The largest beer company in the world upgraded at RBC after debt refinancing

Investors should buy shares of beer giant AB InBev — the largest beer company in the world — as a recent refinancing will lighten the burden from the company’s massive debt load, an analyst at RBC Capital Markets said Tuesday....

EUR/USD Slumps To 1.1340

During the previous trading session, the European Single Currency trade at the 1.1360 level as it was predicted. On Monday morning, the rate was located at 1.1352. In regards to the near-term future, most likely, the currency exchange rate will...

Germany banking: NordLB shows urgent need for reform

Publicly owned regional wholesale banks were part of the financial architecture behind Germany’s post-war economic miracle. However, globalization and European integration – especially the advent of a stronger EU single market and competition framework – has rendered the Landesbanken increasingly...

Sterling Soft on Brexit Stalemate, Yen and Dollar Higher

Sterling is trading lower in Asian session today as UK Prime Minister Theresa May’s uninspiring statement did nothing to break the stalemate. But, commodity currencies are equally weak, if not weaker, following decline in the stock markets. There is no...

Markets Rebound From China Slowdown On Trade Hopes

FX – Dollar not slowing down despite holiday and ongoing partial shutdown The US dollar is mixed against major pairs on Monday. The Martin Luther King holiday in the States did not slow down the dollar at the beginning of...

Brexit: May Unveils Plan B, Market Shrugs

As my colleague Fawad Razaqzada noted earlier this morning, markets were relatively dull heading into the day’s marquee event, the release of UK PM Theresa May’s “Plan B” Brexit bill. Unfortunately, the “new” proposal did little to shake things up....

A $3.5 billion money manager makes a bullish market case for DC’s partisan gridlock

Sometimes, no movement is good movement. In the case of the government shutdown, money manager Larry Glazer believes it’s favorable for Wall Street — at least in the short term. His reasoning: It prevents lawmakers from passing policies that could...

LatAm banking: Keep an eye on the Andeans

COPYING AND DISTRIBUTING ARE PROHIBITED WITHOUT PERMISSION OF THE PUBLISHER: CHUNT@EUROMONEY.COM By: Published on: Monday, January 21, 2019 They aren’t making headlines – for the right reasons. Brazil’s banks – and Brazilian assets generally – have been rallying as new...

No NY’s Resolutions from ECB

Reinvestment policy and forward guidance interest rates to remain unaltered No downgrade of risks to eco outlook (yet) Muted market reaction expected, but sensitivity to comments on TLTRO’s? This week, the ECB holds its first policy meeting after ending net...

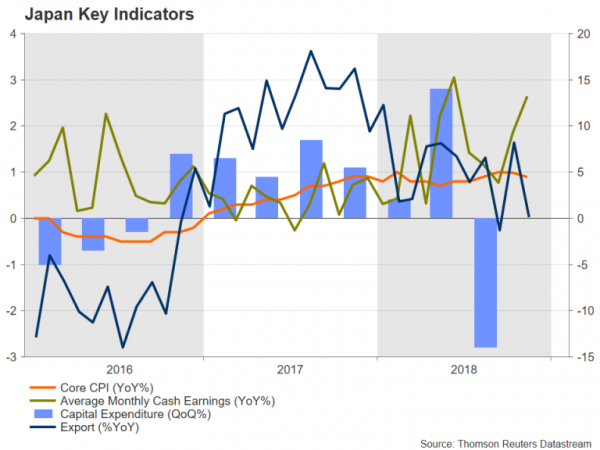

Bank of Japan Meets amid Growing Downside Risks and Stronger Yen

The Bank of Japan will hold its first monetary policy meeting of 2019 on January 22-23, and unlike this time last year when there was a real prospect of a QE exit, policymakers will probably be discussing if or how...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals