USD Index Outlook: Dollar Regains Traction But More Action Higher Needed To Signal Stronger Correction

The dollar regained traction on Friday and cracks initial barriers at 93.16/22 zone (20DMA / Thursday’s high / Fibo 61.8% of 93.87/92.09). The sentiment remains soured by Fed’s dovish stance and fresh increase in jobless claims that adds to gloomy...

EUR/USD Trades Below Moving Averages

On Thursday, the EUR/USD currency pair traded between the 100– and 200-hout moving averages. During today’s morning, the pair dropped significantly and pierced the weekly PP at 1.1806. From the one hand, it is likely that some upside potential could...

GBP/USD Continues To Be Volatile

Yesterday, the GBP/USD exchange rate raised to the weekly R2 at 1.3216. During Friday morning, the rate drop to the weekly R1 at 1.3152. It is likely that the currency pair could be pushed down by the 55– and 100-hour...

USD/JPY Pressured By 55- And 100-Hor SMAS

During Thursday, the USD/JPY currency pair traded downwards. During today’s morning, the pair was testing the resistance provided by the 55– and 100-hour SMAs near 105.80. If the given resistance holds, it is likely that some downside potential could prevail...

XAU/USD Consolidates In 1,940.00 Area

Yesterday, the XAU/USD exchange rate traded sideways around the 1,940.00 level. During Friday morning, the rate maintained its consolidation. Given that yellow metal is pressured by the 55-, 100– and 200-hour moving averages in the 1,960.00 area, it is likely...

GBP/USD Retreats As Volatility Continues

It has been a busy week for the pound, as GBP/USD has been showing significant volatility for most of the week. Currently, GBP/USD is trading at 1.3162, down 0.40% on the day. Retail sales, PMIs head higher On Friday, there...

EUR/GBP: Euro Drops On PMI, Coronavirus

In fact, economic activity has already slowed down according to the latest Purchasing Managers’ Indices from Germany and especially France, where Covid-19 cases have risen sharply since July. Investors will now be cautious about buying the euro as the weakness...

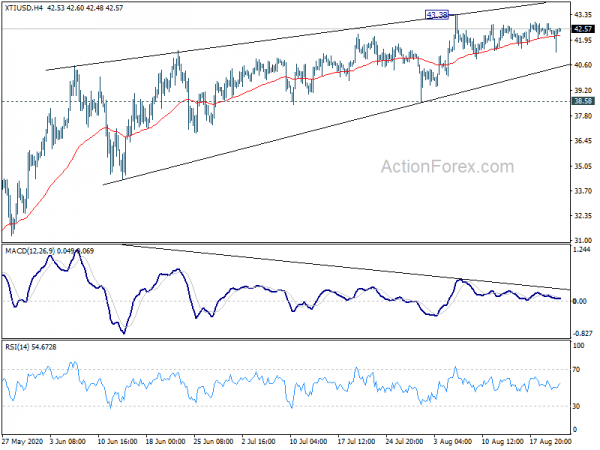

Crude Oil: 43.30 Expected

Pivot (invalidation): 42.60 Our preference Long positions above 42.60 with targets at 43.05 & 43.30 in extension. Alternative scenario Below 42.60 look for further downside with 42.40 & 42.25 as targets. – advertisement – Comment The RSI is bullish and...

Dollar Weakens Again as Rebound Falters, PMIs Watched Today

Dollar is back under pressure as rebound attempt faltered quickly again. Nevertheless, New Zealand Dollar remains the worst one. Canadian Dollar is currently the strongest one in Asian session, lifted as crude oil rebounded quickly after a spike lower overnight....

Immigration risk is troubling for the EU and southeastern Europe

The Covid-19 crisis has raised the stakes worldwide, plunging the global economy into recession and creating unanticipated fiscal pressures for many countries already struggling with domestic problems, geopolitics and global trade wars. Consequently, analysts have downgraded Bulgaria, Cyprus, Malta, Romania...

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals