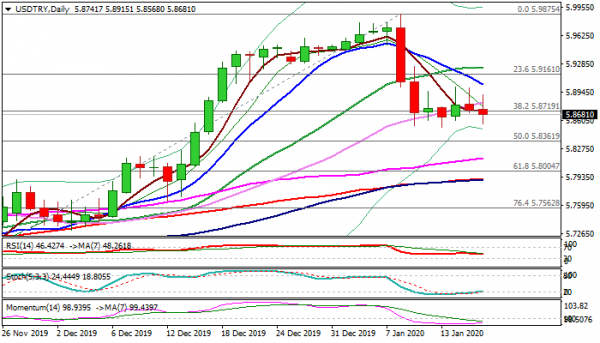

Turkish lira rose against US dollar after CBRT surprised markets by 0.75% rate cut to 11.25% vs widely expected half percent easing. The central bank said that current policy stance remains consistent as inflation outlook continues to improve. Rate cut is expected to support lira, also boosted by strong risk mode in the markets. The USDTRY’s near-term action is congested around cracked pivotal Fibo support at 5.8720 (Fibo 38.2% of 5.6848/5.9875 ascend) for the fifth day and firm break lower is needed to signal continuation of pullback from 5.9875 (8 Jan high) towards 5.80 (Fibo 61.8%) and 5.7909 (200DMA). Daily momentum remains in the negative territory, although in sideways mode, but stochastic emerges from oversold territory that may obstruct bears and keep the pair in extended sideways mode. Falling 10DMA (5.9040) maintains pressure and expected to cap upticks.

Res: 5.8719, 5.9040, 5.9161, 5.9233

Sup: 5.8528, 5.8361, 5.8000, 5.7909

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals