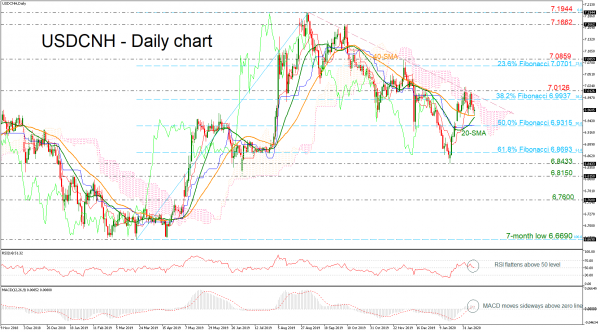

USDCNH is retreating below the five-month descending trend line after pulling back from the 7.0126 resistance level in the preceding week. Earlier today, the pair touched the 40-day simple moving average (SMA) and erased its intraday losses so far. Technical indicators are moving sideways with the RSI holding near the neutral threshold of 50 and the MACD falling below its trigger line slightly above the zero level.

If the 40- and 20-day SMAs prove easy to get through, the highlight could turn to the 50.0% Fibonacci retracement level of the bullish movement from 6.6690 – 7.1944 at 6.9315, which coincides with the blue Kijun-sen line. Below that region, the door could open for the 61.8% Fibonacci of 6.8693.

Alternatively, a successful jump above the Ichimoku cloud and the 38.2% Fibonacci of 6.9937, the price could move higher to the 7.0126 resistance. A significant rally above this area, would increase bullish sentiment, breaking the diagonal line to the upside and testing the 23.6% Fibonacci at 7.0701.

In the bigger view, USDCNH is turning lower again but the moving averages act as strong support levels and are ready for a bullish cross. A failed attempt to push the market lower may switch the outlook to bullish. However, a decline below the aforementioned lines would endorse the bearish structure in the medium term.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals