The Democratic primary race, which will decide who will square off against President Trump at the November presidential election, has kicked off. The field of candidates remains crowded and the outcome uncertain, though national polls increasingly suggest that Senator Bernie Sanders could emerge as the winner. Markets have been complacent so far, assuming that a Sanders surge might boost Trump’s re-election chances by dividing the Democrats. Yet, if Sanders continues to gain momentum, then US stocks – especially the healthcare and energy sectors – may be in for a reality check.

Long way to the top

The Democratic party is searching for a leader to spearhead the electoral battle against Donald Trump. The next few weeks will reveal who that candidate will be from a wide range of contenders with very different policies. While the landscape is still uncertain, some contenders have started to break away from the pack and are rising in the polls.

That said, it’s still very early and much could be decided by how ‘Super Tuesday’ plays out on March 3, when some of the biggest US states – from California to Texas – will vote.

The field

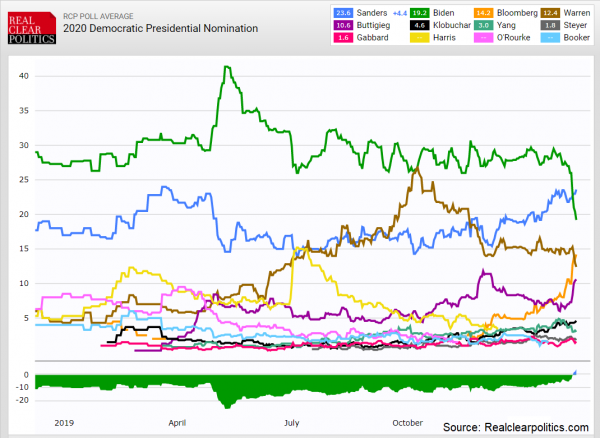

Time to introduce the candidates. According to the national polling average by RealClearPolitics, Senator Bernie Sanders is currently leading the field at 23.6%, followed by former Vice President Joe Biden at 19.2%. Former New York mayor Mike Bloomberg is in third place with 14.2%, while Senator Elizabeth Warren polls at 12.4%. Former South Bend, Indiana mayor Pete Buttigieg is fifth with 10.6%. No other contender is above 5%.

The trends are also worth mentioning. After spending all this time as the frontrunner, Biden is now collapsing, as his poor showings in the first two states – Iowa and New Hampshire – have destroyed his argument that he’s the most electable candidate. Warren is falling too, though her drop hasn’t been as severe. Capitalizing on these losses are Bloomberg and Buttigieg, both of whom are surging. Meanwhile, Sanders is steadily gaining ground.

Betting websites probably paint an even clearer picture of where the race stands right now. According to PredictIt, Sanders has a 45% chance of winning, Bloomberg is at 31%, and Buttigieg stands at 13% ahead of Biden’s 12%.

Sanders – the biggest risk for markets?

Now in terms of policies, Sanders has the most radical and market-impacting agenda. He wants to nationalize America’s healthcare system, eliminate student debt, transition the economy towards renewable energy, and substantially increase the minimum wage. To pay for all this, he would raise taxes on Wall Street via a transaction tax on every trade, reverse Trump’s corporate tax cuts, tax capital gains in a progressive manner, and introduce a wealth tax on the biggest fortunes.

He also wants to limit stock buybacks, so it’s safe to say that a Sanders presidency would be a nightmare for Wall Street, at least initially. On a longer-term horizon it’s debatable, because having a stronger social safety net would put more disposable income in the hands of lower earners who spend more, ultimately benefiting consumption and the top line of major corporations. Likewise, higher government deficits – a realistic assumption under a Sanders presidency – typically translate into stronger economic growth and feed into corporate earnings growth.

Bloomberg – bombarding the air waves

The founder of Bloomberg News and the world’s 9th richest man according to Forbes magazine entered the race much later than his rivals, so he couldn’t compete in the first few states. However, he has spent tremendous amounts of cash on TV advertisements to promote his campaign in crucial ‘Super Tuesday’ states, and his investment is already paying off judging by his gains in both opinion polls and betting markets.

In terms of policies, he is running on a left-leaning agenda as well, though less radical than Sanders’s. He also wants to raise taxes on corporations, tax capital gains in a progressive fashion, raise income taxes on the wealthiest Americans, and hike the minimum wage.

Buttigieg – riding the hype train?

The little-known mayor from Indiana took the national scene by surprise when he narrowly claimed the top spot in Iowa, taking 26.2% of the vote versus Sanders’s 26.1%. He finished a close second to Sanders in New Hampshire, building momentum that could catapult him forward in more delegate-heavy states.

His policy agenda represents the centrist wing of the Democratic party, which he thinks can attract both Democrats and moderate Republicans in a general election. Alas, given that he isn’t pushing for massive changes to the system, any major market reaction in case he gains more ground seems unlikely.

Biden – losing altitude, quickly

Until recently, it looked like the former Vice President would cruise to victory without much trouble, which goes to show how quickly a narrative can change in politics. Having finished fourth in Iowa and fifth in New Hampshire, Biden is now in freefall in national opinion polls, and while not impossible, it would be a herculean task to turn that negative momentum around.

Broadly speaking, Biden offers a continuation of Obama-era politics, with few major economic positions to speak of outside of raising the minimum wage, capital gains taxes, and investing in infrastructure.

Warren – Sinking ship or kingmaker?

The progressive Senator from Massachusetts has also fallen from grace, as her relatively poor showings in the first two states curbed enthusiasm among her supporters. Her chances of outright winning seem low, though she could still form a ‘coalition’ with Sanders down the road, as they share similar views on issues like taxation and regulation.

Final showdown: Sanders vs Bloomberg?

With Biden’s campaign imploding, it looks like the real fight in this primary will be between Sanders and Bloomberg. Sanders has a grassroots army of passionate supporters to keep his fundraising numbers competitive, and is leading not just in national polls but also in delegate-rich states like California, where a victory on March 3rd could give him even more momentum.

Bloomberg on the other hand is emerging as a more centrist alternative to Sanders, is surging in the polls, and his endless wealth ensures that he’ll be in this battle until the very end.

Why not Buttigieg? Admittedly, the Indiana mayor is soaring and it’s too early to dismiss his bid. That being said, polls consistently show he’s struggling to connect with minority voters – which encompasses much of the Democratic electorate – so he might hit a brick wall when more diverse states vote. He also lacks the infinite amount of cash Bloomberg has.

Wall Street thinks Bernie momentum is good for Trump, and stocks

It sounds strange, but there’s no hyperbole here. Recent price action in betting markets suggests that as Bernie gains momentum, investors think Trump’s re-election chances improve, because Sanders might split the Democrats up. By extension, a Trump win would benefit stocks.

Ironically, as Sanders – who has promised to ban health insurance companies – surges, health insurance stocks like United Health have gained, as Wall Street is convinced Trump would obliterate Sanders in the general election.

However, that view isn’t grounded in facts, but rather perception. Poll after poll, Trump consistently loses to both Sanders and Bloomberg in a head-to-head general election, often by wide margins. Meanwhile, betting markets do give Trump a slight edge, but still point to a close race.

Investors might be looking at solid GDP and unemployment numbers, coupled with soaring stock markets, and are concluding that a socialist outsider like Sanders has no chance – but remember, those metrics hardly reflect many people’s experience. Trump was so successful in 2016 because he tapped into voters’ anxiety about issues like stagnant wage growth, income and wealth inequality, as well as surging living and healthcare expenses – none of which have really been addressed.

To write off a populist like Sanders seems like a serious error, and the overall situation feels strangely similar to 2016, when everyone was certain Clinton was going to beat the unorthodox Trump. In other words, by no means is it a ‘sure thing’ that Trump wins reelection, as investors are banking on.

Market effects

In the big picture, it’s probably too early for markets to really worry about a Sanders presidency. The election is far away still and even if he were to become the Democratic nominee and beat Trump in November, he would also need full control of Congress to pass his controversial plans, meaning the Democrats need to retake the Republican-controlled Senate and keep the House. It’s a long shot.

Having said that, if Sanders performs well enough in the Super Tuesday primaries in three weeks, there might be a noticeable market hit – especially for healthcare and energy stocks – as investors start to take his bid more seriously and reevaluate his chances against Trump.

Similarly, while Bloomberg’s policies may be less harmful for stocks compared to Sanders’, they are still more harmful than Trump’s, so if he starts gaining momentum that could also give investors pause for thought. Particularly so because Wall Street will probably view him as the strongest candidate to take on Trump.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals