U.S. Highlights

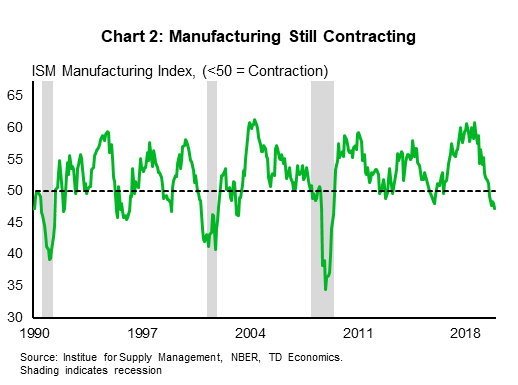

- It was a relatively light week on economic data. The merchandise trade deficit narrowed in November, suggesting some upside risk to real GDP growth in the fourth quarter. Still, activity in the manufacturing sector continues to come in on the weak side, with the ISM index falling again in December to its lowest level since 2009.

- The phase one trade deal between China and the U.S. looks to be signed later this month. Details are still scant and time lines around commitments uncertain.

- News that a U.S. airstrike in Iraq had killed a top Iranian military leader caused oil prices to spike, global stock markets to sell off and bonds to rally on Friday.

Canadian Highlights

- Financial markets were quiet during the holiday season, but Canadian markets followed their global peers lower today as escalating geopolitical tensions triggered risk-off sentiment.

- The holiday season also had little in the way of Canadian economic data releases. October’s real GDP print confirmed the view that the Canadian economy is hitting a soft patch in Q4.

- The Bank of Canada remains in a tough spot, weighing emerging signals of a softening economy against financial stability concerns in its interest rate decisions this year.

U.S. – A Risk-Filled Start to the Year

The first week of the year was relatively light on economic data, but not short on geopolitical developments. Financial markets started the New Year in an optimistic mood, boosted by news that the People’s Bank of China had cut its reserve ratio by 50 basis points. This move injects additional liquidity into China’s banking system in the hopes of supporting growth while also alleviating any potential funding stress for its banks heading into the Lunar New Year holiday.

Alas, this optimism did not last long. Markets were roiled on Friday by news that a U.S. airstrike in Iraq had killed Qassim Suleimani, a top Iranian military leader. Fears of retaliation and further escalation caused oil prices to spike, global stock markets to sell off and bonds to rally, with the 10-year yield falling seven basis points to 1.81% as of writing.

Outside of the torrid developments in the Middle East, the U.S. and China appear to be moving forward on signing ‘phase one’ of their trade deal. Earlier in the week, President Trump announced that he would sign the deal on January 15th. Details of the final deal are expected in the next several days. Early indications are that the text of the deal could remain vague on the exact amount and timing of China’s commitments to purchase additional agricultural and other U.S. goods for fears that specific details could distort markets.

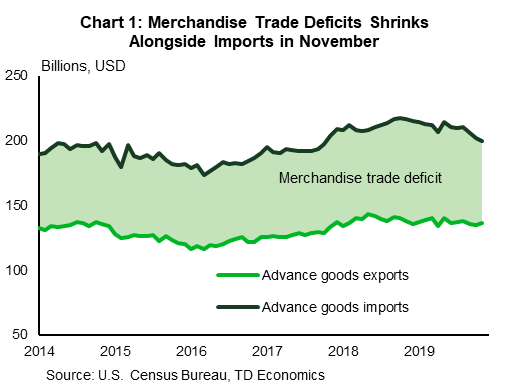

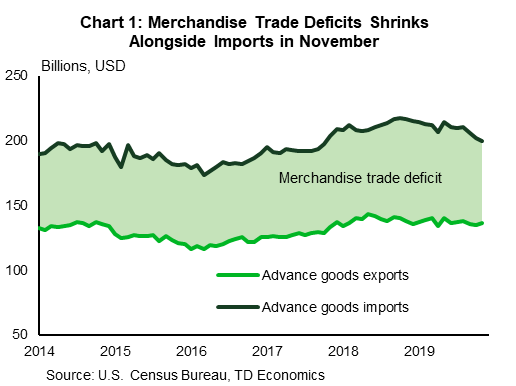

News on the trade deal came as preliminary data on the merchandise trade deficit showed a narrowing in November of last year, reflecting a rise in exports and a sharp decline in imports. The fall in imports came alongside data showing a smaller build in inventories in the fourth quarter. Still, the net impact was enough to raise tracking estimates for fourth quarter real GDP growth north of 2.0% (annualized).

Elsewhere on the economic front, global manufacturing activity continued to struggle through the end of last year. In the U.S., the ISM manufacturing index fell to 47.2 in December from 48.1 in November. The decline was contrary to the median economist forecast for an increase in the index. The ISM index has now been in contractionary territory for five consecutive months and at its lowest point since the recession in 2009. Manufacturing sectors remain weak the world over. The Markit PMI index in Germany edged lower in December as well. While still above its trough, it remains in contractionary territory where it has been through all of 2019.

The data flow will pick up next week with the release of the ISM non-manufacturing index and December employment data. So far, the troubles in the manufacturing sector have remained contained therein while broader services expansion has remained unharmed and, importantly, has provided enough support to the job market to support ongoing consumer spending. We will be watching for any developments on this front in the jobs data next week, as well as the impact of new (and old) geopolitical flare ups.

Canada – A Tough Balancing Act

Canadian financial markets, like their global peers, were relatively quiet during the holiday season. However, escalating geopolitical tensions overnight triggered risk-off sentiment, sending equities lower and providing a lift to safe haven assets (for instance, gold) today. These heightened tensions also sent the price of global oil benchmarks (Brent, WTO) spiking, but do not appear to be lifting the energy-heavy S&P/TSX equity index.

Domestically, the holiday season offered very few data releases. Business and consumer indicators are reaffirming the ongoing narrative of a notably softening Canadian economy in the fourth quarter.

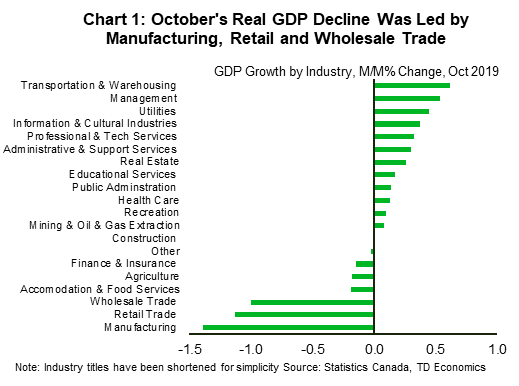

Last week’s GDP release was the highlight, showcasing that the Canadian economy contracted 0.1% in October. Worse, September’s real GDP data was also revised downwards a tenth of a percentage point. The GM strike and its spillovers were only a small part of the story. Indeed, while 13 of the 20 broad industries were in expansion (Chart 1), 13 of the 18 manufacturing sub-sectors contracted, with the pain spread well beyond auto-related sectors. Also worrying was the marked drop in retail trade – evidence of still-lackluster consumer spending despite surging population growth. The disappointing release left our fourth quarter GDP solidly below 1% – lower than the Bank of Canada’s 1.3% estimate in their October Monetary Policy Report.

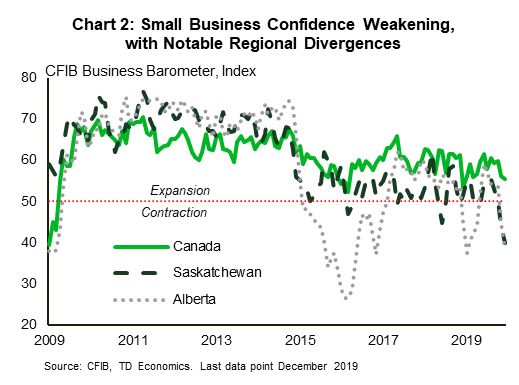

The timelier but less-watched soft data reaffirmed the narrative. The December CFIB Small Business Barometer release showed small business confidence falling to its lowest level this year (Chart 2). Meanwhile, Canada’s manufacturing PMI dropped to 50.4 (from 51.4). Although still in expansionary territory, the sentiment decline, together with hard data, confirm that the global manufacturing slump is having an impact on Canada. Moreover, today’s below-consenus ISM manufacturing print in the U.S. doesn’t bode well for Canadian exports and manufacturing shipments. As noted in a previous report, we expect only a flat-to-slightly-negative performance for the sector in the months ahead.

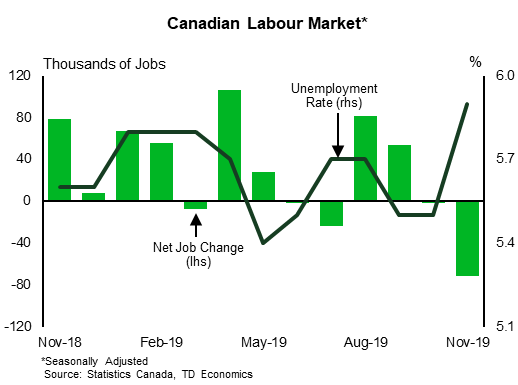

Looking ahead to 2020, the Bank of Canada remains in a tough spot. Last year, the central bank remained on the sidelines as most major central banks eased their monetary policy stances. Driving this divergence has been the difficult task of weighing softening domestic data against financial stability concerns of elevated household debt levels. However, particularly notable in recent months is the impact of debt servicing costs on consumer balance sheets and spending – evident in the rise of insolvencies and lackluster consumer spending. In addition, labour markets have been hitting the brakes after an elongated run of notable strength.

If the softening trajectory continues, 2020 may see some easing from the Bank of Canada. Next week’s Labour Force Survey release is definitely one to watch, as will be Governor Poloz’s remarks the day before.

U.S: Upcoming Key Economic Releases

U.S. Employment – December

Release Date: January 10, 2020

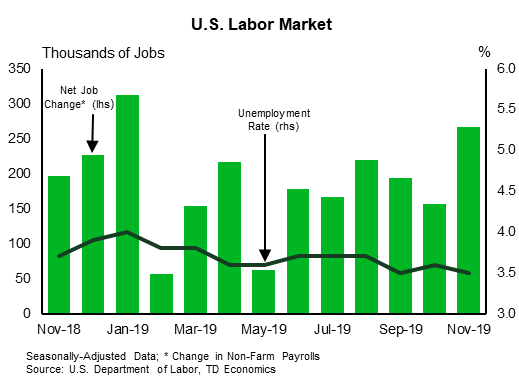

Previous: 266k, unemployment rate 3.5

TD Forecast: 145k, unemployment rate 3.5%

Consensus: 158k, unemployment rate 3.5%

Payrolls probably slowed significantly after an exaggerated surge in November (266K and around 220K excluding returning strikers). Even our below-consensus 145K forecast implies a strong 189K average for Q4, above the 173K average for the first nine months of the year, so the December reading could be even weaker without necessarily signaling a major slowing in the trend. The trend will probably be revised down a bit in the annual revision in early February, but monthly gains would probably have to drop to 100K or less for the unemployment rate to start rising. We expect the unemployment rate to hold at 3.5% in the December report after dropping by a tenth of a point in November. Our 0.3% forecast for the rise in average hourly earnings implies a 3.1% increase on a 12-month-change basis, identical to the November reading.

Canada: Upcoming Key Economic Releases

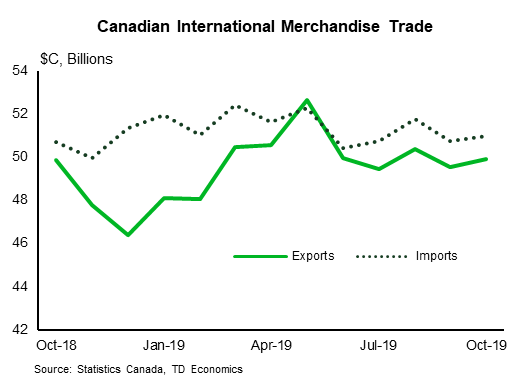

Canadian International Trade – November

Release Date: January 7, 2020

Previous: -$1.1bn

TD Forecast: -$1.1bn

Consensus: NA

The international trade balance is forecast to hold roughly unchanged at a $1.1bn deficit in November. Export activity will benefit from a rebound in motor vehicle production that had been weighed down by US factory shutdowns. US auto shipments bounced back fully in November, but the Canadian recovery will be constrained by the scheduled winddown of GM’s Oshawa facility. Elsewhere, a nominal tailwind from higher crude oil prices will be offset by transportation headwinds, as shutdowns to the Keystone Pipeline weighed on export capacity for part of the month. The CN Rail strike also introduces some downside risk to exports, especially in the agricultural sector. Agricultural exports are down 17% over the last two months, but the combination of the CN strike and ongoing geopolitical tensions with China will limit any rebound. On the other side of the ledger, a return to normal US auto production will provide a tailwind to imports.

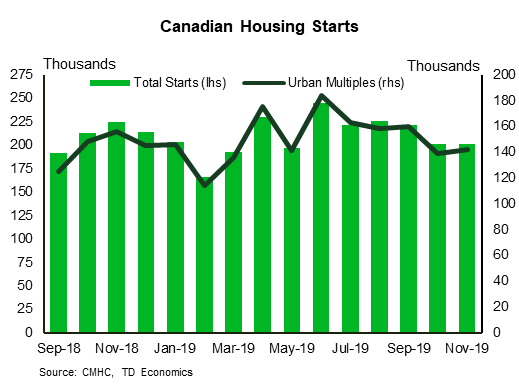

Canadian Housing Starts – December

Release Date: January 9, 2020

Previous: -$1.1bn

TD Forecast: -$1.1bn

Consensus: NA

TD looks for housing starts to moderate to an annualized 194k in December, marking the first time since May that construction has fallen below a 200k pace. While conditions in the resale market remain tight, building intentions have softened in recent months and labour market data has shown the construction industry struggled into year-end. Favourable building conditions, caused by unseasonably warm weather across most of Canada, should help limit the slowdown.

Canadian Employment – December

Release Date: January 10, 2020

Previous:-71k, unemployment rate: 5.9%

TD Forecast: 25k, unemployment rate: 5.7%

Consensus: 32k, unemployment rate: 5.8%

TD looks for the labour market to recover a portion of the 71k jobs lost in November, with Canadian employment forecast to rise by 25k in December. While outsized pullbacks in LFS employment are typically followed by mean-reversion, there are few instances where Canadian employment has fallen by this magnitude outside of the financial crisis. The goods-producing sector should provide the main engine behind the recovery after shedding 67.5k jobs over the last two months, including 2.9% of all manufacturing jobs, and some stabilization within auto production along with positive NAFTA developments should help bolster sentiment in the industry. A partial rebound in employment alongside a modest pickup in labour force growth should allow the unemployment rate to edge lower to 5.7%, while wage growth should slip to a still-robust 4.0% y/y from 4.4% in Novemb er.

er.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals