U.S. Review

2020 Is Off to a Good Start

- Most of this week’s economic reports showed the economy ended 2019 with strong momentum, while the Senate passage of the USMCA and the signing of Phase I of the China trade deal reduce some of the uncertainty hanging over the outlook.

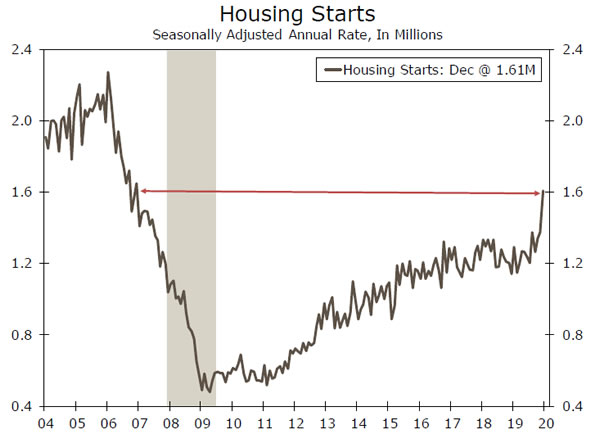

- Mild weather helped housing starts surge 16.9% in December to a 1.61 million-unit pace, the highest in 13 years.

- Manufacturing surveys from the New York Fed and Philadelphia Fed both rose more than expected in December.

- December retail sales were soft, with a 0.5% gain in core retail sales offset by downward revisions to the prior two months.

A Pretty Good Start to the Year

This morning’s much stronger-than-expected rise in housing starts capped off a very good week for the economy. Housing starts surged 16.9% to a 1.61 million-unit pace, the highest level since December 2006. Big jumps like this are not unusual for December. The seasonal adjustment factors are huge and unseasonably mild weather, as we had this past month, can often lead to exaggerated jumps in the seasonally adjusted data. There is also a tendency for multifamily starts to surge at year-end, as apartment developers race to begin projects ahead of new legislative mandates.

December’s data appear to have been impacted by both forces. Single-family starts jumped 11.2% to a 1.06 million-unit pace, the highest since July 2007. Multifamily starts surged an even stronger 29.8% to a 553,000-unit pace, a 33-year high. Permits, which are less impacted by temporary market distortions, fell in December, with single-family down 0.5% and multifamily down 9.6%. The level of construction for both single-family and apartments, however, has been strong for the entire second half of 2019, which means that even if activity stabilizes at recent levels, we would still see sizable year-over-year gains to start 2020. Moreover, we expect to see continued gains—the NAHB index, a measure of homebuilder optimism, held near a 20-year high in December.

We also got some positive signs from the manufacturing sector. While industrial production fell 0.3%, that was entirely due to unseasonably warm weather dragging on utilities output. Manufacturing output exceeded expectations, rising 0.2%. Aside from the GM strike and Boeing’s issues with the 737 MAX, the factory sector is showing signs of stabilizing amid a nascent rebound in global industrial output and some more positive developments in trade policy. Domestic manufacturing surveys are already beginning to reflect this, with the New York Fed (4.8 vs. 3.6 expected) and Philly Fed (17.0 vs. 3.8 expected) both rising more than expected in January. The improvement in the regional surveys should eventually show up in the national ISM survey.

Elsewhere in survey evidence, the NFIB small business index dipped slightly to 102.7 in December, but owners generally remain optimistic and expect improved economic conditions in coming months. The trade deal will likely boost confidence going forward, while impeachment proceedings may weigh on the January data. Owners are still seeing solid sales, which was reflected, to some extent, in the December retail sales report, which showed sales up 0.3%. Downward revisions took some of the shine off the report and meant that 2019 holiday sales were up 4.1% year-over-year, slightly below our expectation. Final data for the holiday period are still a few months away. Strength in control group sales gives us confidence in our Q4 PCE forecast of 2.1%–a slowdown, to be sure, but still well above most initial forecasts for the period.

Inflation, meanwhile, remains relatively tame. The CPI rose 0.2% in December, pushing the year-over-year change to 2.3%. The core CPI is also up 2.3% year-over-year. The Fed’s preferred measure— the core PCE deflator—remains stuck at 1.6%. Low inflation provides the Fed some leeway to maintain an easier monetary policy in place, and expect the Fed to remain on hold this year.

U.S. Outlook

Existing Home Sales • Wednesday

The pace of existing home sales likely continued to climb in December, to around 5.45 million. The housing market in general is now solidly a positive, and resales have been no exception, benefitting from the decline in mortgage rates and improving sentiment. On a year-over-year basis, sales have risen the past five months, after 16 straight months of declines.

With rates unlikely to break out to the upside, we see this strength continuing; however, the pace of improvement is unlikely to accelerate, as there are simply not enough available homes for sale. Last month, inventories fell 5.7% year-over-year to the lowest November level since 1999. The dearth of inventory is exerting upward pressure on prices—now rising 5.4% annually—and capping further improvement in the buying environment. For 2020 as a whole, we expect resales to come in at around a 5.44 million-unit pace, up from around 5.36 million in 2019.

Previous: 5.35 M Wells Fargo: 5.45 M Consensus: 5.43 M

Jobless Claims • Thursday

Next week is extremely light on new economic data, which means the Thursday jobless claims print will probably get too much attention. We would caution that week-to-week movements in claims are far too noisy to gather much insight, but the trend is nevertheless clear— claims are incredibly low on a historical basis (and even lower after adjusting for the growth in the labor force) and attest to the strength and resilience of the U.S. labor market. Last week claims fell by 10,000 to just 204,000, pulling the four-week moving average down to 216,000.

We expect the unemployment rate to remain between 3.5%-3.6% in 2020, while underlying payroll growth should gradually moderate (the actual headline payroll numbers will begin to see some serious distortions from 2020 Census hiring). For now, claims have yet to point to any major deterioration in the labor market, and we think this will continue to be the case in coming quarters.

Previous: 204K Consensus: 214K

LEI • Thursday

The December reading of the Leading Economic Index (LEI) will likely point to a very modest fall in economic growth prospects. The LEI, which is a composite of ten different variables designed to signal peaks and troughs in the economic cycle, was flat in November after three straight declines. Weakness has mainly been concentrated in manufacturing, while equity market strength and an upturn in residential building permits have boosted the index. Stocks kept rolling in December, while manufacturing output actually surprised to the upside. The signing of the Phase I trade deal may modestly lift the index in coming months.

More broadly, the Conference Board states that the LEI is indicating that “economic growth is likely to stabilize around 2 percent in 2020.” This characterization is in accord with our own forecast of full-year growth of 2.1% in 2020.

Previous: 0.0% Wells Fargo: -0.3% Consensus: -0.2%

Global Review

Central Banks Keeping It Easy?

- Data this week continued to point to further easing from the Bank of England, while dovish commentary from policymakers remains consistent with that narrative. We acknowledge that the case for a BoE rate cut has risen dramatically over the past week, and although our official call is for no change in January, we nonetheless agree that a rate cut is a distinct possibility.

- In emerging markets, both Turkey and South Africa’s central banks cut interest rates this week, given subdued GDP growth in each country. Elsewhere, Chinese GDP growth held steady in the fourth quarter, and December activity data exceeded expectations, adding to signs of a stabilizing Chinese economy.

Prospects of a BoE Rate Cut Rise This Week

Data this week continue to point to further easing from the Bank of England (BoE), while dovish commentary from policymakers remains consistent with that narrative. Following weak growth and inflation figures earlier in the week, markets are now pricing in a roughly 70% chance of a BoE rate cut, compared to about 25% at the start of the week. The U.K.’s inflation rate unexpectedly slowed to a three-year low in December, rising just 1.3% year-over-year, while core inflation—which excludes volatile components such as food, alcohol and tobacco—also disappointed, rising just 1.4%. Meanwhile, December retail sales unexpectedly fell 0.8% monthover- month, matching the revised November figure, while sales were also down 0.9% quarter-over-quarter in Q4. Separately, BoE policymaker Saunders said in a speech this week that stimulus measures may be needed to avoid a prolonged period of belowtarget inflation, as U.K. economic growth remains sluggish. Our view has been for the BoE to remain on hold at its policy meeting this month, but given the weaker-than-expected data, we acknowledge that the case for a BoE rate cut is looking stronger by the day.

Turkey and South African Central Banks Ease

The South African Reserve Bank (SARB) caught markets off guard with a 25 bps rate cut to 6.25%. In the accompanying statement, the SARB noted that the domestic economic outlook remains fragile, significantly lowered its medium-term inflation outlook compared to its November forecast, and lowered its GDP growth forecasts. The SARB’s implied path of policy rates indicated additional rate cuts are likely over the course of 2020. The rand initially weakened following the announcement, but retraced its losses. In other central bank announcements, Turkey’s central bank cut rates further, reducing its one-week repo rate 75 bps to 11.25%, the fifth straight decrease. The lira jumped following the announcement, given that the move was less than the 100 bps cut some market participants expected. Given that headline inflation increased to 11.84% in December, the latest interest rate cut pushed the real interest rate below zero (middle chart). The central bank’s decision to ease monetary policy despite elevated inflation and underwhelming growth performance reinforces our view that rate cuts may be premature.

Signs of Stabilization in the Chinese Economy

Chinese GDP growth was unchanged at 6.0% year-over-year in the fourth quarter, in line with expectations. December activity data topped expectations as industrial output rose 6.9% year-over-year, while retail sales growth was steady at 8.0% year-over-year. The last quarter of 2019 seemed to end on a solid note, a sign that China’s growth-supportive policies are beginning to have a positive impact on the economy. This is also consistent with our view of a stable outlook for the Chinese economy. With U.S.-China trade tensions now lessened, in addition to continued stimulus support from the PBoC, we expect real GDP growth in China to remain near 5.9% in 2020 and 2021.

Global Outlook

Bank of Japan Policy Decision • Tuesday

The Bank of Japan (BoJ) held its main policy rate steady at -0.10% at its December 19 policy meeting, and outlined its rules for the ETF lending program, which was first announced in April. The BoJ sounded a bit more upbeat on the global economy and noted that the domestic economy has been showing “a moderate expanding trend.” We do not expect the BoJ to make any major changes to policy in the near future, especially now that a fiscal easing package has been announced to counter a slowdown in the economy.

On the price front, the BoJ made little changes to its inflation expectations, even though inflation remains well below the central bank’s 2% target. In November, headline prices rose 0.5% year-over-year, likely in part due to the October sales tax increase, despite education costs declining 7.8% after free preschool education started in October.

Previous: -0.10% Wells Fargo: -0.10% Consensus: -0.10%

ECB Policy Decision • Thursday

At its final monetary policy announcement for 2019, the European Central Bank (ECB) held monetary policy steady as expected, and made minimal changes to its economic projections. Since its December 12 meeting, incoming data have been relatively more stable. December headline inflation was the strongest since April 2019 and the three-month average of core inflation edged higher to the strongest pace since 2015, an encouraging sign for the ECB. Meanwhile, retail sales rose more than expected in November and industrial data were sturdy.

We still expect the ECB to cut rates an additional 10 bps in March, given that inflation remains below the central bank’s target rate and growth remains soft. That said, we acknowledge that risks are skewed toward no policy easing.

Previous: -0.50% Wells Fargo: -0.50% Consensus: -0.50%

U.K. PMIs • Friday

In the United Kingdom, recent data point to slower growth as the services and manufacturing PMIs were below 50 on average in Q4-2019 and GDP data surprised to the downside in November, falling 0.3% month-over-month. Given the disappointing data over the past couple of months, in addition to dovish commentary from Bank of England (BoE) policymakers, the market is now pricing in roughly a 70% chance of a 25 bps rate cut at the January 30 meeting. We recognize the case for a BoE rate cut has risen dramatically over the past week, and although our official call is for the BoE to remain steady in January, we nonetheless agree that a rate cut is a possibility. Last, we note that the upcoming PMI data release next week should provide some additional insight to the U.K. economy prior to the policy meeting and may result in more market volatility than usual.

Previous: 47.5 (Manufacturing), 50.0 (Services) Consensus: 48.7 (Manufacturing), 51.0 (Services)

Point of View

Interest Rate Watch

Waiting on Inflation, but Does the Fed Have the Tools?

Amid a slew of price data this week, one thing was clear: Inflation remains subdued. While good for consumers, the persistently low rate of inflation this expansion has vexed the Fed. Sub-target inflation leaves the FOMC less room to cut real interest rates and stimulate the economy in an environment when nominal rates are already low.

Core PCE inflation currently stands at 1.6%, on par with its average this expansion. The prolonged shortfall from 2.0%, illustrated in the top chart, has made inflation a key criteria to the Fed cutting rates again even as other risks to the outlook have eased. What levers, then, might the FOMC pull to spur higher inflation?

There is of course the traditional lever of lower interest rates. But given that inflation’s struggle for 2% has been in a period of historically low rates, it is reasonable to question the traditional strength of this relationship. The subdued response of inflation to lower interest rates comes as only about 40% of the inflation basket has a significant link with slack in the economy. As a result, the FOMC may have to run the economy quite “hot” so inflation in cyclically sensitive areas can offset weakness in areas that have historically been unresponsive to the economic cycle (middle chart).

Inflation expectations play a significant role in actual inflation. As a result, the Fed has been reviewing ways in which it may lift inflation expectations as part of its ongoing policy, tools and communication review. We discussed a number of those options in a report last year. In our view, the FOMC has already implicitly moved toward an average inflation target via its emphasis on the committee’s “symmetric” target.

Communicating that inflation would be allowed to run above 2%, if credible, should raise expectations. But that credibility will be difficult to win, given continued misses. If its tools are insufficient to raise inflation, the Fed could be looking at a mismatch with its mandate, which opens up longer-term questions beyond the policy review.

Credit Market Insights

Demand Perks, Mortgage Apps Jump

The first full week of the year saw a surge in housing demand, as mortgage applications jumped 30% in the week ended January 10. Refinancing applications led the surge, up 42.7%, likely stemming from lower mortgage rates, which remain near their lowest levels in three years. The conventional 30-year mortgage rate slipped nine basis points over the past four weeks to 3.65%.

Low rates are not only encouraging refinancing among existing owners but are also enticing prospective buyers to enter the market, as purchase applications climbed 15.5% last week. Low rates should support home buying, but the pace of sales remains restricted by affordability challenges for first-time buyers. Sales of existing singlefamily homes continue to be limited by extremely low inventories, particularly of homes priced at or below the median.

We do not expect this headwind to disappear overnight, as low inventories of existing homes have often been a problem this business cycle, but there may be some room for improvement.

Increased optimism among home builders may lead to more entry level construction, but demographics may also provide a boost. With the tail end of Baby Boomers now 55 years old or older, which is when labor force participation begins to diminish, we expect housing turnover and inventories to increase over the course of the decade.

Topic of the Week

Phase I Trade Deal Signed

President Trump and Chinese Vice Premier Liu He signed the Phase I trade deal in Washington on January 15. The Chinese agreed to crack down on intellectual property theft and forced technology transfer, to avoid currency manipulation and to buy an additional $200 billion of American goods and services, relative to 2017, over the next two years. In return, the United States agreed to not implement tariffs on more than $100 billion of American imports from China, roll back tariffs to 7.5% from 15% on roughly $120 billion of imports and to not label China as a currency “manipulator.” However, 25% tariffs on roughly $250 billion of American imports from China will remain in place.

As we wrote in a previous report, the agreement is a welcome step, because it helps to de-escalate trade tensions between the world’s two largest economies. In addition, increased Chinese purchases of American goods and services, if they materialize as specified, would provide a modest boost to the U.S. economy. ($200 billion over a two-year period would be equivalent to roughly 0.5% of U.S. nominal GDP over that period.)

It remains to be seen how much the trade deal will effect business fixed investment (BFI) spending in the United States. By ratcheting down trade tensions, the trade deal should reduce some of the uncertainty that exerted headwinds on BFI spending in 2019. On the other hand, tariffs remain in place on nearly $400 billion of Chinese imports, and it seems overly optimistic to conclude that trade tensions with China are now a thing of the past. Our forecast looks for BFI to accelerate modestly over the course of the year. But the 3% rise in BFI that we forecast will occur between Q4-2019 and Q4-2020 is hardly “robust.”

We believe that a renewed bout of tariff hikes is not likely in 2020. But the ball is now in China’s court. If China does not honor the commitments that it made in the recently signed trade deal, then we could eventually be in for another round of trade tensions in 2021 or 2022.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals