With not much on the economic calendar to enthuse markets next week, the virus and its impact on economies globally is likely to remain the primary driver of risk sentiment. Still, there are some important indicators worth keeping an eye on. Overall, there’s little to suggest that the dollar’s relentless rally is about to end, as the US economy is much better positioned than its rivals to weather any slowdown in China. That said, the more the dollar climbs, the greater the risk of verbal intervention by the White House or the Fed.

King dollar reigns supreme

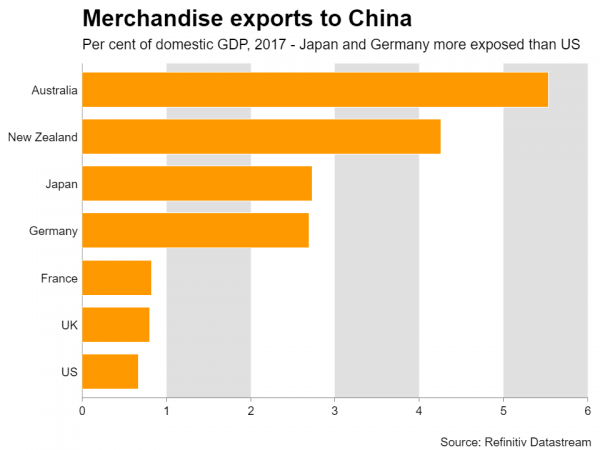

The dollar has overwhelmed the competition lately – smashing through the euro, commodity currencies, and even the defensive Japanese yen – as investors insulate their portfolios from the virus fallout and cut their exposure to economies that will be hardest hit from a severe slowdown in China. That means the US economy is the place to be in, as America has a smaller exposure to China in terms of exports compared to Europe or Japan. Hence, any Chinese shock might be felt less in the US, which explains the powerful rotation towards US assets.

The upcoming economic data are unlikely to change this dollar-friendly narrative. Durable goods orders for January will be released on Thursday alongside the second estimate of GDP for Q4, before personal income and spending numbers coupled with the core PCE price index – all for January – hit the markets on Friday.

What can turn this narrative around? Admittedly, not much. The last few weeks have seen market expectations for Fed rate cuts grow, with more than one and a half cuts now priced in by year end, but the dollar has only moved higher in the meantime. And the more concerns about the virus impact on foreign economies intensify, the more the dollar is likely to shine since the US economy is better protected from a slowdown in China and US authorities have policy room to react to any shock, unlike Europe or Japan.

However, there is a wild card in all this – verbal intervention. If the White House, or better yet the Fed, start expressing concerns about the strength of the dollar and the negative effect that might have on exports, then the reserve currency might correct lower. Still, unless they threaten actual FX intervention to weaken it – which is very unlikely – merely voicing concerns probably wouldn’t be enough to keep the dollar down for long.

Can yen sink further?

The traditionally safe-haven Japanese yen came under unexpected selling pressure lately, plummeting to near 10-month lows versus the US dollar amid fears that Japan’s economy might take a much bigger hit from the virus epidemic than initially projected. Recent economic data has been dire – GDP contracted by a shocking 1.6% on a quarterly basis in Q4, exports declined year-on-year for the 14th straight month in January and machinery orders slumped by 12.5% in the same period.

All this turns the spotlight on next week’s preliminary industrial output print and retail sales report for January – both of which are key indicators of Japanese growth. Another set of dismal numbers could add fuel to concerns that the world’s third-biggest economy is headed for a technical recession, and by extension, raise speculation that the Bank of Japan might resort to more unorthodox stimulus measures to support growth.

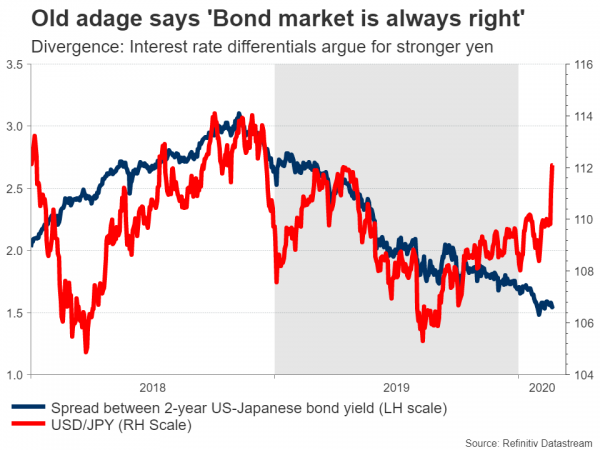

As for the yen, what has been most striking about its recent plunge is that the move was purely FX based – it wasn’t reflected in the bond market and relative interest rates. Divergences like this one usually correct, meaning that eventually, the two will probably recouple. The question is whether it will be the yen that will move back higher as it plays catch-up to the bond market, or whether relative rates will move higher to meet the yen.

More often, it’s the FX market that recouples with rates, so the yen might ultimately recover.

Aussie and kiwi to seek halt to slide from domestic data

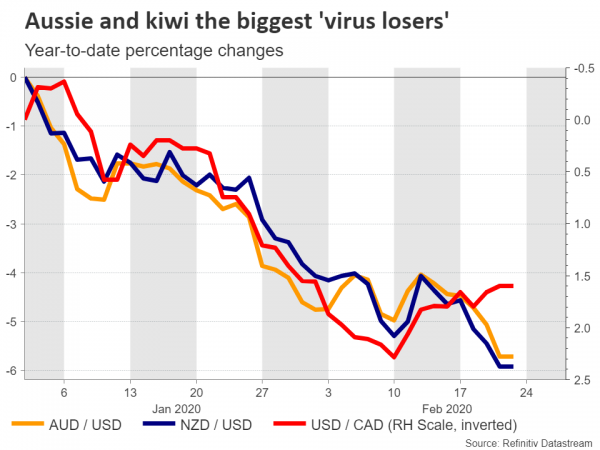

With investors pinning their hopes on governments and central bankers to come to the rescue to limit the economic damage from the coronavirus, the RBA and the RBNZ are the obvious candidates to deliver rate cuts. Hence, the risk-sensitive Australian and New Zealand dollars aren’t moving in tandem with stocks and remain the worst performing majors this year.

In Australia, the main releases are fourth quarter estimates on construction work done (Wednesday) and capital expenditure (Thursday), which should give clues on what to expect from forthcoming Q4 GDP figures. In New Zealand, quarterly retail sales will be watched on Monday, as well as trade data and the ANZ business outlook survey for January on Thursday. In Canada, GDP data for Q4 will see the light on Friday.

Alas, all these figures might be seen as somewhat outdated. Even if fourth-quarter data were stellar, the situation on the ground might be very different now for these export-heavy economies, with China – the world’s biggest consumer of commodities – being paralyzed in recent weeks. Hence, investors might wait for February data to get a clearer picture of how these economies are faring.

As for the battered aussie and kiwi, as long as markets remain so focused on virus risks, any recovery in both currencies will probably remain short-lived. Investors seem to be revaluating the impact and duration of this shock on China, increasingly pricing in a more prolonged slowdown that would inevitably hurt Australia and New Zealand, two of China’s biggest suppliers of raw materials.

For a sustainable rally to be able to materialize, markets might need concrete signs that this epidemic has come under control, and that the worst in terms of an economic slowdown is behind us. Sadly, we might still be far from that point.

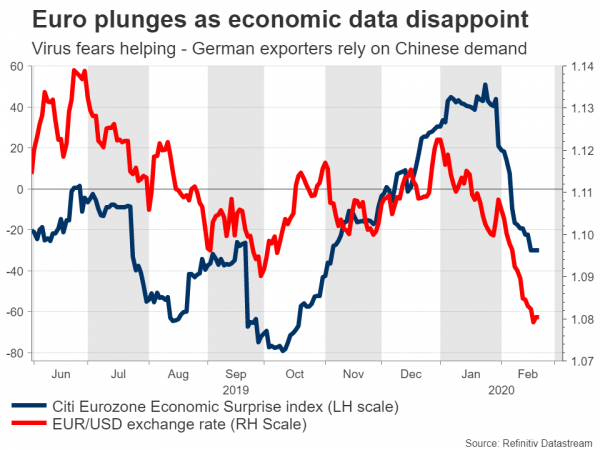

German data unlikely to turn euro’s fortunes around

In euro land, Monday will bring the release of Germany’s Ifo business survey for February, before preliminary inflation numbers for that month come into focus Friday. The single currency has taken a beating lately, as the Eurozone and especially German manufacturers rely on Chinese demand to absorb their exports. Thus, a severe hit to Chinese growth might translate into weaker growth for the Eurozone, which is barely growing already.

Meanwhile, monetary policy is almost exhausted so the ECB can’t do much more to support the economy, and it seems that a recession must be on the horizon before Eurozone governments finally decide to spend more to boost growth.

Until markets get strong signals that a big spending package is on the way, there’s not much to stop the euro’s epic downfall. Supporting this view, while euro/dollar has collapsed already, speculative positioning on the euro is far from extreme short, so there’s room for further declines as more leveraged funds come aboard the euro pain train.

That said, a note of caution: given how much and how fast euro/dollar has plunged already, any piece of positive news for the euro or negative news for the dollar could trigger a bigger-than-usual corrective rebound, as several traders take profits on their prior short positions.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals