U.S. Review

The Consumer-Producer Divide on Full Display

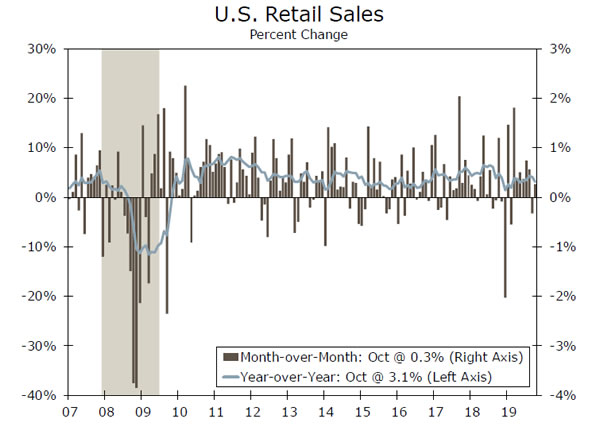

- Retail sales beat expectations and rose 0.3% in October, reflecting the ongoing strength of the consumer. Control group sales, a major input to GDP, also increased 0.3%.

- Industrial production in October declined 0.8%. Overall production remains in the doldrums with the energy sector pulling back and continued weakness in manufacturing, even outside the auto sector.

- The CPI advanced 0.4% during October, the strongest gain in eight months. The monthly jump was owed to a surge in gas prices, and core CPI grew a more modest 0.2%.

The Consumer-Producer Divide on Full Display

Consumer spending continues to be the ray of sunshine pushing through the storm clouds that have grown increasingly dark amid a producer-led slowdown. During October, retail sales advanced a sturdy 0.3%, while industrial production fell 0.8%.

It comes as little shock that the reverberations of slowing global growth and trade uncertainty have been most acutely felt in the factory sector, given newly imposed tariffs on a wide array of producer inputs and globally integrated supply chains. The weakness was on full display in October, as manufacturing production slipped 0.6%, the second straight monthly decline. Adding to their woes, manufacturers have been hit by a string of domestic issues, which have weighed on production even further, such as the continued sidelining of the Boeing 737 MAX. In addition to this, the United Auto Worker strike at GM, which was not resolved until late in the month, also put a sizable dent in production. What’s more, the mining component of industrial production fell 0.7%, likely a result of a continued pullback in capital investment in the energy sector. Following last year’s decline in oil prices, energy producers have become much more financially disciplined, a fact which is increasingly apparent in a steadily declining rig count.

Observers who fear that the slowdown emanating from the production side of the economy is starting to broaden to consumer spending were likely calmed by a solid 0.3% rebound in retail sales during October. Sales strengthened for autos, gas stations and non-store retailers, while clothing, sporting goods, building materials and furniture sales declined for the month. More important, control group sales, which are used as an input into the personal consumption expenditures component of GDP, also rose 0.3% during the month. The rise in the control group sales points to the consumer again offsetting the weakness in business spending. That noted, consumer spending appears to be cooling down a bit and we expect further moderation in overall GDP growth for the fourth quarter.

Meanwhile, inflation pressures remain relatively contained. The CPI advanced 0.4% during October, the strongest gain in eight months, but the jump was owed to a 3.7% surge in gas prices. Core CPI, which strips out the volatile energy and food inputs from the headline index, grew a more modest 0.2%. Additionally, the core measure is up 2.2% on a three-month annualized basis, which marks a substantial downshift from the 3.4% annualized pace registered just a few months back. With overall measures of core inflation coming in on the soft side, the Fed will likely remain in “wait and see” mode with regard to monetary policy.

Relatively tame inflation pressures during the month are notable, given October is the first month we might expect to see the effects of new 15% tariffs on roughly $111 billion of imports from China that went into effect in September. Consumer apparel and household furnishing prices, which were subject to the newly imposed tariffs, actually declined during the month. Meanwhile, producer prices increased 0.4% during the month, but prices excluding food, energy and trade services rose 0.1%.

U.S. Outlook

Housing Starts • Tuesday

Total housing starts declined 9.4% in September, but with all of the drop tied to multifamily starts—which have fallen in three of the past four months—we still believe homebuilding may finally be gaining some momentum. Single-family starts rose 0.3% in September, which marked the fourth consecutive increase. While single-family permits are running below starts, we suspect that both starts and permits are headed higher.

The latest data from the NAHB/Wells Fargo Housing Market Index show builders are remarkably upbeat, with the index at its highest level in nearly two years. Lower mortgage rates and a shift by homebuilders to focus on more affordable product appear to be bringing buyers back to the market. We expect continued builder optimism and increased buyer demand pushed total housing starts up to a 1,295K pace in October.

Previous: 1,256K Wells Fargo: 1,295K Consensus: 1,320K

Leading Economic Index (LEI) • Thursday

Equity markets have continued to reach all-time highs, signaling fears of an imminent recession have subsided. Recent financial market optimism is at least in part tied to easing trade tensions and the prospect of a Phase I trade deal, but economic data also continue to surprise to the upside.

On Thursday, we will get the latest read on the LEI. After declining 0.1% in September, we suspect the index fell 0.2% last month. The average hourly workweek in manufacturing—which represents nearly 30% of the LEI—fell to 40.3 hours in October, the shortest since 2011, meaning it will likely be a drag on the headline. However, the second largest component—the ISM new orders index— improved to 49.1 in October, while consumer expectations of business conditions remained elevated. We will be paying particular attention to the year-over-year rate of the LEI, which has trended lower this year and signals a slower pace of economic growth.

Previous: -0.1% Wells Fargo: -0.2% Consensus: -0.1% (Month-over-Month)

Michigan Consumer Sentiment • Friday

Consumer spending has been one of the strongest areas of the U.S. economy this year, and has acted as a much-needed counterweight to weakness in business investment and international trade. While actual spending continues to grow at a solid pace—October retail sales rose 0.3%—measures of confidence have plateaued since early last year, and the growing gap between the two bellwethers of confidence remains near its widest in history. It is not surprising to see this gap grow as an economic cycle ages, but it also makes it increasingly difficult to gather a cohesive view on confidence. The still-high readings of the two measures show that while consumers have grown more cautious, they are not articulating a degree of caution consistent with a large retrenchment in spending. The University of Michigan’s survey tends to track consumer financial situations more closely, and showed an initial estimate of 95.7 in November.

Previous: 95.5 Consensus: 95.7

Global Review

Another Week, Another Central Bank Surprise

- The Reserve Bank of New Zealand caught markets off guard at its meeting this week with its decision to hold its main policy rate steady at 1.00%, saying that monetary policy is stimulatory and that there is no urgency to act further.

- The latest Swedish inflation data added support to the central bank’s plan to raise interest rates to 0%, even though they were slightly below the Riksbank forecast.

- In a split vote at its meeting this week, the Bank of Mexico opted to ease monetary policy, cutting its main policy rate 25 bps to 7.50%, the third such move this year.

RBNZ Surprises Markets…Again

The Reserve Bank of New Zealand (RBNZ) caught markets off guard at its meeting this week with its decision to hold its main policy rate steady at 1.00%. RBNZ Governor Orr noted that monetary policy is stimulatory and that there is no urgency to act further. The majority of market participants had forecast a 25 bps rate cut, given that recent data suggest that the NZ economy has continued to underperform since the last policy meeting. The NZ dollar initially jumped more than 1% and NZ government bonds rallied on the decision. In the accompanying statement, the RBNZ noted that it expects policy rates to remain at low levels for a prolonged period, while it also reiterated that there remains further scope for additional stimulus, if necessary. Although the next policy rate decision is not until February 2020, market participants will be watching for any developments in the NZ economy as well as abroad, to gauge whether additional stimulus is necessary. The market is currently pricing in only 15 bps of easing over the next year.

Riksbank Plan Supported by Inflation Data

Sweden’s October CPIF inflation printed in line with expectations, edging higher to 1.5% year-over-year from 1.3%, while CPIF excluding energy prices—the central bank’s preferred measure of core inflation—rose 1.7% year-over-year. The latest inflation data added support to the Riksbank’s plan to raise interest rates to 0%, even though it was slightly below its forecast. Also supporting the case for a December rate hike, Sweden’s jobless rate remained at 6.6% (seasonally adjusted) in October, while prior jobless rate figures were revised sharply lower after Sweden’s statistics agency acknowledged that its data for several months had been flawed. Although the revised data still show a slowdown during 2019, they suggest that it was not as dramatic as previously suggested. Given recent comments from policymakers in addition to the data releases this week, we now think the Riksbank will raise interest rates at its next meeting in December, but keep them unchanged for an extended period beyond that.

Banxico Eases Policy for a Third Straight Time

The Bank of Mexico at its meeting this week opted to ease monetary policy, cutting its main policy rate 25 bps to 7.50%, the third such move this year. The decision, however, was not unanimous as two policymakers dissented, opting for a larger 50 bps rate cut. The Mexican peso was largely unchanged after the decision. In the accompanying statement, the central bank noted that the trajectory of GDP growth for 2019 and 2020 would likely be below that previously anticipated. Although the statement was not as dovish as expected, the central bank still suggested that additional rate cuts could be coming. With core inflation falling for the fourth consecutive month and growth expectations still subdued, the market is still pricing in 163 bps of additional easing over the next year by the Bank of Mexico. For comparison, markets are priced for 25 bps of easing in the United States over the same period, and 26 bps of additional easing in Canada.

Global Outlook

Chile Q3 GDP • Monday

Over the first two quarters of 2019, the Chilean economy has modestly decelerated. Chile’s economy is primarily driven by copper exports to China and copper prices have remained subdued for some time now, as U.S.-China trade tensions have intensified. In response to lower copper prices, Chile’s central bank has been aggressively cutting interest rates, which should provide some support to the economy in Q3. However, looking further ahead, we expect the Chilean economy to decelerate amid the social unrest that has taken place over the past few weeks. Since the middle of October, there have been violent protests in the capital city of Santiago over increased living costs. These protests have had a significant impact on Chilean asset prices and have injected new political risks into the country. While difficult to quantify at this point, we expect economic activity to slow significantly as a result of the protests and for the Chilean economy to decelerate even further headed into 2020.

Previous: 0.8% (Quarter-over-Quarter) Consensus: 0.7% (Quarter-over-Quarter)

Japan CPI Inflation • Thursday

Earlier this year, the Japanese government moved forward with a hike to the country’s consumption tax rate. After being delayed multiple times, the consumption tax was raised to 10% from 8%, which we expect to have a modest negative impact on Japan’s GDP growth. However, we expect the consumption tax hike to have a bit of a more material impact on inflation and expect Japanese inflation to pick up a bit in 2020. For quite some time, inflation has remained well below the Bank of Japan’s 2% target. While we expect inflation to tick up next year, we still believe Japanese inflation will fail to reach the central bank’s target. With growth and inflation subdued, and global monetary policy turning more accommodative, it is possible the Bank of Japan will look to ease monetary policy even further. While this is not our base case assumption at this point, it is worth highlighting that BoJ policymakers have suggested additional easing has been discussed.

Previous: 0.2% Wells Fargo: 0.4% Consensus: 0.3% (Year-over-Year)

Eurozone PMIs • Friday

For most of 2018 and 2019, the Eurozone economy has remained relatively subdued. In response, the ECB has cut its main interest rate further into negative territory, while also restarting its net asset purchase program, in an effort to provide support to the European economy. However, over the past few weeks, activity data have been slightly more positive as retail sales were stronger than expected, while the German economy was able to avoid falling into technical recession. In addition, Eurozone Q3 GDP was revised higher to 1.2% year/year, while the manufacturing PMI improved in October. Next Friday, the November manufacturing and services PMIs will be released, with consensus forecasts suggesting further improvement in Eurozone sentiment. While we acknowledge that activity and sentiment indicators have improved recently, we still believe the ECB will move forward with another 10 bps rate cut in December, pushing the main deposit facility to -0.60%.

Previous: 45.9 (Manufacturing); 52.2 (Services) Consensus: 46.6 (Manufacturing); 52.4 (Services)

Point of View

Interest Rate Watch

Could the Fed Go Negative?

There were a number of FOMC speakers on the wires this week including Fed Chair Powell, Vice Chair Clarida, Governor Quarles and the presidents of eight Federal Reserve Banks. In general, they stuck to the theme, which was expressed by Powell in his appearance before the Joint Economic Committee of Congress, that the current stance of monetary policy likely will “remain appropriate as long as incoming information about the economy remains broadly consistent with our outlook of moderate economic growth, a strong labor market, and inflation near our symmetric 2 percent objective.” In short, the FOMC likely will keep rates on hold at its December 11 policy meeting, if not for longer.

With policy rates in negative territory in a number of major economies, including the Eurozone, Japan, Sweden and Switzerland, the question of whether the Fed could cut its target range for the fed funds rate below zero percent naturally arises. As we wrote in a report earlier this year, a necessary condition for negative rates in the United States would be a recession. Even then, there appears to be reluctance among some Fed policymakers about going negative. Responding to a question following a speech this week in Oslo, Norway, Boston Fed President Rosengren said “I would personally not choose negative rates in the next recession.” Other Fed officials, including Chair Powell, have also expressed skepticism about the wisdom of going negative.

Their reticence is based, at least in part, on an internal study that the Fed conducted after the financial crisis. For starters, it is not clear that the Fed has the legal authority to take its policy rates into negative territory. Thus, an act of Congress may be needed for the Fed to go negative. The study also found that money market funds, which provide an important source of financing in the U.S. economy, could be negatively affected by negative rates. Therefore, shortterm rates could become volatile if the balance sheets of money market funds were to decline significantly. In our view, there is a very high bar for the Fed to go negative.

Credit Market Insights

Consumer Credit Continues Its Climb

Aggregate household debt balances increased $92 billion in the third quarter, bringing the outstanding debt level to $13.95 trillion. Debt balances increased for every major category, with the exception of home equity lines of credit, but the most notable increases came in the form of new auto loans and mortgages. Mortgage originations, the number of new mortgages appearing on consumer credit reports, including refinancing, were up to $528 billion in Q3, the highest level in almost three years. This builds on last quarter’s big jump and illustrates the resurgence of the housing market amid historically low interest rates.

Auto loan originations, which includes new loans and leases, increased slightly from their high level in Q2 to the second highest volume in the data’s history. The share of new auto loans and leases going to prime borrowers has been steadily increasing over the past decade and the share of new borrowers with a credit score of 760 or greater now stands at its highest level on record. With the number of auto loans increasing generally, however, there are now more subprime auto loan borrowers than before. Given that subprime borrowers are more likely to default, this has led to an increasing number of auto loans transitioning into serious delinquency (90+ days delinquent). While the proportion of auto loans in serious delinquency (2.34%) remains below the crisis peak (3.48%), it has plateaued at a high level and warrants monitoring.

Topic of the Week

Talking Heads

Fed Chair Powell’s testimony before Congress on Wednesday and Thursday proceeded without any major fireworks, at least compared to some of the other testimony occurring this week in the Capitol Building. Powell delivered a relatively upbeat assessment of the economy and indicated that the current stance of monetary policy was “likely to remain appropriate.” In other words, the Fed is content to pause after cutting the fed funds rate 25 bps at three consecutive meetings, believing that it has done enough, for now, to help the economy weather the storm of weakening global growth and trade policy uncertainty. Even long-time ultra-dove James Bullard said in a separate speech on Thursday that it now “makes sense to wait and see.” Financial markets seem to agree that the 75 bps of cuts has been sufficient stimulus—the implied probability of a fourth cut at the December FOMC meeting has fallen to just 2.7% today from around 60% in October. We agree with this assessment.

We do, however, still see scope for a cut early next year, and perhaps more than markets expect (they are pricing in just a 35% chance of a cut by the March meeting). This week, Powell continued to cite potential risks, and only to the downside, stating “there’s no signs that things are overheating,” while trade risks are “ongoing.” Speaking of risks, President Trump also opined on the economy this week in a speech at the Economic Club of New York, offering more haze than clarity on the prospects of a Phase I trade deal, saying, “it could happen soon. But we will only accept a deal if it’s good for the United States.” More concerning for markets and policymakers was his statement that “if we don’t make a deal, we’re going to substantially raise those tariffs.”

The threat of further trade war escalation is therefore very real, as are the chances of the Phase I deal falling through, despite the ebullience sweeping across markets recently. With that in mind, we take Powell at his word that, for now, the economy is in a good place, but further easing may be warranted as things develop.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals