The S&P 500 Futures are posting a rebound after they in the red again on Friday. Investors became cautious ahead of the Nov. 3 presidential election, and remained concerned over the record-breaking Covid-19 cases around the world.

Later today, the U.S. Commerce Department will report September construction spending (+1.0% on month expected). The Institute for Supply Management will post its Manufacturing Index for October (55.6 expected). Research firm Markit will publish final readings of October Manufacturing PMI for the U.S. (53.3 expected).

European indices are on the upside. British Prime Minister Boris Johnson has announced England will enter a second national lockdown from Thursday until December 2. Research firm Markit has published final readings of October Manufacturing PMI for the eurozone at 54.8 (vs 54.4 expected), for Germany at 58.2 (vs 58.0 expected), for France at 51.3 (vs 51.0 expected) and for the U.K. at 53.7 (vs 53.3 expected).

Asian indices closed in a strong up move.

WTI Crude Oil futures remain under pressure. The total number of rotary rigs in the U.S. rose to 296 as of October 30 from 287 in the prior week, and rigs in Canada increased to 86 from 83, according to Baker Hughes.

US indices closed down on Friday, pressured by the Technology Hardware & Equipment (-4.52%), Retailing (-3.7%) and Semiconductors & Semiconductor Equipment (-1.94%) sectors.

Approximately 60% of stocks in the S&P 500 Index were trading above their 200-day moving average and 16% were trading above their 20-day moving average. The VIX Index rose 0.59pt (+1.57%) to 38.18, while Gold gained $11.26 (+0.6%) to $1878.85, and WTI Crude Oil dropped $0.57 (-1.58%) to $35.6 at the close.

On the US economic data front, Personal Income rose 0.9% on month in September (+0.4% expected), compared to a revised -2.5% in August. Personal Spending increased 1.4% on month in September (+1.0% expected), compared to +1.0% August. Market News International’s Chicago Business Barometer slipped to 61.1 on month in October (58.0 expected), from 62.4 in September. Finally, the University of Michigan’s Consumer Sentiment Index advanced to 81.8 on month in the October final reading (81.2 expected), from 81.2 the October preliminary reading.

Gold slightly rebounds while the U.S dollar consolidates before U.S presidential election and as COVID-19 cases continue to surge.

Gold rose 12.66 dollars (+0.67%) to 1891.46 dollars.

The dollar index was flat at 94.032.

GBP/USD fell 20pips to 1.2927 on UK lockdown

U.S. Equity Snapshot

Apple (AAPL), a tech giant, was ordered to pay security software company VirnetX Holding Corp 503 million dollars in a security patent trial by the jury in Tyler, Texas, according to Bloomberg.

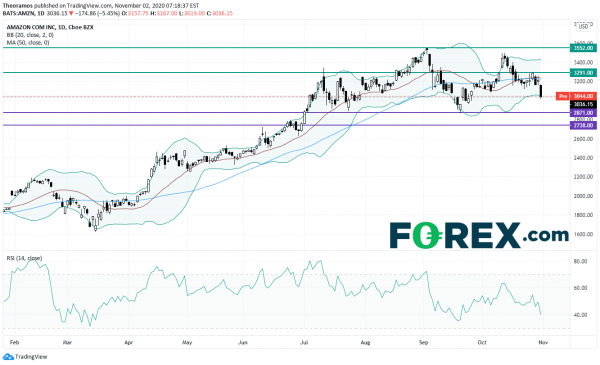

Amazon.com (AMZN)’s, the e-commerce giant, price target was raised to 3,900 dollars from 3,800 dollars at Independent Research.

Source: TradingView, GAIN Capital

Wynn Resorts (WYNN), a luxury resort and casino company, was upgraded to “overweight” from “equalweight” at Morgan Stanley.

Marathon Petroleum (MPC), one of the largest U.S. oil refiners, reported third quarter sales down 44% to 17.55 billion dollars, below estimates. LPS was 1.57 dollar, beating expectations, vs an EPS of 1.66 dollar a year earlier.

Signal2forex.com - Best Forex robots and signals

Signal2forex.com - Best Forex robots and signals