U.S. Review

Looking Back at a Soft Q3

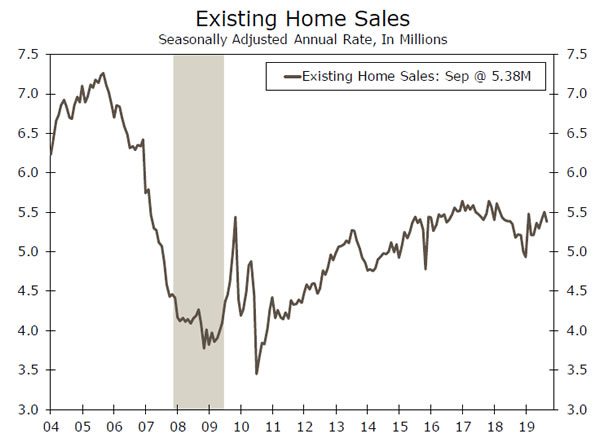

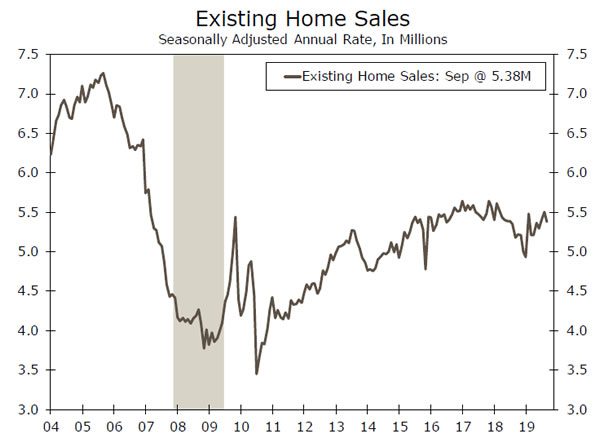

- Sales of existing homes fell 2.2% to a 5.38 million-unit pace in September, but sales and prices were still up enough in the quarter that they will add solidly to Q3 GDP growth.

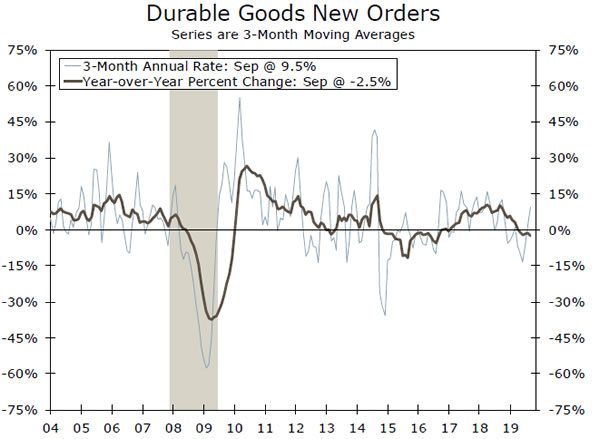

- Overall durable goods orders fell 1.1% in September, reflecting weak demand for aircraft and motor vehicles. Boeing’s issues and the GM strike are becoming more apparent in the macro data and are likely to become increasingly so in coming weeks.

- Sales of new homes fell 0.7% to a 701,000-unit pace in September from a revised 706,000-unit pace the prior month. With mortgage rates down more than a percentage point from last year, housing is set to become a more positive force.

When The Upside Is Down, Scale Back Expectations

The next few weeks are likely to be a challenging time for the U.S. economy. Most of the major economic indicators are likely to be flashing warning signs, as the legitimate slowdown in overall economic growth is exaggerated by the continuing drag from Boeing’s issues with the 737 MAX and the lingering strike at General Motors. The effect from both was apparent in September’s advance durable goods report, which saw overall orders fall 1.1%. Orders for transportation equipment fell 1.6%, reflecting declines in orders for civilian aircraft and motor vehicles. Production of motor vehicles plunged 4.2% during the month, so the effect of the GM strike should be even more apparent in October’s employment data, which will be reported next Friday.

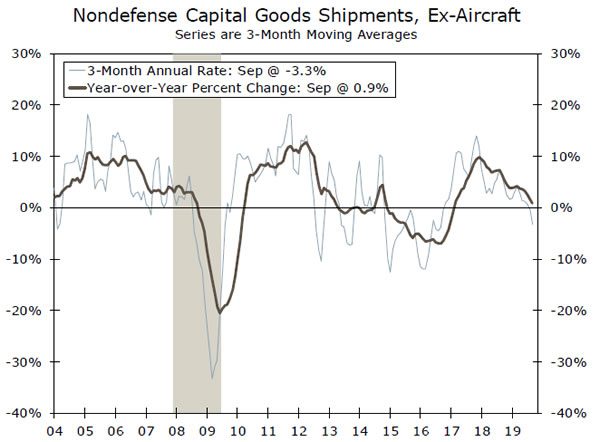

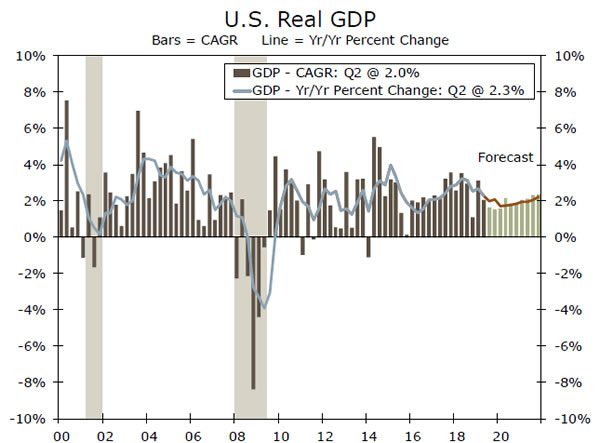

Data for Q3 GDP growth will be reported next week as well and our forecast for 1.4% growth is close to the current consensus. Nondefense capital goods shipments, which feed into the BEA’s measure of equipment spending, ticked down 0.1% in September. This puts nondefense capital goods shipments over the past three months down 9.2% on an annualized basis, and suggests a weak outturn for equipment spending in next week’s Q3 results. This raises the possibility of a downside surprise for the GDP report. It is important to remember, however, that GDP measures production and larger inventories (or less drag from inventories) are likely to offset some of the drop in shipments. Capital spending is not likely to meaningfully improve during Q4, although a settlement to the GM strike, progress on the trade front and some movement toward a resolution to Boeing’s issues would certainly set the stage for a better 2020.

This past week’s housing data were underwhelming. Sales of new and existing homes fell modestly in September and mortgage applications also declined. The pace of home buying has picked up in recent months, so the modest decline left sales at a fairly high level. Prices of existing homes firmed this past month, reflecting the continued dearth of lower priced homes on the market. Lower interest rates also provided a boost to sales of higher priced homes, which should lift brokers’ commissions. Residential investment is set to make a positive contribution to GDP growth in Q3, marking its first contribution to growth in nearly two years.

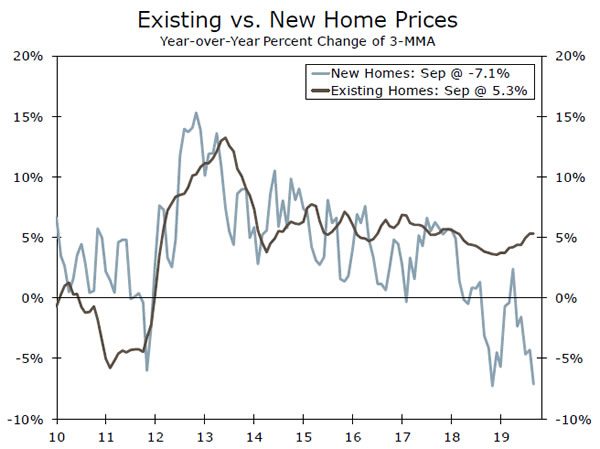

Several larger homebuilders have reported strong demand for new homes, reflecting renewed efforts to deliver more affordable homes to a rising tide of first-time Millennial buyers. There is a bit of a split in home prices, with tight inventories of existing homes leading to a bit of a reacceleration in existing home prices, at least as measured by the National Association of Realtors. Prices for new homes, however, have continued to moderate, reflecting a shift to more affordable starter homes, particularly in the South and Midwest, where land and development costs tend to be lower.

Unfortunately, residential investment is too small to make a meaningful contribution to top-line real GDP growth. That may change, as mortgage rates are expected to remain below 4% in 2020 and households are in relatively good financial shape.

U.S. Outlook

GDP • Wednesday

GDP growth likely moderated in Q3 to a 1.4% annualized pace, down from 2.0% in Q2. Last quarter, the consumer saved the day, as personal consumption (PCE) rose at a 4.6% pace and offset a 1.0% decline in business fixed investment (BFI). Businesses were first to pull back spending amidst the trade war, but with no end in sight to the current stalemate, cracks are beginning to materialize in the consumer, the bedrock of the U.S. economy. Confidence is wobbling and the monthly spending numbers are beginning to moderate, and we expect PCE growth to come back to earth in Q3, to a 2.4% pace, before moderating further in Q4 as job growth continues to slow. BFI should contract again, and we also expect net exports and inventories to shave down growth. Boeing’s 737 MAX issues and potential agriculture inventory swings are two wildcards that could affect the headline numbers in Q3 and beyond. One bright spot— housing should boost growth in Q3 for the first time in six quarters.

Previous: 2.0% Wells Fargo: 1.4% Consensus: 1.6% (Quarter-over-Quarter SAAR)

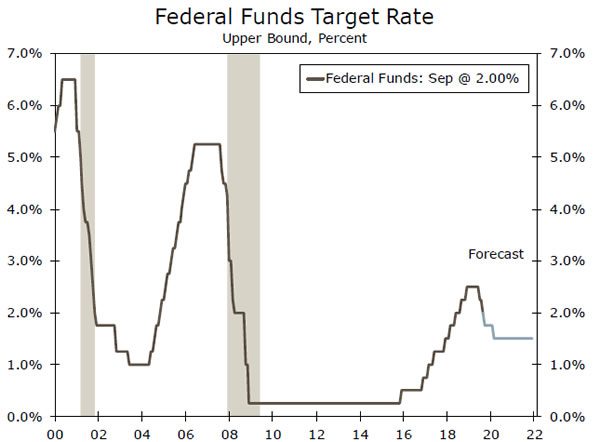

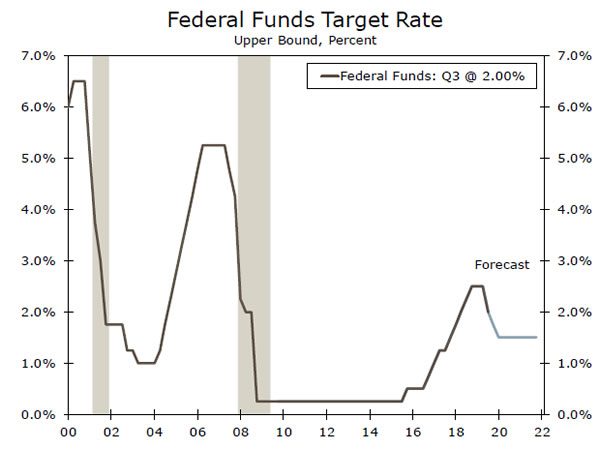

FOMC Rate Decision • Wednesday

We expect the FOMC will cut interest rates for the third meeting in a row next week. Financial markets are pricing in a 90% probability of a cut, but we would place the odds at around 60% (see our full preview of the meeting here). Still, the fact that Fed speakers made no earnest attempt to walk back market expectations have made us increasingly confident in our call that the FOMC will ease again. Approaching the one-year anniversary of the market meltdown at the end of last year, we suspect Chair Powell and the Fed have learned their lesson about the importance of listening to financial markets, or at least more clearly telegraphing their intentions.

The post-meeting press conference will be the first opportunity for Powell to speak about the FOMC’s inter-meeting decision, announced on October 11, to purchase T-bills in response to funding market turbulence. Powell will likely aim to explicitly portray such moves as purely technical, and not another round of QE.

Previous: 2.00% Wells Fargo: 1.75% Consensus: 1.75%

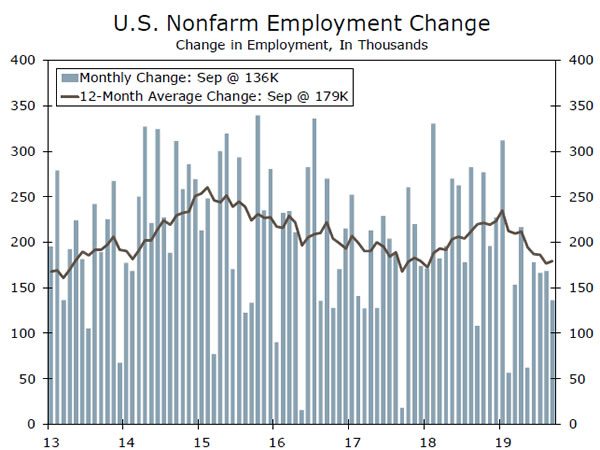

Nonfarm Payrolls & ISM Manuf. • Friday

Payroll growth is slowing, but the GM strike will make things looks worse than they are. More than 40,000 UAW members were picketing the largest U.S. automaker during the survey week for the October employment report, but the effect may be even larger due to payroll adjustments at an array of firms up and down the auto supply chain. Determining the magnitude of the strike impact is a bit of a toss-up—the standard deviation of forecasts submitted to Bloomberg is around 35K—but the direction is clear. Leading indicators of labor demand point to slowing payroll growth, and we expect 75K.

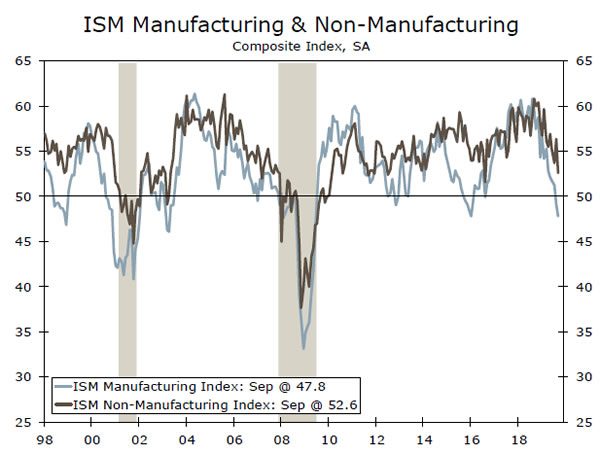

Last month the ISM Manufacturing fell to the lowest level since June 2009, indicating that more firms in the U.S. factory sector were seeing declining activity than rising activity. Regional PMI surveys since then have been a little better, pointing to an improvement in the national survey. We expect it will stay in contraction territory (under 50) for the third straight month, but will improve to 49.3.

Previous: 136K & 47.8 Wells Fargo: 75K & 49.3 Consensus: 90K & 49.0

Global Review

The Big Ease-ing

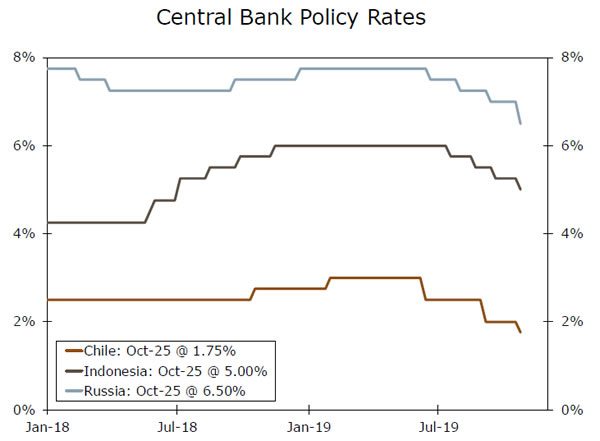

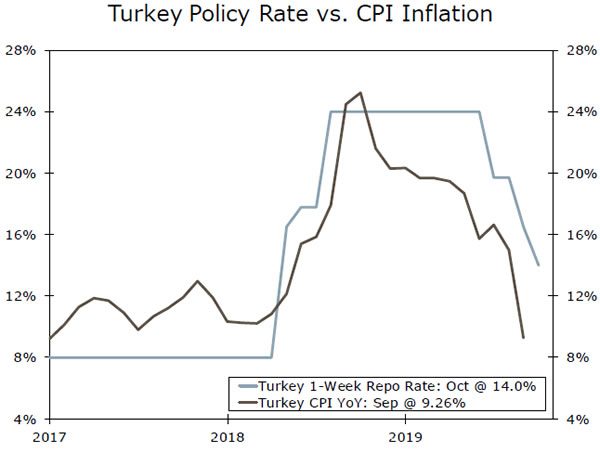

- The global easing theme was at the forefront this week with rate cuts from several central banks. Turkey’s central bank lowered its policy rate 2.50 percentage points, while central banks in Chile, Indonesia and Russia cut rates 0.25%-0.50%.

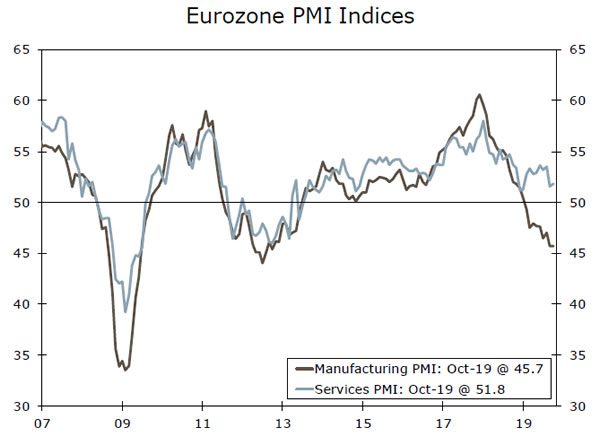

- The European Central Bank held monetary policy steady this week, but further easing seems likely at some point. Eurozone October PMIs surprised to the downside, while Q3 GDP growth is expected to slow further from an already sluggish Q2 pace.

- In Canada, PM Trudeau’s Liberal Party won the most seats in this week’s election, but fell short of the number needed for an outright majority.

Canada’s Election Unlikely to Alter Economy’s Course

Canada’s general election held on October 21 passed relatively smoothly, with only limited reaction in Canada’s foreign exchange and financial markets. PM Trudeau’s Liberal Party won the most seats (157), but fell short of the 170 seats needed for an outright majority. Still, with the support of one of the smaller political parties (for example the New Democrat Party with 24 seats), the Liberal Party should be able to form a stable government. The result augurs well for political and policy continuity, while we may also see further budget stimulus over and above that already announced.

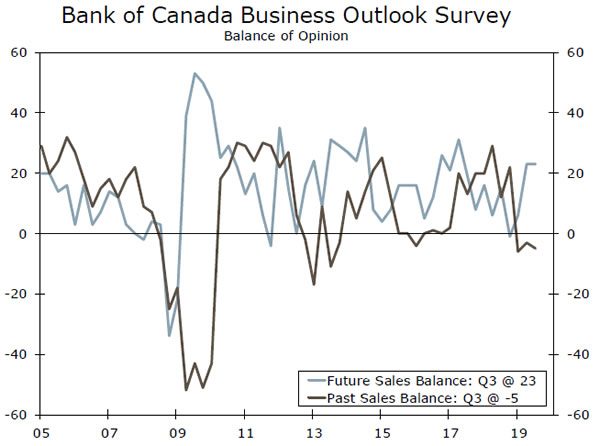

On the economic front, recent data were mixed. August retail sales unexpectedly fell 0.1% month-over-month, while sales excluding autos fell 0.2%. Meanwhile, in the Bank of Canada’s Q3 Business Outlook Survey, the balance for reported sales over the past 12 months was subdued, dipping to -5, but expectations for sales over the next 12 months were more upbeat, with that balance holding steady at +23. With activity indicators mixed but inflation close to target, and the labor market sturdy (both in terms of employment and wage growth), the Bank of Canada should be comfortably on hold at next week’s monetary policy meeting, with the overnight rate target seen remaining at 1.75%.

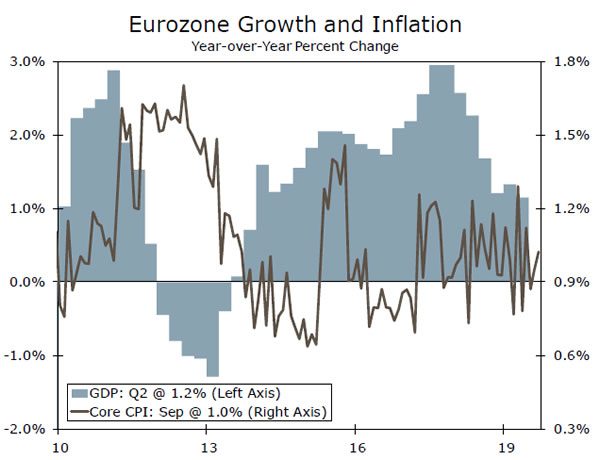

Eurozone Economy Still Bouncing Along the Bottom

The European Central Bank October monetary policy meeting passed with little fanfare, with no change in the central bank’s monetary policy stance, as expected. The ECB had already eased policy in September, while this was also the last policy meeting for ECB President Draghi, who will be replaced as president by former IMF Chief Christine Lagarde in November.

Draghi departs at a time when the Eurozone economy is not in recession but is nonetheless struggling with slow growth and inflation. The Eurozone October PMIs were consistent with that message, as the manufacturing PMI was steady at 45.7 and the services PMI improved only modestly to 51.8. Given that economic backdrop, further ECB easing in December is certainly possible, although we acknowledge that given the reports of pushback by several ECB policymakers to the September move, December monetary easing is not guaranteed.

Easy Does It

It was a busy week for central banks, with the theme of global monetary easing quite prevalent. Among the central banks to lower interest rates, Turkey’s central bank cut its policy rate 250 bps to 14.00%, Chile cut its policy rate 25 bps to 1.75%, Indonesia cut its policy rate 25 bps to 5.00% and Russia lowered its policy rate 50 bps to 6.50%. The European Central Bank, Norwegian central bank and Hungary’s central bank all held rates steady, with those central bank announcements passing with little fanfare. Sweden’s central bank was perhaps the exception to this easy monetary policy rule. The Riksbank kept its repo rate at -0.25% and, although it revised the projected path for its repo rate lower, it signaled that the repo rate would likely be raised to zero percent in December.

Global Outlook

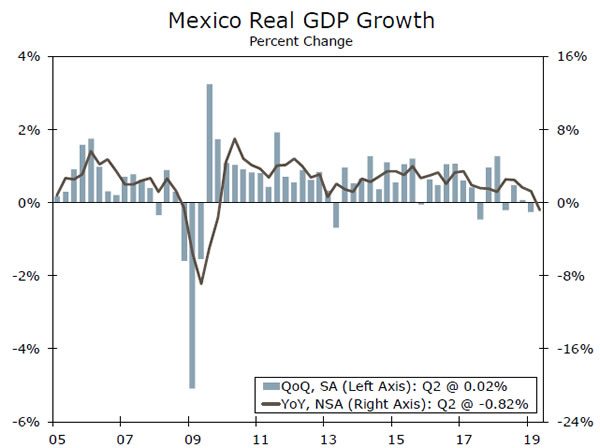

Mexico GDP • Wednesday

Mexico’s economy has come to a standstill in the past few quarters, a slowing in growth that is expected to have extended into Q3. Q3 GDP is seen rising just 0.2% quarter-over-quarter, after zero growth in Q2. High real interest rates in Mexico, along with some slowing in growth in the United States, seem to be weighing on Mexico’s economy.

On an annual basis Mexico’s Q3 GDP is expected to rise 0.5% year-over-year, but that appears to be due to technical factors rather than reflective of any real improvement in Mexico’s economy. In fact, Mexico’s manufacturing and services PMIs could both remain below the breakeven 50 level in October, which means those surveys will remain at levels consistent with a contracting economy. Finally, elsewhere, Brazil’s central bank is expected to cut its policy interest rate 50 bps to 5.00%, with slow economic growth and subdued inflation providing scope for further monetary easing.

Previous: 0.0% Consensus: 0.2% (Quarter-over-Quarter)

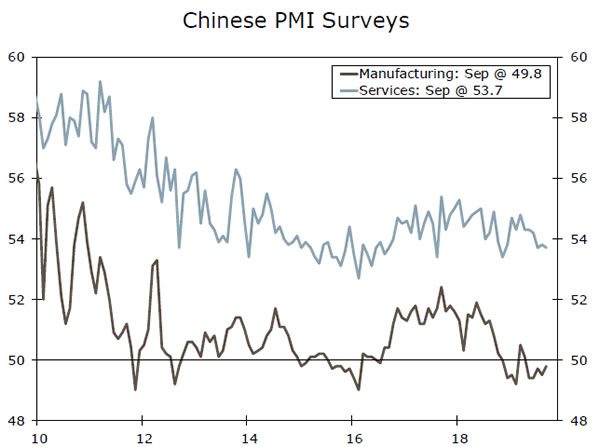

Chinese PMIs • Thursday

We get an early read of the state of the Chinese economy in Q4 next week, with the release of the manufacturing and services PMIs for October. Although China’s economy slowed further in Q3, the quarter seemed to end on a brighter note with a firming in retail sales and industrial output in September. The October PMI surveys may show some of that momentum carried over into Q4. The official manufacturing PMI is expected to be steady at 49.8—remaining below the breakeven 50 level, but still higher than the February low. In a separate survey, the October Caixin manufacturing PMI is forecast to fall, to 51.0.

Elsewhere, the October services PMI may hint at steady growth in the service sector, with that PMI index expected to be unchanged at 53.7. While the economy may have started Q4 enjoying moderate growth, it is not clear how long that will be sustained, and we expect a further gradual GDP growth slowdown over time.

Previous: 49.8 (Manufacturing), 53.7 (Services) Consensus: 49.8 (Manufacturing), 53.7 (Services)

Eurozone GDP • Thursday

Next week sees the first reading of Eurozone Q3 GDP growth. The Eurozone economy has struggled for the past several quarters, something we expect continued in Q3, where we forecast growth of just 0.1% quarter-over-quarter. While full details are not released with this initial estimate, monthly manufacturing activity and survey data suggest the slower economic growth was due to a sharp contraction in industrial output, while services PMIs also suggest a slower but still positive pace of growth in the service sector. We expect Q3 GDP to rise just 1.1% year-over-year, which would be the smallest increase since 2014.

The initial estimate of the Eurozone October CPI is also due, with the headline CPI expected to slow to 0.7% year-over-year and the core CPI seen holding steady at 1.0%—both well below the ECB’s inflation target. With economic growth slow and inflation modest, expect further ECB monetary easing in the months ahead.

Previous: 0.2% Wells Fargo:0.1% Consensus: 0.1% (Quarter-over-Quarter)

Point of View

Interest Rate Watch

What to Expect from the FOMC

The Federal Open Market Committee (FOMC) will hold its next policy meeting on October 29-30. Unlike in the two previous meetings, when it was widely expected that the committee would reduce its target range for the fed funds rate, there is a bit more uncertainty regarding the outcome of this meeting.

There is a compelling case to ease policy further. The ISM manufacturing index recently fell below the demarcation line separating expansion from contraction, and the comparable index for the service sector receded to its lowest level in three years (top chart). Uncertainties regarding U.S. trade policy continue to linger, which have had a depressing effect on business fixed investment spending, and inflation remains below the Fed’s target of two percent.

On the other hand, trade tensions have not gotten any worse. Indeed, the United States and China may be inching toward a minideal that could de-escalate tensions. The unemployment rate currently stands at its lowest level (3.5%) in nearly 50 years, and inflation has edged a bit higher in recent months. Moreover, support for further easing among committee members is not universal. On balance, we assign a 60% probability that the FOMC will cut its target range for the fed funds rate 25 bps and a 40% probability that it will leave rates on hold. Even if the committee refrains from easing policy on October 30, we would then look for it to cut rates 25 bps in December and another 25 bps early next year (middle chart).

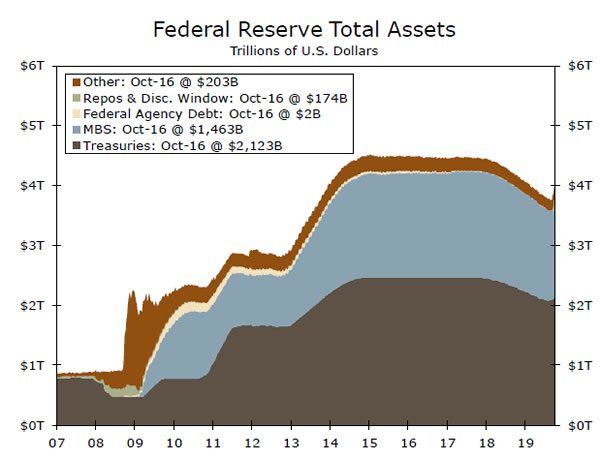

There is also the issue of the Fed’s balance sheet (bottom chart). The FOMC announced on October 11 that it will begin to grow its balance sheet again to prevent another spike in money market rates such as occurred in September. However, there was not much detail regarding the Fed’s plans that was announced on October 11, so Chair Powell may use his post-meeting press conference as a forum for filling in some of the missing details about balance-sheet expansion.

Credit Market Insights

Lower Fixed Rates Can’t Fix It All

The 30-year fixed-rate mortgage rate increased to 3.75% this week, according to Freddie Mac, coinciding with a 12% drop in mortgage applications for the week. Despite the recent move upward, the average 30-year fixed-rate mortgage rate is down more than a percentage point, from this time last year. This drop has spurred demand and lifted the nation’s long-struggling housing sector. Existing home sales posted the third straight month of year-over-year increases, after 16 months of declines, and new home sales are up 7.2% year-to-date. Moreover, the mortgage purchase index from the Mortgage Bankers Association is up almost 7% compared to last year, suggesting home sales should continue to improve.

While mortgage rates have moved lower, headwinds for homebuyers remain. Affordability has been a consistent problem for potential homeowners throughout this cycle, as a lack of supply has kept prices rising faster than incomes. While new home prices have been trending lower, the median price for an existing home, which make up more than 90% of total home sales, is up 5.9% over last year—a pace that has been accelerating since the beginning of the year. Uncertainty about the current economic situation may also be dissuading some individuals from buying a home. The most recent National Housing Survey by Fannie Mae, which declined 2.3 points overall, reported an eight percentage point decrease in net “Confidence About Not Losing Job.”

Topic of the Week

Assessing the Risk of Co-working Office Space

The well-publicized trials and tribulations surrounding WeWork, the largest co-working company in the United States, has reignited the debate surrounding the durability of the flexible office space model. The rise of co-working space have also led to concerns that this model is creating a new type of potential financial stability risk. These worries are not unfounded. Co-working firms, which typically take on long-term leases and re-lease the space on a short-term basis, would likely be especially vulnerable to the falling occupancy and declining rents that tend to occur during a downturn.

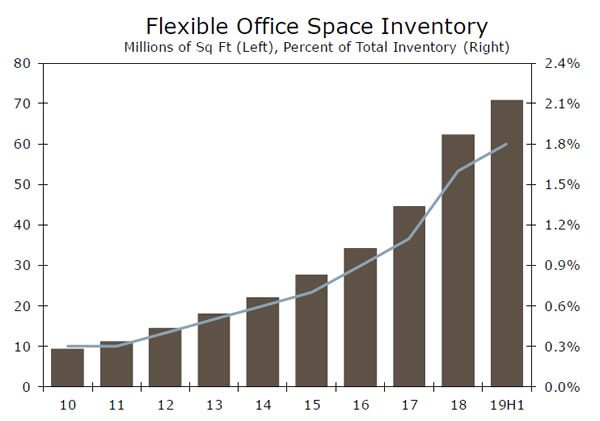

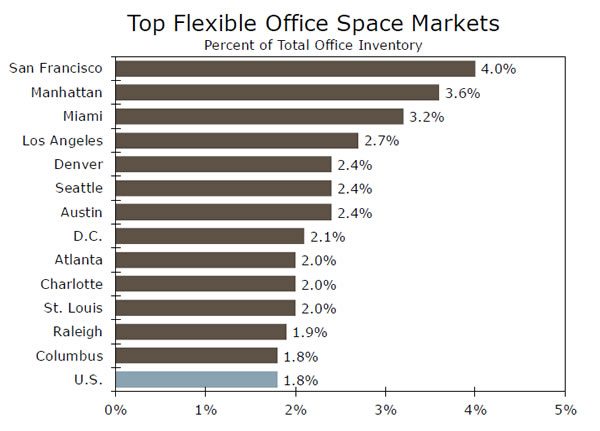

However, we doubt the growing share of co-working leases presents an outsized risk for CRE or the financial system more broadly. While flexible office space square footage has more than doubled since 2015, it is estimated to be just under 2% of overall inventory (top chart). Co-working companies have their largest footprints in San Francisco and Manhattan, but are expanding rapidly in up-and-coming secondary markets such as Austin and Charlotte. Even in the largest and fastest growing flex markets, which tend to have a heavy presence of creative and knowledge-based industries, the ratio of flex space to total inventory remains relatively low (bottom chart).

That noted, the next recession may not be particularly kind to the co-working space model. During a downturn, slightly higher overall office vacancies and slower rent growth in the largest co-working markets would likely occur given that flex tenants predominantly include categories of workers that tend to feel the effects of a recession early, such as startups and entrepreneurs. But even if the flex space model bends, it likely will not break. Co-working space allows firms to gain efficiencies by reducing the average space per employee and offering a more collaborative work environment with streamlined services. Moreover, flex space enables firms to gradually expand into new markets without making long-term commitments. The greater challenge facing the office market would be a more dramatic slowdown in hiring, and thus demand for office space in general.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals