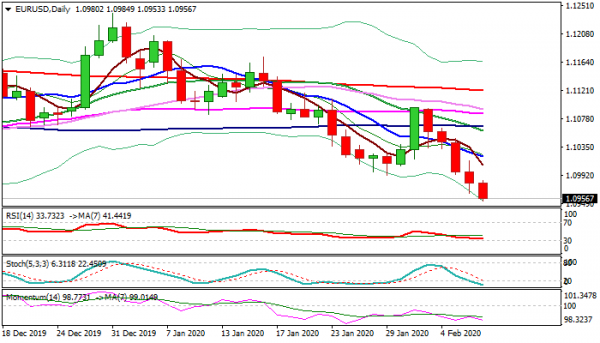

The Euro extends steep fall into fifth straight day and hits new lowest level since early Oct on Friday, on track for the biggest weekly fall since early November.

Downbeat German industrial production data added to weak tone of the single currency ahead of today’s key event – US jobs report.

US non-farm payrolls are expected to rise 160K in Jan vs 145 K increase previous month and average hourly earnings are forecasted to rise 0.3% in Jan vs 0.1% in Dec, with strong figures expected to point at stable US economy growth and further inflate dollar.

Daily techs are in strong bearish setup and supportive for further weakness which could be sparked by upbeat US jobs data.

Bears focus key supports at 1.0878/63 (2019 low, posted on 1 Oct / Fibo 76.4% of larger 1.0340/1.2555 ascend), break of which would open way towards 1.0340 (2017 low).

Broken 1.10 support zone (psychological / former low at 1.0992) marks initial resistance, followed by falling 10DMA (1.1021) and only break above these barriers would sideline immediate bears.

Res: 1.0984, 1.1000, 1.1021, 1.1047

Sup: 1.0928, 1.0913, 1.0878, 1.0863

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals