U.S. Highlights

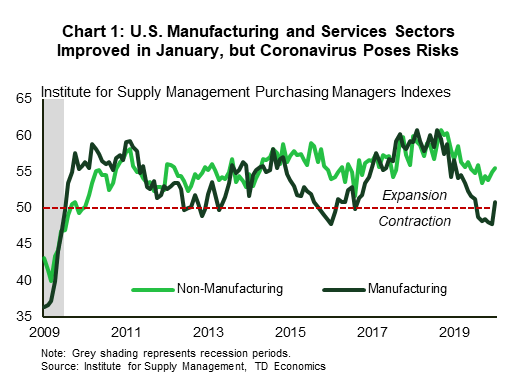

- U.S. manufacturing activity expanded in January for the first time since July and the services sector was the strongest since August.

- The coronavirus outbreak continued to disrupt trade and supply chains, impact financial markets, and force multinational companies to make production decisions with limited information.

- Even with downward revisions to 2019 employment data, the U.S. job creation streak continues with the labor market adding 225k jobs to kickoff 2020.

Canadian Highlights

- In contrast to the last week’s selloff, global equity markets have staged a rebound this week, with the S&P/TSX following its global peers higher. Global benchmark oil prices remained under pressure, however, Canadian oil prices rose on positive developments regarding the Trans Mountain pipeline expansion and Line 3 replacement.

- In addition to the good news in the domestic oil sector, the much-awaited employment report did not disappoint today. The labor market added 35k new jobs in January, marking a second consecutive monthly gain.

- Following temporary disruptions due to the shutdown of the Keystone pipeline and the CN Rail strike in November, exports rebounded strongly in December. The trade deficit narrowed to $370 million, down from $1.2 billion in November.

U.S. – Green Shoots Threatened by Viral Outbreak

Events surrounding the outbreak of the novel coronavirus continued to impact economic activity this week. Several airlines have suspended flights to China, a move expected to further dampen tourism activity, which was already negatively impacted by restrictions on tour groups leaving the country. Closures of Chinese factories and shutdown of business operations by some U.S. owned companies in China (Apple, Tesla, Starbucks) will likely depress profits and investment stateside, further weighing on economic activity.

In related news, China reported that it would reduce tariffs on $75 billion of U.S. imports by as much as 50% beginning February 14th. The move comes amid growing concerns about China’s ability to implement its responsibilities under the phase-one trade deal. The coronavirus outbreak currently underway has resulted in a near-standstill in economic activity in the country, making it more difficult for China to achieve the deal’s import targets ($200 billion over the next two years). The gesture may also aim to foster goodwill between the two countries as China hopes for flexibility in meeting its requirements under the deal.

Closer to home, the ISM Non-Manufacturing Index edged higher in January to 55.5, registering 120 consecutive months of expansion. Survey respondents generally conveyed a sense of optimism. The index’s manufacturing counterpart also managed to eke out a return to growth for the first time since July 2019 rising to 50.9 in January from 47.8 in December (Chart 1). A word of caution, however – both surveys may have been completed before uncertainty over the coronavirus disrupted global trade. With several factories in China closed until February 10th and possibly later, the downside risk to global manufacturing supply chains is very real, threatening to blunt the nascent recovery in the sector, while services are impacted via lower tourism and air travel.

In the meantime, the U.S. trade deficit widened for the first time in three months, rising to $48.9 billion in December. Just as it was starting to give cause for concern, imports bounced back in December. Following three months of contractions, good imports surged, rising by 2.7% on the month. For 2019, the trade deficit narrowed for the first time in six years as disputes on several fronts reshaped trade relationships. Exports also declined for the first time since 2016, but imports fell more sharply, resulting in a 1.7% reduction in the overall trade deficit for 2019.

Finally, on the employment front, total nonfarm payrolls increased by 225k in January, compared with an average monthly gain of 175k in 2019. Notable job gains occurred in construction (+44k) and health care (+36k) while manufacturing was down (-12k). The labor department also implemented benchmark revisions which resulted in a net 12k reduction in previously published 2019 data (Chart 2). Even with downward revisions, the U.S. was still able to maintain its longest streak of job creation. Overall, the U.S. economy continues to show its resiliency. The corona-outbreak’s widening fallout will test it again.

Canada – Labour Market Shows Resilience

Following last week’s selloff, global equity markets staged a nice rebound this week. The risk-on sentiment was supported by news that China was cutting tariffs on U.S. imports as it looked to cushion the economy from coronavirus fallout and meet its commitments under the phase one deal. The S&P/TSX composite index followed its global peers higher, ending the week up 2.2% (as of 11:35 AM).

Global benchmark oil prices remained under pressure, amid the ongoing concerns about the impact of coronavirus on demand from China as well as the uncertainty surrounding OPEC production cuts. Despite the weakness in world prices, Canadian oil prices have fared better, with the spreads to U.S. prices narrowing (Chart 1). The move higher in Canadian prices was supported by the news that the Trans Mountain pipeline expansion project cleared a major legal hurdle following a positive ruling in the Federal Court of Appeal. There was also a positive decision by a regulatory body in the U.S. on Line 3 replacement.

In addition to the positive developments in the domestic oil sector, the much-awaited employment report did not disappoint today. The labor market added 35k new jobs in January, marking a second consecutive monthly gain. However, as has been the case for the last 12 months, many of the net new jobs created last month were in the public sector, hardly a ringing endorsement of economic strength. Aggregate hours worked were another fly in the ointment, falling a touch month-on-month in the third such decline, and leaving year-on-year growth a paltry 0.5%. Taking a longer view, however, suggests that despite many headwinds and shocks weighing on Canadian economy of late, the labour market remains resilient, with the six-month hiring trend at a solid 20k, roughly in line with the economy’s trend job-creation potential (Chart 2).

The same cannot be said about the export sector, which faced many headwinds last year, both temporary and more persistent ones. Following temporary disruptions due to the shutdown of the Keystone pipeline and the CN Rail strike in November, exports rebounded strongly in December. The trade deficit narrowed to $370 million, down from $1.2 billion in November. However, even with this rebound, goods export volumes still ended Q4 in negative territory, leaving our tracking for 2019Q4 GDP growth unchanged at a tepid 0.3% (annualized). The near-term outlook for exports remains uncertain. While global trade tensions have eased in recent months, the coronavirus outbreak will likely weigh on foreign demand. Some sectors, including agriculture and base metals, may face disproportionate demand and price impacts if the slowdown in China persists – although the former could stand to gain by potentially replacing disrupted production in China.

All in all, while the labour market remains resilient, the list of temporary factors weighing on the Canadian economy seems to grow longer every day, with the coronavirus the latest addition. With the high level of household debt potentially exacerbating the impact on consumer spending in case of an economic slowdown, the Bank of Canada may not be able to shrug off the headwinds for much longer.

U.S: Upcoming Key Economic Releases

U.S. Consumer Price Index – January

Release Date: February 13

Previous: 0.2% m/m, 2.3% y/y

TD Forecast: 0.1% m/m, 2.4% y/y

Consensus: 0.2% m/m, 2.4% y/y

The headline CPI was probably tempered in January by lower gasoline prices—we forecast up 0.1% month-over-month. Gasoline prices were down around 0.6% m/m. Despite the soft monthly expansion, we look for an increase in the annual pace to 2.4% from 2.3% in December – that would be its highest level since end-2018. Our core CPI forecast is near the recent trend, but the y/y figure will likely drop to 2.2% from 2.3% if the m/m change is less than 0.24%; we forecast 0.23%.

U.S. Retail Sales – January

Release Date: February 14

Previous: 0.3% m/m, ex-auto: 0.7%

TD Forecast: 0.2% m/m, ex-auto: 0.1%

Consensus: 0.3% m/m, ex-auto: 0.3%

For retail sales, huge swings in unadjusted data make forecasting January especially challenging, but we anticipate a weak 0.0% m/m reading for the key control series after a fairly strong 0.5% rise. Despite this, headline sales likely advanced 0.2% m/m with a likely boost from auto sales (sales ex-auto: +0.1% m/m). The backdrop for spending has remained positive, with the labor market still fairly strong, wealth measures rising and consumer confidence staying high.

Canada: Upcoming Key Economic Releases

Canadian Housing Starts – January

Release Date: February 10

Previous: 197k

TD Forecast: 200k

Consensus: NA

TD looks for a modest pickup in housing starts to a 200k annualized pace for January, slightly above the 197k print in December. Unseasonably warm weather will provide a tailwind to residential construction, although we see limited scope for a more substantial rebound given the muted trend in building permits, with the six-month average of multi-unit permits sitting at the lowest level since 2018Q2, and a decline in total hours worked during January. We expect the pickup to be led by stronger single-family construction, while multi-unit starts should hold near recent lows.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals