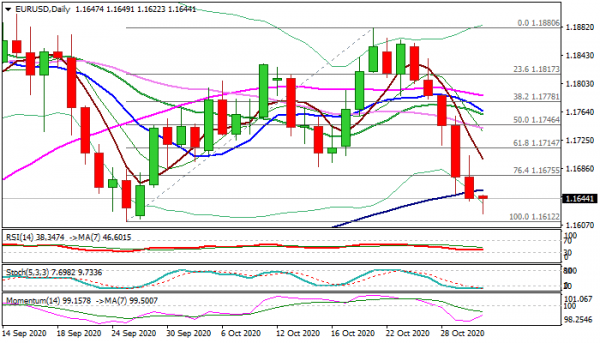

The Euro remains in red for the sixth straight day and extends steep fall to the lowest in over one month in early Monday’s trading.

The pair fell near 1.8% last week, driven by strong risk aversion and registered the monthly fall (Oct) of 0.65% as traders continue to flee into safety on growing fears over fresh lockdown measure across the Europe, as well as strong uncertainty over US Presidential elections.

Dovish stance from the ECB, as the central bank in its last weeks’ policy meeting sent strong signals for further monetary easing by the end of the year, increased pressure on Euro and risk of fresh bearish acceleration on break through key support at 1.1612 (25 Sep low).

Loss of 1.1612 pivot would risk drop towards next key support at 1.1486 (Fibo 38.2% of 1.0637/1.2011 recovery leg).

Last week’s massive bearish candle weighs heavily, suggesting limited recovery attempts, which should be ideally capped by daily cloud base (1.1692).

Res: 1.1656, 1.1692, 1.1714, 1.1741

Sup: 1.1612, 1.1548, 1.1510, 1.1486

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals