China and the US appear to be on a collision course as tensions escalate. In what originally began as a “blame game” over the coronavirus, is now turning into an economic and political escalation. China has decided to cut back on Australian imports as well. Central Banks are still committing to more stimulus, as needed, as the world continues its re-opening after the coronavirus. Germany and France have taken the lead for a European recovery fund as well. Data continues to be terrible for Q2, however markets are hopeful that a vaccine will be found soon, and life can resume in the “new normal”. With the US and UK holiday on Monday, and a light economic calendar this week, month-end and headlines should dominate flows.

At the beginning of last week, China cut back on its imports of Australian barely and beef as a response to Australia joining the call into an investigation of the origins of the coronavirus. China continued to take out its frustrations politically as they have taken unilateral measures to arbitrarily impose national security legislation on Hong Kong as security law. China also announced an acceleration in its investment of information technology infrastructure of around $1 Trillion! This came in response to the US, after the Senate passed a bill at the aim of boosting oversight of Chinese companies. These companies would be forced to certify that they are not under any foreign government control. This could cause companies such as BABA and BIDU to delist form the NASDAQ. In addition, the US sold $180 million worth of submarine-launched torpedoes. Oil traded lower amid headlines, however, have since recovered, with the July futures contract trading above $33, up over an additional 12% last week.

Something to watch: The US State Department will release a report shortly which will address Hong Kong’s autonomy. If the report shows that Hong Kong no longer has autonomy, they may lose the status of Special Administration Region and possibly their trade privileges with the US. The headlines should be abundant this week regarding China and could be market moving.

As PMIs continued to be dismal, central banks continued to promise more stimulus if needed. The BOJ provided an additional $280 billion facility for small businesses at an emergency meeting last week. The ECB said they are further prepared to adjust PEPP as necessary. There are continued hints at the possibility of negative rates in many countries, including the US, UK, and New Zealand. Separately, France and Germany are leading the call in Europe for a $500 billion Euro recovery fund.

Drug manufacturers are racing to find a vaccine for the coronavirus. The most positive news came last Monday, as Moderna showed promising results. Stocks were quick to soar, however speculation ensued, and the small sample size negated some of the validity. Watch for comments this week from other companies showing promising results. As the markets showed last week, extreme optimism and pessimism may be reflected in the markets as a result of new, promising vaccines. Could the vaccine headlines may be the new “trade deal” headlines?

Earnings season is winding down, however there are 2 noteworthy releases this week: CRM and COST.

The economic calendar is relatively light next week, relegated to mostly second tier data. Some major data releases are as follows:

Monday

- UK: Bank Holiday

- US: Bank Holiday

- Germany: GDP Growth Rate QoQ Final

- Germany: Ifo Business Climate (MAY)

Tuesday

- New Zealand: Trade Balance

- Germany: Gfk Consumer Confidence (JUN)

- US: New Home Sales (APR)

Wednesday

- US: Fed Beige Book

Thursday

- EU: Business Confidence (MAY)

- EU: Consumer Confidence Final (MAY)

- EU: Economic Sentiment (MAY)

- Germany: Inflation Rate Prel (MAY)

- US: Durable Goods (APR)

- US: GDP Growth Rate QoQ 2nd Est (Q1)

- US: Pending Home Sales

- Crude Inventories

Friday

- New Zealand: Consumer Confidence (MAY)

- UK: GfK Consumer Confidence (MAY)

- Japan: Unemployment Rate (APR)

- Japan: Industrial Production (APR)

- Japan: Retail Sales (APR)

- Japan: Consumer Confidence (MAY)

- Germany: Retail Sales (APR)

- EU: Inflation Rate Flash (MAY)

- Canada: GCP Growth Rate QoQ (Q1)

- US: Personal Spending (APR)

- US: Personal Income (APR)

- US: PCE Price Index (APR)

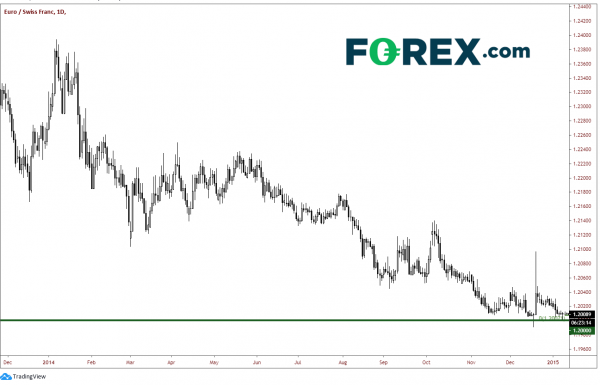

Chart of the Week “Special”: EUR/CHF -Deju Vu All Over Again?

The Swiss National Bank (SNB) admittedly intervenes in the fx markets to slow the appreciation of the Swiss Franc. Recall back in January 2015 the SNB had the EUR/CHF pegged to an artificial floor at 1.2000. However, on January 15th, 2015, the SNB dropped the peg and EUR/CHF immediately dropped below .9700. The results were disastrous to some individuals, funds, and brokers, as they were unable to meet margin calls. Below is the daily chart prior to January 15th, 2015:

Source: Tradingview, FOREX.com

Below is the weekly chart after January 15th, 2015 until present:

Source: Tradingview, FOREX.com

Clearly one can see the destruction of wealth caused by the SNB for those who believed the they would hold the peg at 1.2000, creating a sense of fear in the market for Swiss Franc traders. In the years in since then, EUR/CHF did retrace back to 1.2000 in April 2018, however the resistance level held. The pair has been selling off since then and is currently trading near the 61.8% Fibonacci retracement level from the January 15th, 2915 lows to the April 2018 highs, roughly around 1.0500.

Below is a current daily EUR/CHF chart:

Source: Tradingview, Forex.com

The SNB has recently been in the market intervening once again. Although they haven’t specifically said it, market participants are suspecting that the SNB has pegged EUR/CHF to 1.0500. Notice the similarities in price action between 2015 and today, in particularly the aggressive spikes at the floor level. If those similarities continue, EUR/CHF may drift lower back towards 1.0500. What happens there is anyone’s guess!

***TRADERS MUST BE ACUTELY AWARE OF A POTENTIAL BREAK OF 1.0500 IN EUR/CHF***

If the SNB is holding a peg, the downside can be extreme and lead to disastrous results, as it did in 2015! If one wishes to trade this pair, trade safely and use proper risk/reward!

With the many on holiday Monday, fx trading should be like. The rest of the week could be volatile as month end flows arrive. In addition, China headlines and vaccine headlines will dominate as we head into June next week!

Have a great and safe weekend and please remember to always wash your hands!

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals