With Europe’s biggest economies shutting down in March as the coronavirus wreaked havoc across the continent, no one is expecting the Eurozone’s first quarter GDP estimate due on Thursday (09:00 GMT) to be anything but abysmal. But just as in previous crises, it is the European Central Bank that has been first to come to the rescue and with European Union leaders still bickering over the details of a virus recovery fund, it will be up to Lagarde and her team to calm investor nerves when they announce their latest policy decision on Thursday at 11:45 GMT.

GDP data turning very ugly

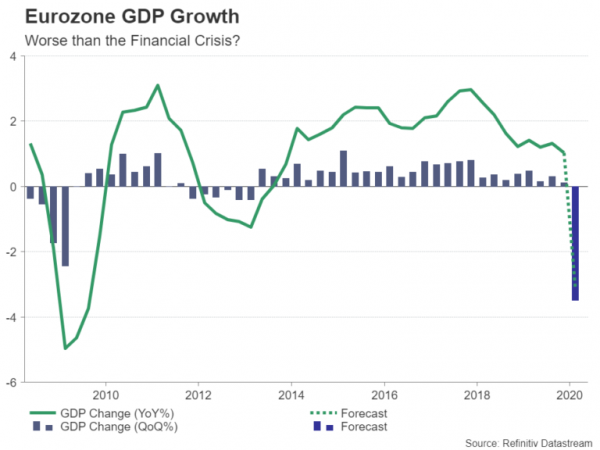

After China reported a near 10% quarterly slump in economic output in the first three months of the year, it will be the turn of the United States and the Eurozone to spread the gloom this week. On the bright side, European and American GDP numbers are not anticipated to be anywhere near as bad as the Chinese one. The euro area economy is forecast to have contracted by 3.5% from the prior quarter – a would-be historical low but less than half of China’s rate of decline.

However, this is only down to the fact that the virus didn’t break out in Europe and the US until February when it had already peaked in China. Moreover, the failure of authorities in those countries to quickly get a handle on the situation has meant more extensive and potentially longer lockdowns than necessary and so GDP figures for the second quarter will likely be far worse than the projected readings for Q1.

EU stimulus dwarfed by America’s response

Yet the prospect of Europe suffering its worst economic downturn since the Second World War does not seem to be resonating with all politicians, particularly northern European ones, who are once again in the spotlight accused of lacking solidarity by their southern peers. There was some progress last week when the EU agreed to a €1 trillion economic fund to help member states recover from the pandemic. But not only does this pale in comparison to America’s near $3 trillion fiscal package, leaders have yet to decide the details of raising half of that sum, while the package won’t become available until June.

All this has put the heat on the ECB as markets once again look to the central bank to safeguard the euro. After some initial blunders, first by underreacting to the crisis with only a modest stimulus and then by suggesting that it’s not the ECB’s job to keep Eurozone yield spreads stable, President Christine Lagarde finally appears to be rising to the challenge of her job.

ECB under pressure to ramp up asset purchases

Policymakers last month launched a €750 billion Pandemic Emergency Purchase Programme (PEPP), taking the Bank’s total asset purchases for the year to €1.1 trillion. But with the virus crisis not looking like it will end anytime soon and the EU dragging its feet on meaningful measures to support the hardest-hit member states, expectations are growing that the ECB will boost the PEPP by between €250 billion and €500 billion at this week’s meeting.

If those expectations are met, the euro could advance towards its 50-day moving average in the $1.0955 region on relief that the extra stimulus, combined with the modest easing of the lockdowns, will avert a too severe recession. If, though, the ECB keeps the size of its stimulus unchanged and just fine tunes existing measures, the euro would be in danger of revisiting the $1.0775 support as doubts would resurface about the Eurozone’s recovery plan.

Could ECB join unlimited QE bandwagon?

In the more medium-term, the ECB’s forward guidance and any hints on future policy will be more significant for the euro’s outlook. In particular, should Lagarde suggest that unlimited bond purchases were discussed in the meeting, this could limit future rebounds against currencies where their central banks have also pledged unlimited QE (like the Federal Reserve and Bank of Japan).

Such a decision is unlikely to be taken at the April meeting and could meet opposition from the hawks within the Governing Council. But another turmoil in the markets could easily force the ECB’s hand. The Bank has already loosened its criteria for eligible bonds. In March, it removed the restriction for not being able to buy more than a third of a Eurozone nation’s debt issuance, and last week it said it would start accepting some junk bonds as collateral. This could be broadened to include purchases of junk sovereign bonds as many think it’s only a matter of time before countries such as Italy lose their investment grade rating.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals