The Bollinger Band® reversal pattern occurs frequently across all financial markets. When employed in a strategy, Bollinger Band® reversal signals can provide traders with encouraging risk-reward ratios, and both experienced and novice traders alike can reap the benefits.

This article will cover the basics of the Bollinger Band® reversal strategy:

- What are Bollinger Band® reversal patterns?

- How to identify a Bollinger Band® reversal pattern

- Top tips and strategies

This article assumes the reader has a basic understanding of Bollinger Bands®. If you’d like a refresher, read our guide to Bollinger Bands® in forex trading.

What are Bollinger Band® Reversal Patterns?

Bollinger Band® reversal patterns occur while using the Bollinger Band® indicator. These reversal signals can appear in all financial markets and are associated with both bullish and bearish reversals.

Identifying the reversal is simple and relates closely with the double bottom and double topcandlestick patterns (also referred to as ‘W’s’ and ‘M’s’).

How to identify a Bollinger Band® Reversal pattern

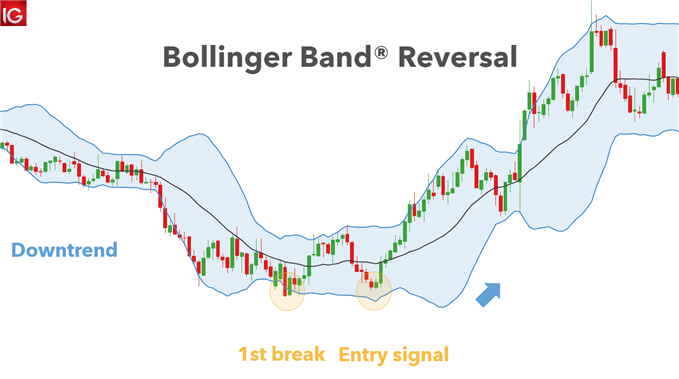

A step-by-step guide to identifying the Bollinger Band® Reversal pattern on a chart:

- Add a Bollinger Band® indicator (20 period, 2 standard deviation) to the chart – usually daily or hourly

- Identify preceding uptrend/downtrend using price action or technical indicators

- Isolate a double top/bottom, depending on the preceding trend

- Look for the first top/bottom breaking through the respective Bollinger Band®

- Wait for the second top/bottom to appear which DOES NOT break the Bollinger Band®

- Look to enter from this point or take the traditional entry point using the double top/bottom method of using the neckline as the reference point

Bollinger Band® Reversal Trading Strategies

Below is an example of Bollinger Band® reversal on a forex pair. The steps above are shown clearly to illustrate the simplicity of this trading technique.

NZD/USD Daily chart bearish reversal

The chart below shows the Bollinger Band® reversal on an NZD/USD chart. The trend has been identified as an uptrend using simple price action movement of higher highs and higher lows.

The first peak of the double top (‘M’) is seen breaking through the upper Bollinger Band® (highlighted in yellow), after which the second peak is seen falling short of the upper Bollinger Band®. This shows a lack of momentum to the upside by bulls.

Some traders enter into a short position from this point however, using the neckline (dashed line) of the double top is commonplace. Simply put, a break in the neckline will trigger the short entry.

This can be done by a pure break or a candle close below the neckline. This is completely at the trader’s discretion. Stops are generally taken from recent swing highs in this example, while limits (take profit) levels can be determined by price action or Fibonacci levels.

Further reading on Bollinger Bands®

• Go back to basics with our guide to trade forex with Bollinger Bands®

• Are you a keen day trader? Learn how to use Bollinger Bands® in day trading

• Another popular strategy among traders is the Bollinger Bands® and MACD approach

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals