Week Ahead: Goodbye 2019

Understandably, there will only be a handful of not-so-important economic indicators this week as trading winds down ahead of Christmas holidays and the festive hangover will not clear until the second week of January. Ahead of year-end, we are expecting...

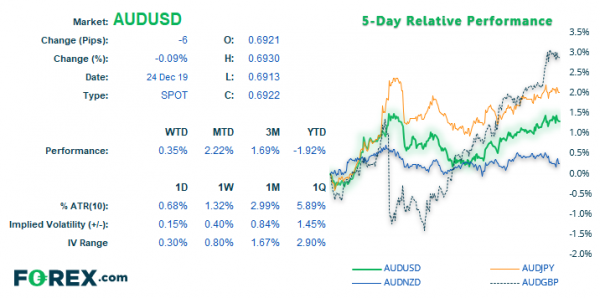

After 21 Months, AUD/USD Finally Closed Above Its 200-Day Average

With the Aussie closing above its 200-day MA for the first time in 21 months, does it pave the way for a strong start on January, or is it a red herring? It depends. The daily close above the 200-day...

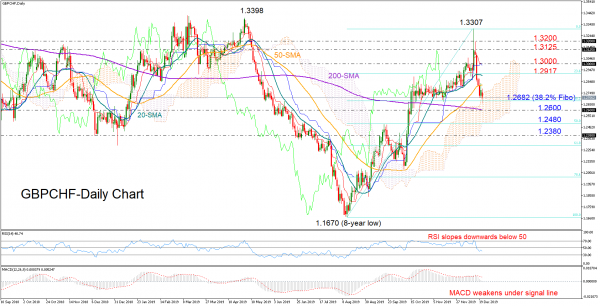

GBPCHF Enters Bearish Area; Maintains Uptrend in Medium-Term

GBPCHF lost significant ground and dived below its 20- and 50-day simple moving averages (SMAs) after unsuccessfully attempting to grow into the 1.3300 region. The market is currently trading in bearish waters according to the RSI, which is strengthening to...

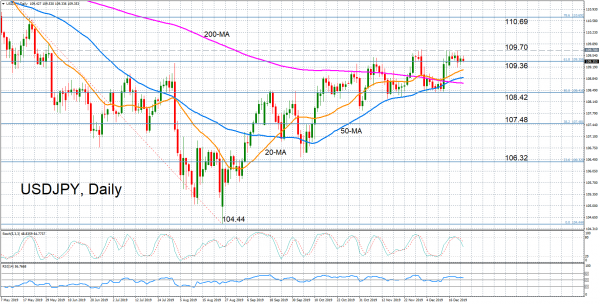

USDJPY Constrained around 61.8% Fibonacci, Lacks Momentum

USDJPY has been hovering around the 61.8% Fibonacci retracement level of 109.36 of the downleg from 112.39 to 104.44 for the past 10 days, with the 109.70 barrier holding back efforts to break above this key resistance point. Momentum indicators...

Blockchain takes back seat in drive to digitize Asian trade finance

CamelOne is a multi-bank portal designed to support trade finance applications from companies for all participating banks. But unlike other trade finance platforms such as we.trade and Komgo, CamelOne is not built on blockchain – perhaps surprising, given Euromoney reported...

Market closes early, Santa rally period begins, Richmond Fed data: 3 things to watch for on Tuesday

Traders work on the floor of the New York Stock Exchange. Michael Nagle | Bloomberg | Getty Images Here are the most important things to know about Tuesday before you hit the door. 1. Early close We’ll get a short...

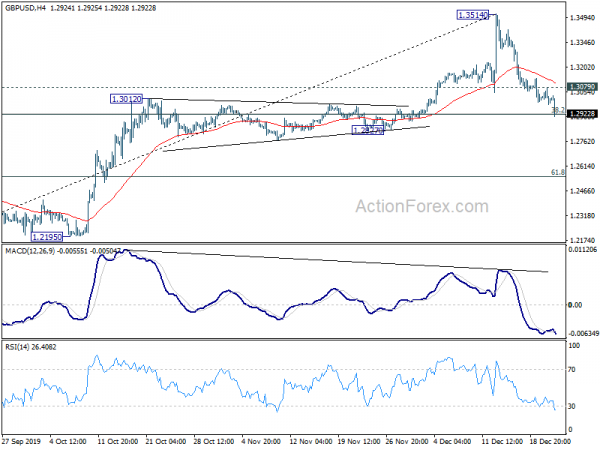

GBP/USD Outlook: Extended Weakness Hit New Three-Week Low and Cracked Important Fibo Support

Cable extended weakness to new three-week low at 1.2904 on Monday, following brief consolidation above psychological 1.30 support and subsequent bearish acceleration. The sentiment remains weak as fears about hard Brexit at the end of 2020 rise, keeping near-term focus...

Canada: Strike Spillovers and Drop in Retail Spending Drive an October GDP Contraction

The information contained in this report has been prepared for the information of our customers by TD Bank Financial Group. The information has been drawn from sources believed to be reliable, but the accuracy or completeness of the information is...

Canada GDP Soft in October

GDP declined 0.1% in October Weakness (still) concentrated in goods sector, although services also softer Transitory factors also at play, but Q4 growth tracking below prior estimates The 0.1% decline in GDP in October was the first monthly drop in...

Sterling Suffers Renewed Selling, Canadian Lower on GDP

Sterling is trading as the weakest one for today as it suffers renewed selling ahead of holidays. Canadian Dollar is currently the second weakest, weighed down by unexpected contraction in October GDP. Meanwhile New Zealand and Australian Dollars are the...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals