The preliminary PMIs for February will take centre stage next week as they will provide the first insight into the possible impact of the coronavirus on the global economy. The flash releases in the Eurozone, Japan, the United Kingdom and the United States should reveal how businesses outside of China have been affected by the outbreak with the risk that runaway equity markets may be handed a tough reality check. In other data, Australian employment and Canadian and UK retail sales will be watched closely, while in Japan, fourth quarter GDP numbers are likely to renew pressure on policymakers for additional stimulus measures.

Australian labour market under spotlight

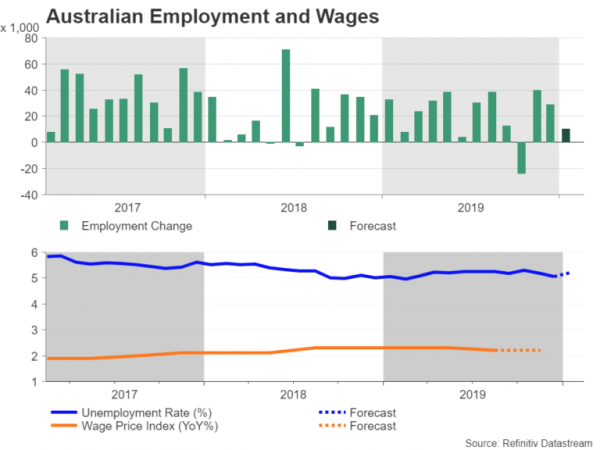

Australia’s labour market will be scrutinized over the next week as quarterly wage growth figures are due on Wednesday and the latest employment report is out on Thursday. With the Reserve Bank of Australia looking increasingly reluctant to make deeper cuts to interest rates, the labour market indicators will test policymakers’ questionable economic optimism.

Apart from the devastating bushfires that so far do not appear to have notably dented growth, Australian businesses have also had to grapple with the coronavirus epidemic, which is bound to disrupt trade with China – Australia’s biggest trading partner. The Australian dollar has bounced off 11-year lows on hopes that the outbreak may be slowing but any evidence that the spread is far from receding could pull the currency to fresh lows.

Investors will also be keeping an eye on the manufacturing and services PMIs for February due on Friday to get a better sense of how the various headwinds may be affecting the Australian economy, as well as on the minutes of the RBA’s February meeting to be published on Tuesday.

Japan’s economy likely contracted in Q4

Despite a year-long slump in exports, Japan posted impressive growth rates for the first three quarters of 2019. However, growth is expected to have taken a huge hit in the final three months of 2019 as consumer spending, which had been supporting the economy until the October sales tax hike, crumbled, while the protracted trade war continued to wreak havoc for exporters.

The GDP report on Monday is expected to show the economy shrunk by 0.9% on a quarterly basis and by 3.7% on an annualized basis, which would mark the biggest fall in output since the second quarter of 2014 when the sales tax was last raised. Revised industrial production figures for December are also due on Monday and next to come under the radar will be December machinery orders and export numbers for January on Wednesday. The flurry of data will continue on Friday with the consumer price index for January and the Jibun flash manufacturing PMI for February.

A rebound in exports in January is possible as early data suggests there was a worldwide upswing in manufacturing activity at the start of the year. However, the manufacturing PMI could show conditions deteriorated again in February.

A negative set of releases are likely to weigh on risk appetite, especially if the data elsewhere is also not very encouraging, and this would only mean increased safe haven demand for the Japanese yen.

Eurozone PMIs could spell more trouble for battered euro

The flash PMI readings by IHS Markit will be the highlight of the European calendar amid doubts about the green shots of recovery in the euro area. Eurozone manufacturing PMI has been steadily recovering since October and picked up some speed in January. However, the rebound could be cut short by the virus outbreak and so Friday’s PMIs for both the manufacturing and services sectors will be very important for detecting any shift in the outlook for the Eurozone economy.

Also out the same day are the final inflation prints for January and ahead of Friday’s data, the ZEW economic sentiment index will be watched out of Germany on Tuesday and the European Central Bank’s meeting minutes for January might attract some attention on Thursday.

The euro is at risk of accelerating its declines if next week’s figures do not provide any reason for optimism. Euro/dollar tumbled to a 33-month low of $1.0826 this week on the back of bleak industrial output numbers, which have coincided with upbeat indicators from the US. Unless there’s a change in the contrasting picture, the pair is likely to remain pressured to the downside.

Busy week in the UK

Over in the UK, the flash PMIs will be just as crucial as the virus fallout could create a fresh headache for British businesses just as they are getting back on their feet from last year’s Brexit chaos. Before the PMI release though, there will be a string of other data that will shed light on how the UK economy is performing.

Jobs figures are up first on Tuesday and after last month’s surprise jump in employment growth, investors will be looking to see if a similar momentum was maintained in the three months to December. Wage growth will be closely monitored too given the recent weakness in consumer spending. On Wednesday, it will be the turn of January inflation numbers before attention moves to the latest retail sales data on Thursday. Retail sales in the UK have not grown since July of last year as households turned more cautious amidst the political turmoil generated by Brexit. A bounce in retail sales in January would suggest the decisive election outcome in December went some way in restoring confidence among consumers.

But a bigger reassurance for markets that growth is returning to normal would be positive PMI readings on Friday. Both the manufacturing and services PMIs rebounded sharply in January and a broadening recovery in February would reinforce the view that the UK’s soft patch is over.

It would also further dampen expectations of a rate cut this year, likely benefiting the pound. Sterling already got a boost this week on speculation that the unexpected resignation of the UK’s finance minister will pave the way for looser fiscal policy, helping cable recover from 2½-month lows.

Few economic drivers for the dollar

It will be somewhat of a muted seven days in the US, with mostly second tier releases making up the schedule. The week will get off to a quiet start as markets will be closed on Monday for President’s Day and the Empire State manufacturing index for February – the first of several business surveys next week – will make the rounds on Tuesday. Housing numbers will dominate on Wednesday with building permits and housing starts for January on the agenda, along with the latest producer price index. On Thursday, the Philly Fed manufacturing index will provide another glimpse into the state of the manufacturing sector in February, and on Friday the flash PMIs and existing home sales will wrap up the week. Although the IHS Markit PMIs do not carry the same weight as the ISM PMIs, they could nevertheless move the greenback in an otherwise lacklustre week, especially if there is a global trend in the PMIs of worsening economic activity in February as a result of the coronavirus.

Not as likely to see much of a market response will be the Federal Reserve’s minutes of their January meeting due on Wednesday. Following Chairman Powell’s testimony in Congress this week, the minutes will be seen as somewhat out-of-date and will probably be ignored by traders.

Inflation and retail sales coming up in Canada

Moving north of the border to Canada, inflation and retail sales numbers will be eyed on Wednesday and Friday, respectively. Manufacturing sales on Tuesday will also be viewed. But the data is at best only anticipated to trigger knee-jerk reactions in the Canadian dollar as investors pare back their expectations of a rate cut in the coming months. Bank of Canada Governor Stephen Poloz struck a neutral tone in remarks this week, further dashing expectations of a near-term rate reduction. However, the loonie is still vulnerable to downside moves if oil prices fail to stabilize from their recent falls and investors will be watching carefully how well the coronavirus is contained and whether OPEC and its allies decide to go ahead with additional production cuts.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals