Key Highlights

- Gold price rallied significantly above the $1,820 and $1,850 resistance levels.

- A new multi-year high is formed near $1,876 and the price is a few steps away from a new all-time high.

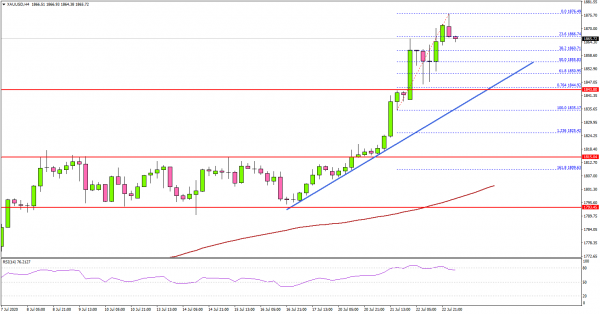

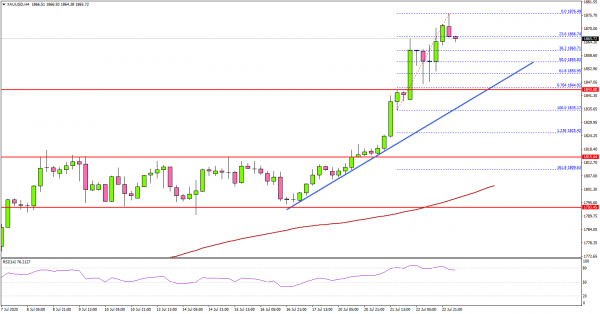

- A crucial bullish trend line is forming with support at $1,840 on the 4-hours chart of XAU/USD.

- The US Initial Jobless Claims in the week ending July 18,2020 could remain at 1,300K.

Gold Price Technical Analysis

This week, gold price started a strong increase above the $1,820 resistance against the US Dollar. The price traded to a new multi-year high near $1,876 and it seems to be trading in a nasty uptrend.

The 4-hours chart of XAU/USD indicates that the price broke the range resistance near $1,815 to start the recent rally. The bulls gained strength, pushing the price above the $1,850 resistance.

The price traded to a new multi-year high, and settled well above both the 100 simple moving average (red, 4-hours) and the 200 simple moving average (green, 4-hours). After trading as high as $1,876, the price corrected lower.

There was a test of the 23.6% Fib retracement level of the recent rally from the $1,835 swing low to $1,865 high. If there are more losses, the price could correct lower towards the $1,840 support.

There is also a crucial bullish trend line forming with support at $1,840 on the same chart. Any further losses may push gold price towards the $1,820 support zone.

On the upside, the bulls are likely to aim another lift-off and they could target a new all-time high (probably above $1,900) in the coming days.

Overall, gold price is trading in a strong uptrend above $1,840 and $1,820. Looking at EUR/USD, the pair extended its rally above the 1.1550 and 1.1580 resistance levels. GBP/USD traded close to 1.2780 before starting a downside correction.

Economic Releases to Watch Today

- US Initial Jobless Claims – Forecast 1,300K, versus 1,300K previous.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals