U.S. Highlights

- The House’s impeachment of President Trump did little to detract from broader economic optimism. U.S. equity markets reached new highs this week.

- Housing and consumer spending data released this week confirmed the narrative of resilient U.S. household demand.

- Hopefully the recent progress on Brexit and U.S.-China trade relations are signs that headwinds to global growth will diminish in the New Year, giving the global economy a necessary jolt of goods news after a somber 2019.

Canadian Highlights

- Heading into the holidays, this week’s economic calendar was more like an advent calendar, overflowing with top-tier data and events. U.S. lawmakers finally approved the CUSMA, removing notable uncertainty from the business climate. Also stealing headlines, the federal fiscal update revealed a much higher projection for federal debt levels.

- Data this week would please the Grinch, as manufacturing, wholesale and retail sales volumes all fell. However, consumer price inflation and home price growth heated up in November.

- The soft data places notable downside risk to the BoC’s (and our) fourth quarter growth forecast. However, accelerating consumer and house prices and positive news on the CUSMA file points to a sidelined BoC in the very near-term.

U.S. – Hope for Good Tidings in 2020

Politics dominated headlines this week as the House voted to impeach the President. Impeachment proceedings are set to move on to the Senate. Nevertheless, financial markets appear to have largely shrugged off political uncertainty, at least for the time being. U.S. equity markets reached new highs this week, while yields marched a bit higher on a greater sense of economic optimism.

Data received this week remained consistent with the narrative of household resilience. November housing starts beat forecasts for a more subdued increase. Both single family and multi-family units rose in the month. Moreover, permits – a leading indicator of residential construction activity – improved for the seventh consecutive month. Housing starts have risen and persisted above the rate of household formation for several months, and all signs point to this trend holding into early next year as well.

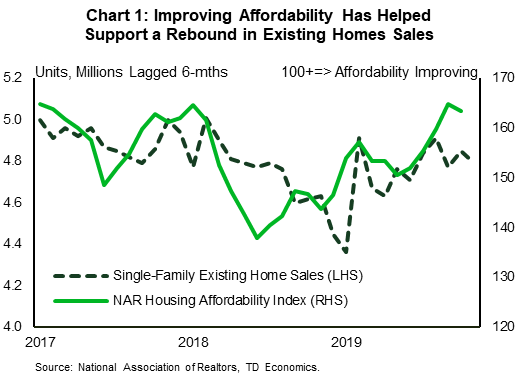

The signal of health from existing home sales was a little less positive. November sales fell 1.7%, bringing the level back to a still healthy 5.35 million units annualized. Improved affordability, largely due to a decline in borrowing costs, has been a major driver for the recovery in existing home sales in the second half of this year (Chart 1). However, a dearth of inventory in many regions has put upward pressure on prices lately, tempering strong demand.

Consumer spending on goods and services plus housing form the key pillars of our U.S. outlook that foresees the economy expanding 2.0% next year, a slight cooldown from 2.3% this year. Underlying this view is that the labor market should continue to improve, absorbing more and more workers while wage growth is also expected to hold at fairly robust levels. Add lower interest rates and you get all the ingredients for household spending to rise at a sustainable clip in the year ahead.

In contrast, business investment is expected to be less supportive of the outlook. Manufacturing output has been in a slump globally this year, and recently in the U.S.. Despite a Phase 1 trade deal with China, we don’t anticipate that trade policy uncertainty will diminish enough to see a big resurgence in private investment. Outstanding trade disagreements remain with China, the EU, and other nations. What’s more, political uncertainty associated with next year’s election is likely to hamper plans by businesses to expand capacity until further clarity on the likely direction of future policies.

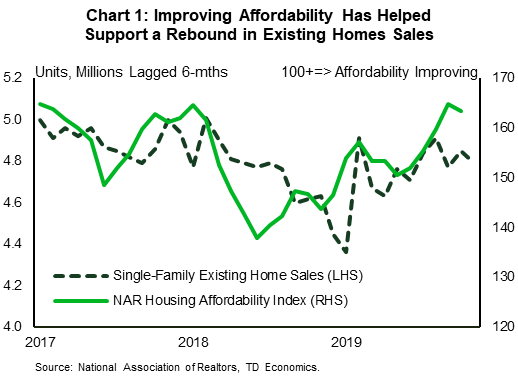

Weak foreign demand combined with elevated economic uncertainty does not bode well for a quick recovery in global industrial production. Instead, it raises concerns about whether consumers worldwide will remain stalwart in the face of persistent uncertainty (Chart 2). The global economy this year is expected to grow 2.8%, the slowest pace in a decade. In the year ahead, we anticipate a slight uptick to 3% largely due to more supportive government policies. The hope is that the recent progress on Brexit and U.S.-China trade relations are signs that headwinds to growth will diminish in the New Year. The global economy could definitely use some good tidings after a somber 2019.

Canada – Data Only the Grinch Could Love

Heading into the holiday week, this week’s economic calendar was more like an advent calendar – full of top-tier data and notable events. Businesses across North America were delivered an early Christmas present, as the U.S. House of Representatives met expectations and voted to approve the CUSMA trade pact, removing the largest obstacle to the agreement’s ratification. Doing so should lift some uncertainty in the business environment.

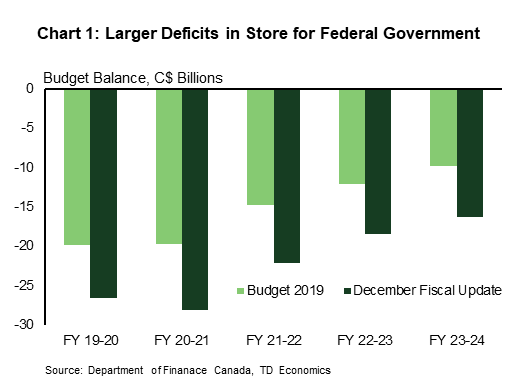

Also commanding headlines, the federal government delivered its economic and fiscal update. What was supposed to be a staid affair was anything but, as the government marked up its deficit by a cumulative $36.8 billion over five-years (Chart 1). Part of this upgrade reflected previously telegraphed personal income tax cuts taking effect on January 1st. More surprising was the jump in forecasted outlays for employee pension and benefits – chalked up to a lower projection for interest rates and an actuarial revaluation. We foresee the personal income tax cuts providing a marginal lift to consumer spending next year. Meanwhile, the upwardly revised deficit, while not overly concerning when scaled to GDP, does imply less fiscal room to manoeuvre in the event of a downturn.

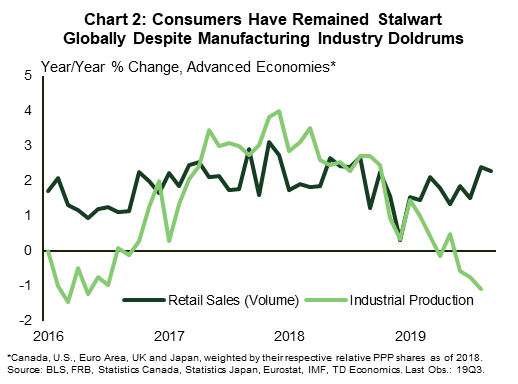

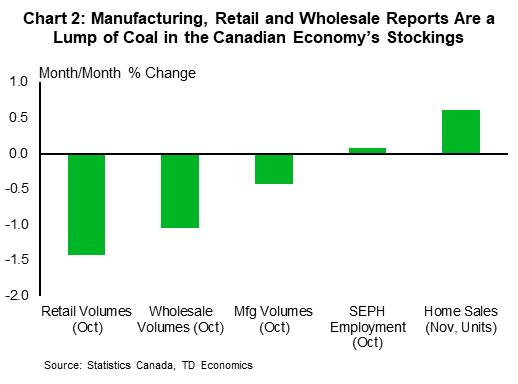

Data this week generally delivered headlines only the Grinch would love (Chart 2). Wholesale volumes tumbled 1.1% m/m in October. Retail spending was no better, with volumes off 1.4% m/m in October thanks to broad-based weakness across categories. Meanwhile, manufacturing volumes dipped 0.4% m/m. Adding a lump of coal to the manufacturing report, new and unfilled orders volumes also dropped while inventories remained elevated. Tempering some of the pessimism, a chunk of the decline stemmed from the GM strike, which has since ended. All told, these weak reports suggest some downside risk to our already modest call for 1.2% annualized growth in the fourth quarter of 2019.

Other releases were more festive, as home sales increased by 0.6% m/m in November. More noteworthy was the fact that price growth continues to heat up. Indeed, year-on-year Canadian home price growth is now near where it was a few years ago, just before the Fair Housing Plan began cooling overheated markets in Ontario. It wasn’t just home prices running hot, consumer price inflation also accelerated to 2.2% year-on-year in November on a turnaround in energy prices. More important from the Bank of Canada’s perspective, the average of their three core inflation measures clocked in at 2.2% year-on-year, the highest since May 2009.

So, what does the Bank of Canada takeaway from this week’s events? Growth indicators were weak, on balance, placing downside risk to the BoC’s projection for fourth quarter growth. However, on-target consumer price inflation, sharply rising home prices and positive news on trade points to the BoC remaining sidelined in the near-term. As discussed in our latest Quarterly Economic Forecast, we expect the BoC to ease in 2020, but for now, the Bank of Canada will join the rest of us in taking a holiday.

U.S: Upcoming Key Economic Releases

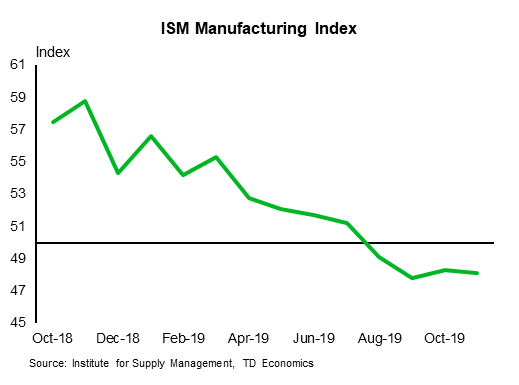

ISM Manufacturing Index- December

Release Date: January 3, 2020

Previous: 48.1

TD Forecast: 49.5

Consensus: 49.0

We will review our ISM forecast after more regional surveys are released (the first three surveys have been mixed), but we expect the U.S.-China trade deal will lead to a less negative tone in the report and an improvement to 49.5. The report will likely reflect a mixture of pre- and post-trade-deal-announcement responses; the deal was announced on December 13. That said, we don’t expect the deal to lead to a dramatic change.

Canada: Upcoming Key Economic Releases

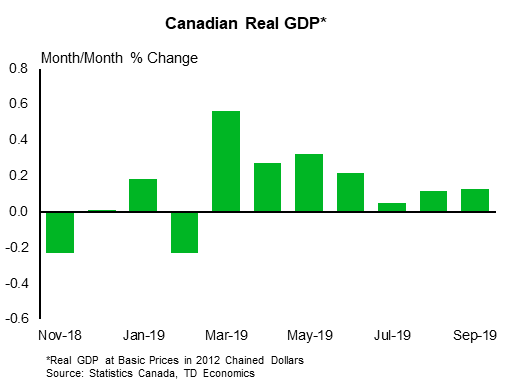

Canadian Real GDP – October

Release Date: December 23, 2019

Previous: : 0.1%

TD Forecast: -0.1%

Consensus: 0.1%

Industry-level GDP is forecast to decline by 0.1% m/m in October owing to a contraction in the goods-producing sector and a large drag from retail and wholesale trade. Preliminary crude output edged lower which will offset the rebound on the East Coast after a series of oil spills weighed on offshore production through Q3. Elsewhere, the UAW strike will weigh on motor vehicle production and contribution to a pullback in manufacturing activity during the month. Weaker utilities output will provide another headwind, owing to unseasonably warm weather during the month. Services should fare slightly better, although a sharp pullback in both retail and wholesale trade volumes will be a drag. Professional services, a significant driver of recent strength in the services sector, saw a large (+2.1%) increase in hours worked for October which should provide a tailwind. A 0.1% decline for industry-level GDP is hardly a desirable start to Q4 but should leave quarterly growth tracking near 1%, slightly below the latest BoC projections.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals