U.S. Review

Overarching Economic Themes Remain in Place

- Retail sales increased for a fourth straight month in January, underscoring the resiliency of the U.S. consumer. Fundamentals are solid and support our expectations for healthy consumer spending gains in coming months.

- The industrial sector remains challenged, however, as total production declined for the fourth time over the past five months.

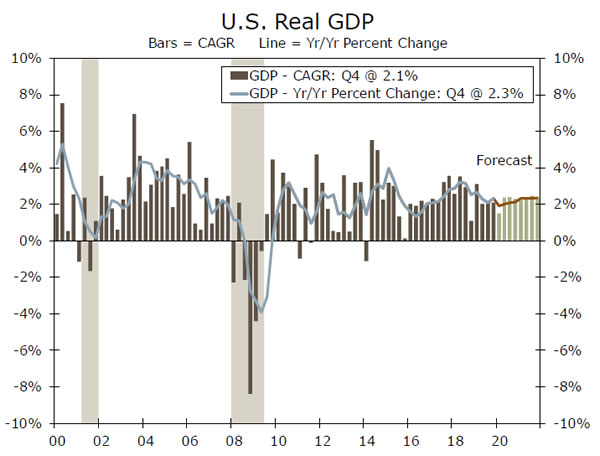

- The U.S. economy remains firmly on its expansion path, yet we are mindful of the risks to the outlook, including the ongoing coronavirus threat. Amid what should be a soft start, we look for U.S. real GDP to increase 2.0% this year.

Mildly Easing Momentum as Coronavirus Hits

As the ongoing coronavirus outbreak understandably continues to capture financial markets’ attention, this week offered a wideranging release of instructive economic indicators that continue to extend overarching themes we have seen in the overall economy in recent months.

The first theme highlights the primary strength of the ongoing economic expansion: the resilient U.S. consumer. Retail sales increased for the fourth consecutive month in January, up 0.3%. Spending gains were broad-based as nine of the 13 major categories increased on the month, led by building materials and eating & drinking establishments. Not all was rosy, however, as “control group” sales—which feed directly into personal consumption in the GDP report—remained flat, weighed down by a 3.1% drop in clothing. That said, the consumer remains in good shape at the start of the year. Resilient hiring gains and solid wage growth have buoyed consumer sentiment and spending. While the coronavirus presents a risk, we look for this consumer resilience to continue, with spending increasing at a healthy 2.5% pace in Q1.

The second theme highlights the ongoing struggles in the industrial sector. Industrial production fell 0.3% month-overmonth in January, marking the fourth decline over the past five months. Mining rose 1.2%, while unseasonably mild winter weather resulted in utilities plunging for the second straight month. Manufacturing output fell 0.1%, largely due to a 10.7% drop in aircraft & parts, a result of the Boeing 737 MAX production shutdown. Outside of the Boeing impact, solid gains were seen in motor vehicles and computers & electronics. Looking ahead, headwinds should continue to plague the sector in the near term, as concerns now center on supply chain disruptions emanating out of China as a result of the coronavirus outbreak.

The third theme highlights the steady, yet tame, performance of consumer inflation. The Consumer Price Index (CPI) rose 0.1% month-over-month in January, taking the year-over-year pace up to 2.5%. Core CPI inflation remained steady at a 2.3% year-over- year pace for the fourth consecutive month, suggesting that the underlying trend, while in line with the Fed’s target, is still not running at levels that would materially change its outlook. As such, we continue to expect the Fed to remain on the sidelines for the foreseeable future.

So what does this all mean for the U.S. outlook? On balance, the U.S. economic data have broadly shown a more positive trend over the past few months, and this week’s indicator performance supports that trend. That said, GDP growth in Q1 is nonetheless set for a slowdown, to a 1.5% annualized pace, as another sizeable drag from inventories alongside a modest drag from trade are poised to weigh on the pace of overall growth. Until there is a greater understanding of the magnitude of the economic impact, the coronavirus poses downside risk to the outlook. However, our base case is that the virus does not become a full-blown pandemic, and that the short-term U.S. economic impact is noticeable, yet manageable. As such, we look for the U.S. economy to remain in expansion, with real GDP increasing at a 2.0% pace this year.

U.S. Outlook

Housing Starts • Wednesday

The seasonally adjusted January housing starts numbers will likely show a decline, but only because the December numbers were boosted by unusually warm weather. One of the warmest Decembers on record saw non-seasonally adjusted starts actually rise 3.2%— activity typically falls sharply during winter months—which translated into a 16.9% seasonally adjusted surge to a 1.61 millionunit pace, the highest since December 2006.

While weather boosted the level of starts above its trend, that trend is undeniably strong. We expect continued gains, supported by elevated builder optimism, rising price appreciation and solid consumer fundamentals. What’s more, last month was the fifth warmest January on record, meaning the seasonal adjustment may shoot the number above trend again. The January jobs report already showed this effect, with construction employment reportedly surging by 44,000 jobs.

Previous: 1,608K Wells Fargo: 1,523K Consensus: 1,400K

FOMC Meeting Minutes • Wednesday

The Fed left rates on hold in January as was widely expected, but markets now expect a cut before the end of the year. With the Fed making it clear that it needs to see a “material” change to the outlook, we continue to think it will remain on the sidelines. However, the minutes will provide greater clarity on just how close committee members view various factors—the coronavirus’ effect on domestic growth and persistent below-target inflation, for example—come to being “material.”

The minutes may also expand on the Fed’s plan to wind down its T-bill purchases. We expect $60 billion per month until mid-April, falling to $30 billion by mid-June and then a non-predetermined amount going forward to match organic balance sheet growth. The minutes will also reiterate that the committee views its balance sheet expansion as a technical measure to prevent dislocations in money markets, rather than a form of stimulus.

Leading Economic Index • Thursday

The Leading Economic Index (LEI) should bounce back from negative territory in January, aided by a strong month for equity markets. The December reading was the first negative year-over-year print since November 2009, which led to some overly bearish headlines, in our view. The LEI overweights manufacturing, which had a particularly bad December as the ISM manufacturing index fell to 47.2, the lowest since 2009. The ISM, in turn, has also been overstating the extent of manufacturing weakness relative to hard data on orders and production. Therefore, we would think the negative print last month was a false flag, but the trend clearly is one of moderating growth. For January specifically, the ISM manufacturing rebounded nicely to 50.9, indicating growth again after five straight contractionary readings. We expect the LEI rose 0.4% in January, and will watch for coronavirus fears feeding through survey data in coming weeks.

Previous: -0.3% Wells Fargo: 0.4% Consensus: 0.4%

Global Review

China Near-term Outlook Remains Challenging

- A revision to diagnosis methodology led to a nearly 30% jump in new reported cases of coronavirus in China, and while many of those cases are days or weeks old, the revision only raises further questions over the extent to which China’s economy will be affected by the outbreak. Still, the country’s top officials have been resolute that the country can still hit its 2020 GDP targets.

- The Eurozone is among the more exposed major developed economies—bad news for its already struggling manufacturing sector, especially in Germany, which is the most exposed to China of the Eurozone’s major economies.

Markets Still in the Dark on Full Virus Effect

It was not a particularly busy week for global economic data and events, and much of the attention remained on the fallout from the coronavirus. Chinese authorities abstained from the large liquidity injections they resorted to the prior week, but remained resolute in their pledge to meet their growth target of “around 6%” for this year despite the significant economic disruption from the virus outbreak. As a reminder, we downgraded our China GDP outlook to 5.5% for full-year 2020, while we look for growth of just 5.1% on a year-over-year basis in Q1-2020 (top chart). New reports this week suggest that China had previously underreported the number of coronavirus cases by around 30%, only adding to the downside risks for Chinese economic growth and the growth of its key trading partners. Among the first official data of note that will provide insight into the extent of economic damage in China are the PMI figures for February, scheduled for release on February 28. That said, we will not receive “hard” data from China on February retail sales and industrial output until March 15, suggesting markets will remain largely in the dark on the full extent of any economic effect until then.

Among the major developed economies, the Eurozone—and particularly Germany—may be among the most exposed to weakness in Chinese demand, and are certainly much more exposed than the United States (middle chart). The Eurozone factory sector was already struggling long before the virus outbreak, and data this week confirmed that the weakness in the sector continued into December. Industrial output in the Eurozone declined 2.1% during the month, the sharpest decline since 2016, with broad-based declines in all the region’s largest economies. Meanwhile, data showed that German real GDP was flat on a sequential basis in Q4, suggesting the Eurozone’s largest economy carried little momentum into Q1 even before the virus outbreak.

Meanwhile, in the United Kingdom, growth and activity data for Q4 were hardly encouraging. Real GDP essentially stagnated during the quarter, with consumer spending rising just 0.1% (not annualized) on a sequential basis and fixed-investment spending declining 1.6% (not annualized). Perhaps a bright spot in the data were signs that the economy picked up some momentum in December, as services and manufacturing output both rose a healthy 0.3% during the month following sharp declines in November. Those figures bode well for the Q1 GDP figure, while solid January PMI data released a few weeks ago also suggest the U.K. economy likely bounced back into the new year. On a separate but related note, U.K. Chancellor (Finance Minister) Sajid Javid stepped down this week, raising hopes of more aggressive fiscal stimulus from the U.K. government, another upside risk for U.K. economic growth in 2020. As we discuss in the Global Outlook section on the next page, next week will be a big one for U.K. economic data, particularly the retail sales figures for January, the first hard data for the post-election period and likely a key indicator for the Bank of England (BoE) officials as they decide whether stimulus is warranted.

Global Outlook

Canada CPI • Wednesday

Among the G7 central banks, the Bank of Canada (BoC) is arguably the most successful at present in achieving its inflation target. Indeed, an average of three core inflation measures tracked by the BoC is currently running just above the 2% target, and averaged exactly 2% in full-year 2019. That has likely been a major reason the BoC has bucked the trend of global easing over the past year, keeping rates steady throughout 2019.

Looking ahead, we expect the BoC will remain on hold throughout 2020, but that forecast is predicated on inflation remaining near the 2% target. Recent BoC communications have been a bit more dovish and tilted the risks further toward easing, and thus the central bank will likely be particularly sensitive to any downside surprises on inflation, should they occur. In addition to January CPI figures, retail sales data for December are also slated for release next week.

Previous: 2.2% Wells Fargo: 1.9% Consensus: 2.3% (Year-over-Year)

U.K. Retail Sales • Thursday

Next week is a crucial one for U.K. economic data. Arguably most important will be retail sales for January, as this will be the first significant piece of hard data released for the U.K. economy that entirely reflects activity after the December general election. The BoE has stated that it has refrained from easing policy because sentiment indicators have pointed to a post-election bounce in activity, but critically, it noted that if the hard data did not confirm this bounce, it may resort to rate cuts to support growth. Thus, the BoE may be particularly sensitive to any downside surprises in next week’s retail sales figure.

Also on the docket next week are employment figures for Q4, CPI inflation for January and the February PMIs, all of which could be considered “tier-one” data for the U.K. economy and will likely be closely watched in addition to the retail sales data.

Previous: -0.6% Consensus: 0.7% (Month-over-Month)

Eurozone PMIs • Friday

Recent hard economic data from the Eurozone have been somewhat disappointing, including outsized weakness in retail sales and industrial output in December, which led to softer-than-expected Q4 GDP growth of just 0.1% on a sequential basis. Signals from the manufacturing and services PMIs for January suggest the economy remained sluggish at the start of Q1. The question now is whether the manufacturing sector will finally start to gain more traction and catch up with its services counterpart, or whether it will continue to languish and drag down services with it. February PMI data will be crucial in that sense, and we would note that there may be some downside risks to these figures given the outbreak of the coronavirus may have weighed on manufacturing sentiment in particular. The Eurozone economy, and specifically the German economy, is quite reliant on China as an export market, and thus, we may see further weakness in manufacturing sentiment in next week’s release.

Previous: 47.9 and 52.5 Consensus: 47.4 and 52.3 (Manufacturing and Services)

Point of View

Interest Rate Watch

Sticking to the Script

It was a busy week on Capitol Hill when it came to Fed testimony. Chair Powell gave his semi-annual testimony to Congress. His remarks echoed those of the most recent FOMC meeting.

Powell signaled rates were unlikely to be changed in the near term as policy was currently “appropriate,” but the committee stood ready to adjust if there was a “material” change to the outlook, including more widespread effects of the coronavirus. Hints that officials are increasingly willing to let inflation run above 2% for a time suggested that the Fed’s overall policy bias remains dovish.

A Fully Staffed Board of Governors?

Also testifying this week were nominees to the Board of Governors, Christopher Waller and Judy Shelton. If both were to be confirmed, the Board of Governors would be fully staffed for the first time since 2013.

Waller has served as the research director of the St. Louis Fed for the past 11 years. While considered mainstream, his views fall on the dovish side of the spectrum, having questioned traditional inflationary drivers like labor market slack. Notably, however, he has come out against the use of negative rates. It appears likely his nomination will make it out of committee and he will eventually be confirmed.

Less certain is Shelton’s confirmation. Shelton has advocated returning to the gold standard and questioned the existence and mandates of the central bank. More recently she has advocated the central bank take explicit efforts to weaken the dollar.

Shelton’s confirmation would add to concerns about the Fed’s independence from political pressure. Over the past decade, she has moved from hawkish views on inflation and interest rates to wanting to cut rates “expeditiously” while serving as an advisor to President Trump.

A number of Republican Senators have expressed concerns, putting her candidacy up in the air. Given the typical timeline between hearings and confirmations, it will likely be months before the full Senate takes up the vote, if her nomination makes it out of the Senate Banking Committee.

Credit Market Insights

Mortgage Originations Soar

The mortgage market ended a busy year with a $224 billion jump in new mortgage balances, according to the New York Fed’s Household Debt and Credit Report. This increase brought the total amount of mortgage originations for the quarter t0 $752 billion, the highest since 2005 (see bottom chart). Home purchases have been picking up, though refinances continue to drive the bulk of mortgage demand, accounting for roughly 60% of mortgage applications in recent quarters. Despite the pick-up in new mortgages, credit quality has not appeared to deteriorate. Sixty-four percent of the new mortgages in Q4 went to borrowers with a credit score of 760 or better, the highest share since 2000 when the series started. Tighter lending standards along with the healthy economy have also pushed down delinquency rates. The MBA’s latest national delinquency survey reported a drop in the delinquency rate to 3.77%, the lowest on record.

While these metrics highlight the financial health of homeowners, debt growth over the past decade has come primarily from consumer credit. Delinquencies rates for student, auto and credit card loans, which comprise the bulk of consumer credit, have drifted up in prior quarters, although banks have responded by tightening standards. For 2020, banks expect higher demand for credit card loans, but lower demand for auto loans. Existing borrowers’ ability to keep current will, like the rest of consumer spending, largely depend on the continued resilience in the labor market.

Topic of the Week

A Primary Primer

In our preview of the Iowa caucus and its economy, we highlighted the fact that it resembles several swing states with its reliance on manufacturing (14% of employment, well above the 8% national average) and agriculture (Iowa is the second largest agricultural producer after California). Given this dual emphasis on globally exposed sectors, Iowa has been one of the most affected states by the trade war. It is also one of the whitest states, leading some to criticize its perennial spot at the front of the primary schedule.

New Hampshire is the 41st smallest state, with around 40% of its 1.4 million residents living in the Greater Boston area. In addition to being 93% white, it is also the second oldest state, a demographic challenge which has resulted in sluggish labor force growth. Health care is its fastest growing sector, while manufacturing (10% of payrolls) has shed 1,200 jobs over the past year. For comparison, Bernie Sanders’ margin of victory over Pete Buttigieg was only 3,867 votes.

Nevada is next in line, and is the first primary state with a sizable non-white population. Nevada was hit extremely hard by the housing bust and ensuing recession, and did not recover all the jobs lost until the end of 2015. It is now growing rapidly, however, and has added 321,000 jobs since 2010 across a broader array of industries, including logistics & distribution, health care and advanced manufacturing. Low taxes and business-friendly regulations have boosted the professional & business services and tech sectors, which have also benefitted from an affordability migration out of California. The influx of businesses has in turn spurred rapid population growth.

We will be publishing a preview of South Carolina, which has one of the lowest unemployment rates in the country, aided by its success attracting manufacturers and foreign direct investment. Its population is growing rapidly, as job-seekers and retirees move in, but there are major differences between the state’s largest metro areas and the surrounding rural areas.

Three days after the South Carolina primary brings Super Tuesday, when voters in California, Utah, Colorado, Texas, Oklahoma, Minnesota, Arkansas, Alabama, Tennessee, North Carolina, Virginia, Massachusetts, Vermont and Maine head to the polls. These 14 states comprise 40% of the U.S. population, and their economies run the gamut from rapidly growing to stagnant. It is therefore difficult to assess the economic backdrop of these primaries, but it may also be less necessary—the primary schedule inherently overweights the first few states and the idiosyncrasies of their economies, with momentum often compounding behind the candidate who nabs the early victories. This dynamic will resurface in the general election, which often comes down to just a few swing states. Indeed, a key to Trump’s victory was his outperformance in some Midwestern states, which he was able to narrowly flip—Michigan, Pennsylvania and Wisconsin were all decided by less than one percentage point, but Trump claimed all their electoral votes. In other words, while Iowa, New Hampshire, Nevada and South Carolina are disproportionately important for the nomination process, other states will be disproportionately important for the general election.

In terms of the general election, we have previously published: (1) an overview, (2) a primer on the leading candidates’ major proposals and (3) an outline of how those proposals might or might not be implemented.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals