A torrid week in politics and dovish BoE comments are grim news for the pound

Considering the clobbering from headlines it received this week, sterling is holding up quite well, though appearances can be deceptive. It is acknowledged that whilst The Supreme Court’s “unlawful” ruling on Parliament’s suspension lowered no-deal Brexit risk further, it did nothing to reduce uncertainty. And it was followed by one of the most rancorous, bad-tempered weeks in politics seen for years, with consequences likely for House of Commons relations that should make bridging divides even more difficult. Then on Friday, the Bank of England’s chief economist, Michael Saunders, indicated that lower rates might be required whether Britain leaves the European Union with a deal or not.

Meanwhile, an election—that would add further dimensions of delay and unclarity to the Brexit process—hangs over the pound. Opposition parties have made it clear they won’t use powers implied by the Tories’ lack of a majority to topple the government, which would start the clock for an election, until Prime Minister Boris Johnson moves towards an extension to the EU’s 31st October Brexit deadline. He has suggested he would rather be dead than request one.

Chart thoughts

Against this backdrop, sterling remaining above early Friday lows for all of the European session may not be as promising a sign as it appears. This is still the worst week for the pound since early August, with a 1% slide against the dollar since Sunday night’s open. True, the pound retains around half of its 5.2% ramp off virtual 34-year lows between the start and the middle of this month but the up leg that topped at $1.2583 on 20th September is immaterial for the broader picture.

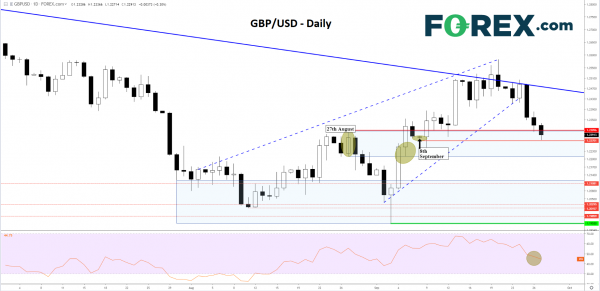

The year’s downtrend remains very much intact. In the chart below, the diagonal line bisected on 19th and 20th September falls from GBP/USD’s cycle high on 17th April 2018. The line clearly resisted the updraft from lows, forcing price back to the band encompassed by the energetic swing high of 27th August pretty much at $1.2310; with added weight from that day’s low being pretty much at $1.2210. Though ripped apart a few days later, the range remains resonant given a tag as support on 5th of this month very near the $1.2210 low, which cued sterling’s latest attempt to escape its trend.

Cable now eyes a weekly close within the band. It’s below the top, though it has marked a low almost identical to the one at the bottom of an ambiguous hammer on 8th September. As falling momentum gathers pace, signified by an ailing RSI, this is not much of a promising picture for buyers.

Holistically, cable looks to head lower, with some corroboration from the wedge/pennant continuation pattern that has been broken this week. Higher risk now seems to reside on the downside and that implies a return to the complex of lows set up last month which echoed a host of struggles for the pound as it ground out multi-year bottoms in late 2016 and early 2017. As such, this suggests coming sessions will feature a return to the $1.21 handle and possibly below.

GBP/USD – Daily [27/09/2019 20:05:10]

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals