | 0.20% | -0.10% | |

| 12:30 | USD | PPI Core Y/Y Aug | 2.30% | 2.20% | 2.10% | |

| 14:00 | USD | Wholesale Inventories M/M Jul F | 0.20% | 0.20% | ||

| 14:30 | USD | Crude Oil Inventories | -2.7M | -4.8M |

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals