RBA Hinted Further Easing in 1Q20

At the RBA minutes for the December meeting, policymakers affirmed that it was appropriate to leave the cash rate unchanged at 0.75%. While acknowledging stabilization in the economy, the members, however, noted that further easing would be possible. They pledged...

Homebuilder confidence jumps to highest level in 20 years

A stronger economy and a severe housing shortage have the nation’s homebuilders feeling better than they have in two decades. Builder confidence in the newly built, single-family home market jumped 5 points in December to 76, the highest reading since...

Funding Xchange shows how data analytics will transform business lending

Small companies with short trading histories and thin credit files make up a growing part of the economy that established banks are not set up to serve.

Mohamed El-Erian sees US and China going into an economic war beyond trade after 2020 election

The Allianz chief economic advisor says he doesn’t think the phase one trade agreement is the first step to a long-term cooling in U.S.-China relations.

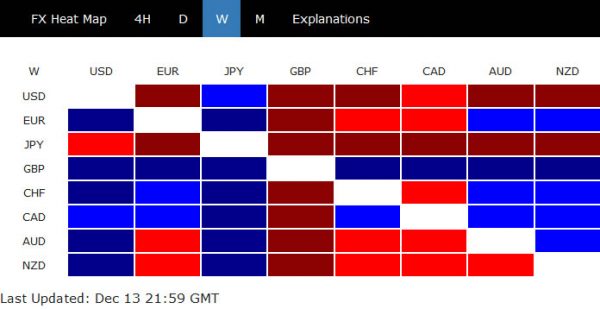

Investors Shrug Poor Eurozone and UK Data, Risk Appetite Continues

Commodity currencies are general higher today, with the help from risk appetite in European markets, and US futures. Poor Eurozone and UK data are largely shrugged off by investors. Canadian Dollar is so far the strongest, additionally supported by mild...

Oil Market Week Ahead: New Shipping Fuel Regulations to Hit Oil Markets from January 1

Whether the slight shift in the trade balance between the US and China over the last few months represents a sustainable long-term trend remains to be seen, but what is definite is that in September, the US – for the...

EURUSD Catalyst Needed

The euro currency is moving lower against the US dollar, following the release of more weak Manufacturing data from the German economy. A minor technical correction back towards the 1.1115 support level still remains possible for the EURUSD pair. Overall,...

Risk Appetite Takes a Back Seat, Sterling to Face More Event Risks Ahead

Risk appetite is taking a back seat for now as investors are not too satisfied with the tiny tariff rollback in the US-China phase one trade deal. Better than expected economic data from China also provide little inspiration. Australian Dollar...

Path is clear for a year-end rally with key hurdles like the trade war removed

With trade tensions toned down, stocks have clearance to rally into year end, a traditionally positive time for stocks.

Dissatisfied With Tiny US-China Tariff Rollbacks, Risk Appetite Might Struggle to Push Forward

The markets were rocked by three key events last week, UK Election, US-China trade deal and FOMC rate decision. Sterling ended as the strongest one last week as boosted by the Conservative’s landslide victory in UK election, removing a large...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals